Gwinnett County is one of the most diverse and fluid communities in America. The second-largest county in Georgia, Gwinnett County has seen a population and housing boom that few other communities can match. With a meteoric rise in population, the demand for housing is soaring, driving up values for homes across the county. While great for sellers, it also puts stress on homeowners wishing to stay, as it brings increases in property taxes.

The Atlanta area has suffered from staggering property taxes for years, and it seems to only be getting worse. With increased migration, construction, and gentrification abound, Gwinnett County is seeing the price of all properties rise to levels never seen before. The taxable value of family homes is up 7.9%, while commercial properties are up a whopping 15.6%.

Gwinnett Taxable Value of Homes Jumps 7.9%

The taxable value of homes across Gwinnett County saw a sizable jump once again, this time the increase was a strong 7.9%. The Gwinnett Board of Assessors estimated that single-family homes had a combined market value of $115.02 billion. The largest contributor to this value was homes worth between $250,000 and $500,000, with a combined total of $61.94 billion. These homes saw their taxable value grow by 6.3%. With $34.69 billion in combined value, homes worth $500,000 to $750,000 took the No. 2 spot, while also increasing by 9.5%.

Reflecting the numbers from the previous graph, the majority of taxable value was tied to homes on the smaller end of the range. Homes smaller than 2,000 square feet totaled $24.68 billion, while those between 2,000 and 3,999 square feet totaled $71.27 billion. They also saw growth increases of 5.9% and 8.4% respectively. Homes between 4,000 and 5,999 square feet came in at No. 3 with $13.99 billion, while also leading with the highest increase at 9.1%. While smaller parts of the total value, the largest luxury homes also saw significant increases in their tax burden.

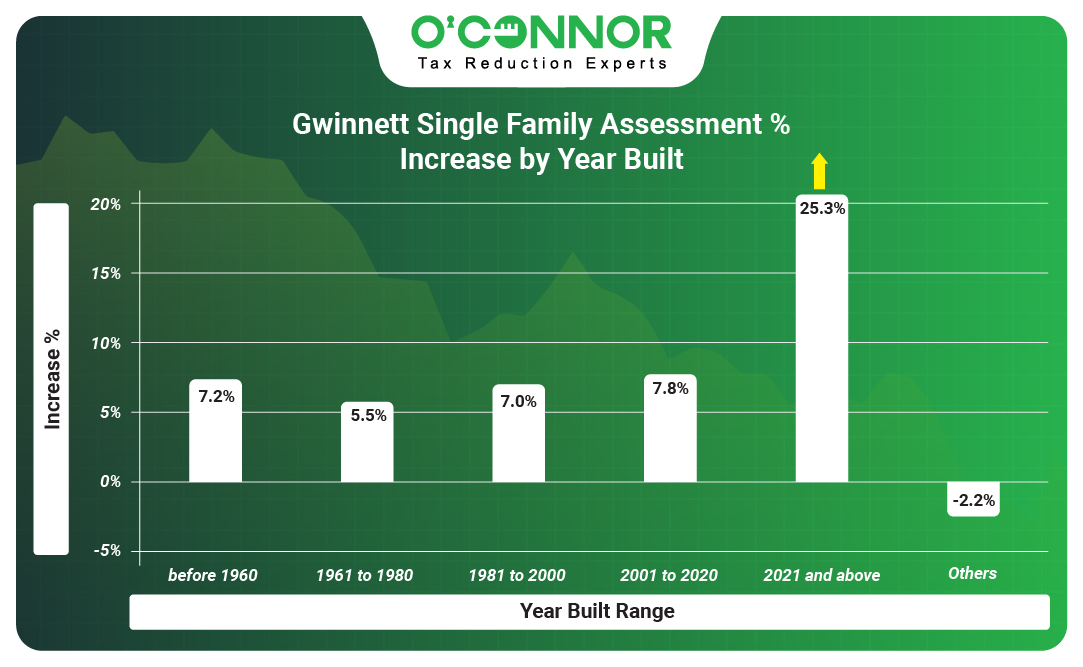

Gwinnett County is one of the fastest growing communities in the past few decades, and this is reflected in the value of homes when broken down by age of construction. $51.24 billion in total value is in homes built between 1981 and 2000, while $44.39 billion is from homes constructed between 2001 and 2020. This means that these properties contribute 84% of all value. New construction steals the show, growing in value by 25.3%, already making up 5% of all housing value.

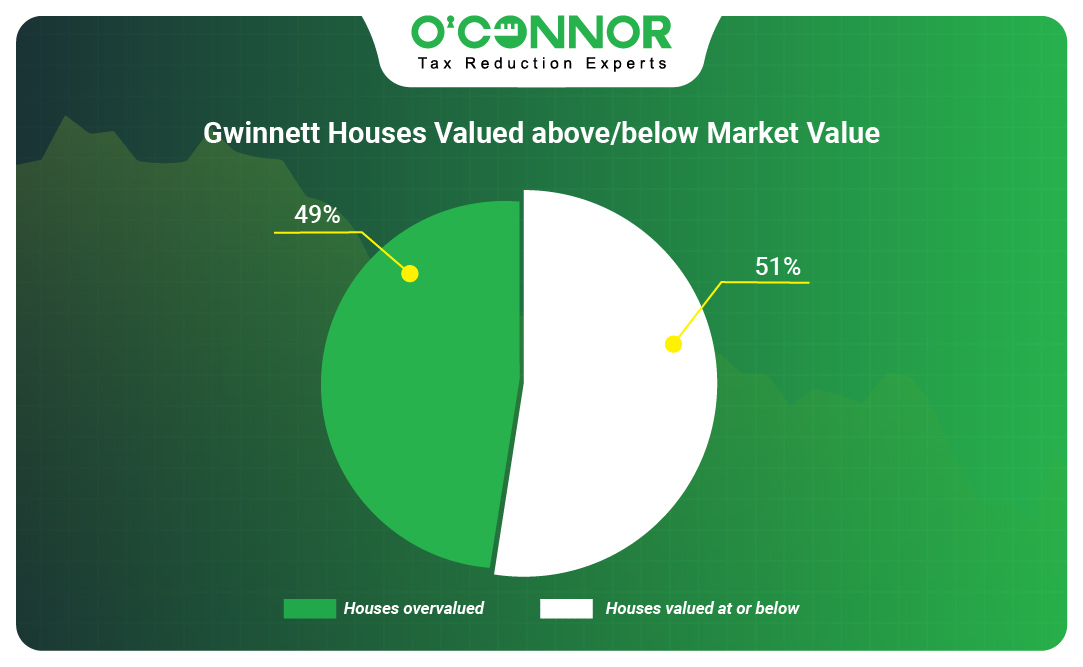

Half of Single-Family Homes Overvalued

While the demand for housing in Gwinnett County cannot be denied, it seems that the values handed out by the Gwinnett Board of Appraisers certainly can. It was calculated that 49% of all residences in the county were overvalued in 2025. This means that almost half of all homes were being taxed above their real market value. This is why property tax appeals are becoming so prevalent in Gwinnett County and why every taxpayer should look at protesting.

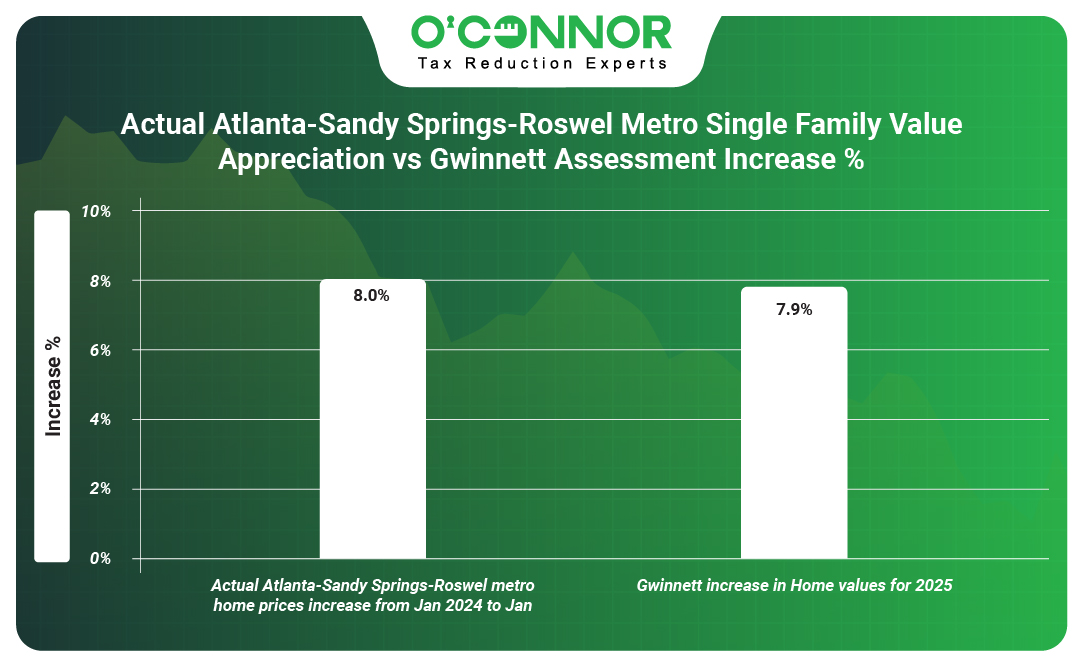

An outside source does throw some cold water on these overvaluation claims;, however, and their data seems to indicate that home values are closer to being under market demand. Georgia MLS Real Estate Services, a research group meant for local realtors, shows that homes across the county sold for 8% more in 2025 than they did in 2024. This is slightly above the Gwinnett Board of Appraisers claim of 7.90% growth. Since there is only a 0.10% difference in the numbers, that could indicate that the truth lies in a gray area between the two. Either way, it confirms that the real value of homes in Gwinnett County is only increasing.

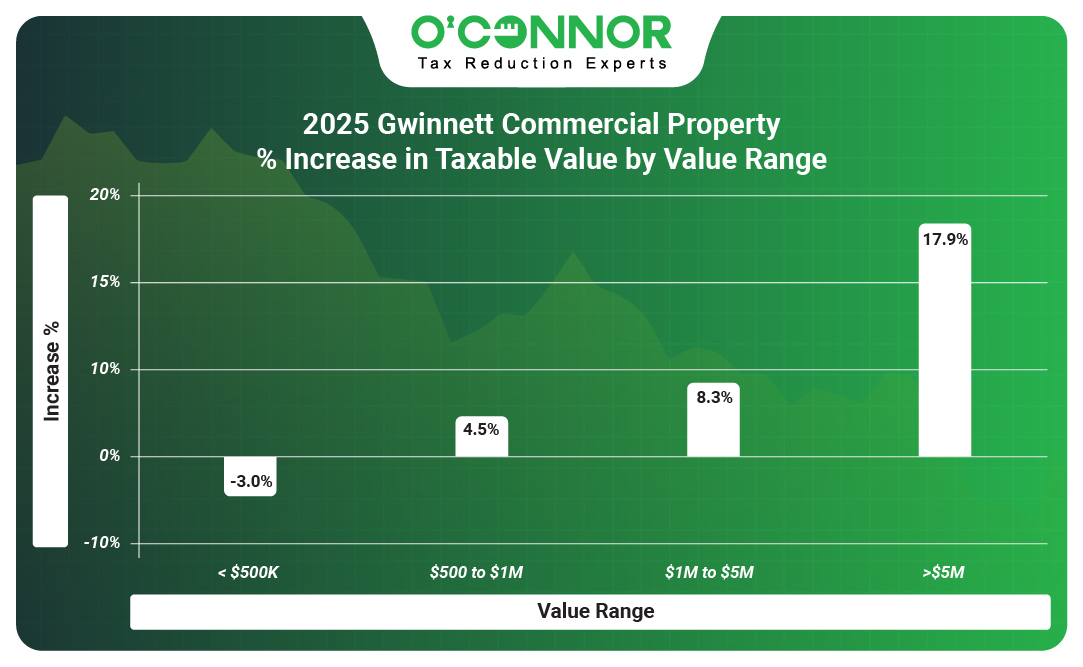

Gwinnett County Business Property Adds 15.6% in Value

While homes were busy adding 7.90% in taxable value, this figure was almost doubled by commercial properties. Totaling $38.60 billion in 2025, commercial properties saw their taxable value shoot up 15.6%. This was driven by businesses worth more than $5 million, which saw a growth of 17.9%. As these commercial properties account for $30.99 billion of the value, this percentage bump means a large increase in the total. All commercial property saw growth, except for the smaller businesses, which lost 3% of their value.

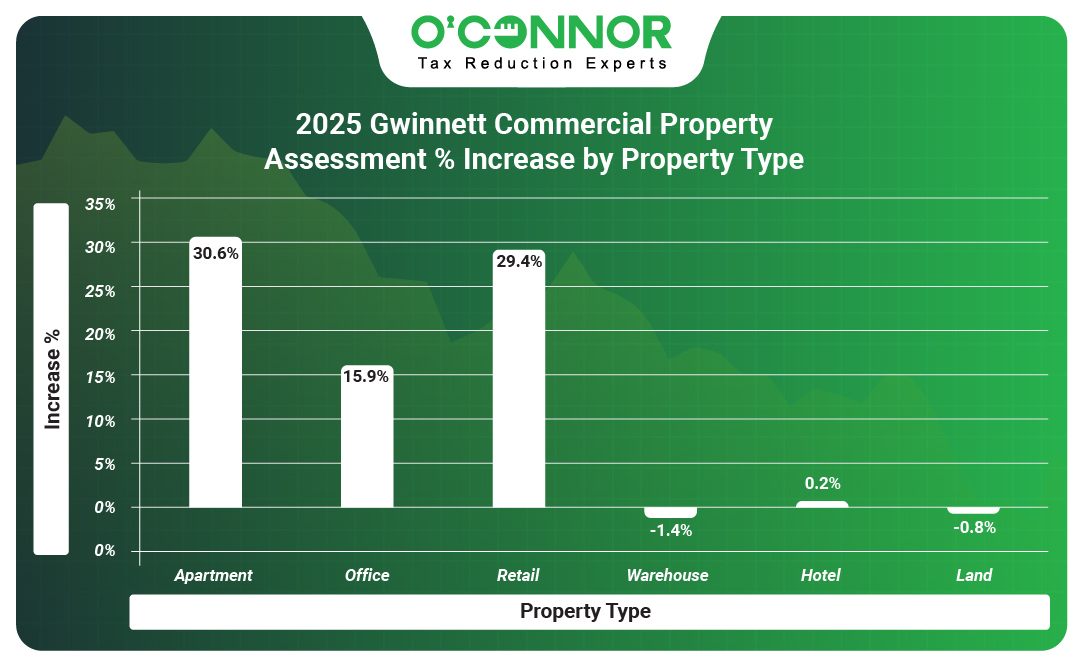

Looking at the data, it is clear that the primary reason for the overall jump is that apartments saw their value grow by an astounding 30.6%. Apartments were already in the No. 2 spot thanks to a 2024 total of $11.69 billion. However, this shot to $15.27 billion in 2025, making apartments the top commercial property. The former No. 1, warehouses, lost 1.4% in value. While having a lower total than warehouses or apartments, retail saw a massive rise of 29.4%. Raw land experienced a tiny drop of 0.8%.

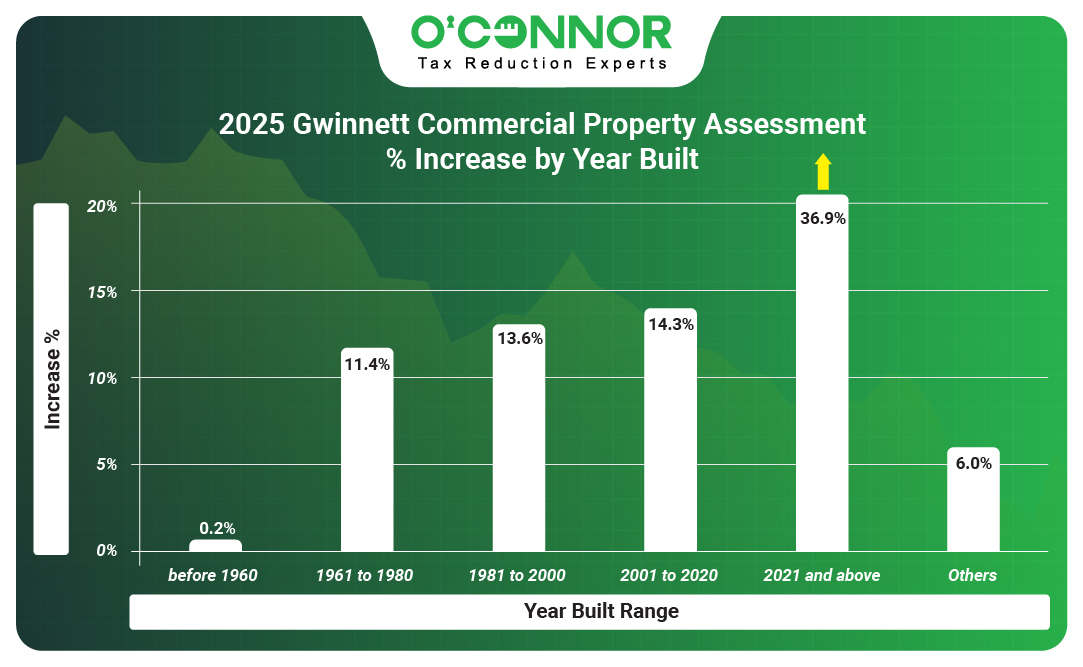

When it comes to breaking down commercial properties by their construction date, it seems that they follow residential properties almost to the letter. 48% of all commercial value was built between 1981 and 2000, while 28% was built between 2001 and 2020. New construction did even better for commercial properties, growing taxable value by 36.9% in 2025, setting it up as 12% of all value. Commercial property looks to be growing at a break-neck pace.

Gwinnett vs. the Nation

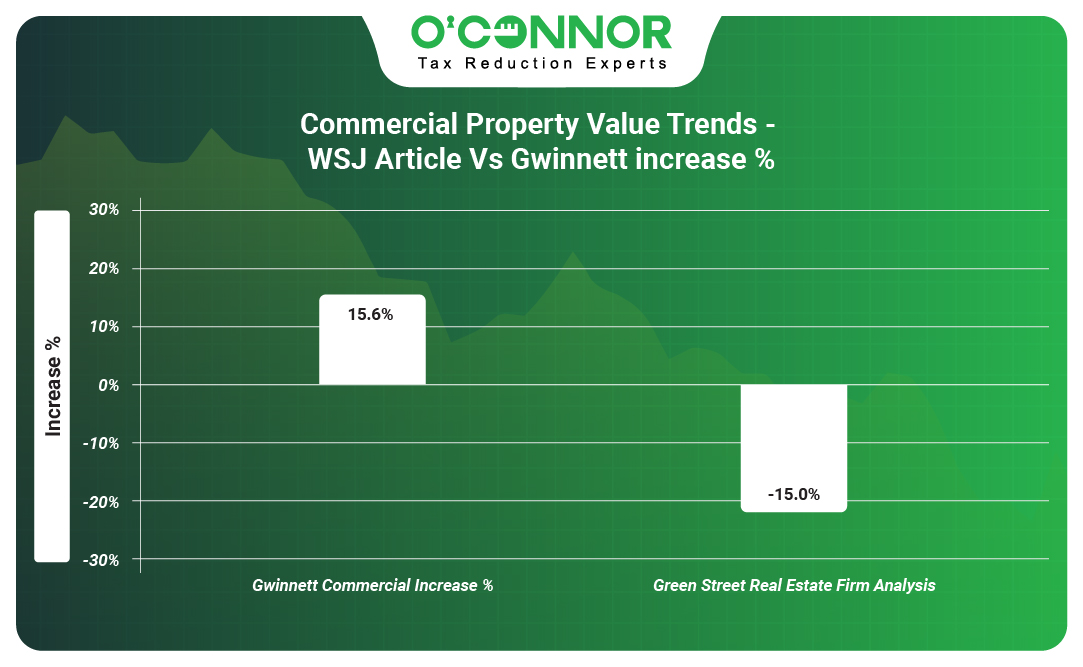

While an outside source cast some doubt on residential values, another study comes for commercial values like a hurricane. Green Street Real Estate, an iconic property analytics firm, claims that the value of commercial property has fallen by 15% nationwide. This is in direct opposition to the Gwinnett Board of Appraisers’ claim that values are up 15%. Green Street claims that high interest rates, high-yield bonds, and other economic matters have made commercial property unappealing investments. This is for the United States as a whole, not for Georgia alone, so these numbers could matter little for Gwinnett County. Still, it does open up territory that could be exploited by a property tax protest.

Apartments Rocket to the Top

Apartments jumped 30.6% in assessed value in 2025, becoming the top commercial property in Gwinnett County. When apartments are looked at by the age of construction, it is clear why they saw such a jump in value. New construction saw a value increase of 41.1%, moving it up to 21% of all apartment value. That is a lot to be added to the books at one time. The biggest value pool is apartments built between 1981 and 2000, and this block saw a growth of 26.1%. All apartment age ranges grew by over 25%. This seems to reveal an even bigger demand for housing than single-family residences indicated.

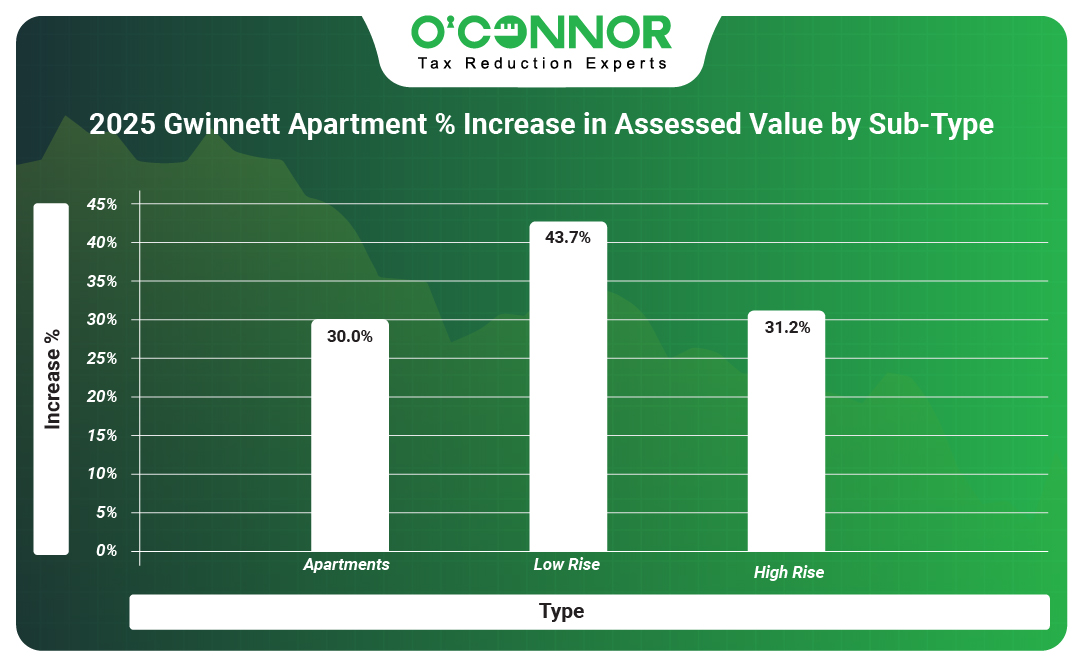

The Gwinnett Board of Appraisers classifies apartments into three subtypes. The largest block is generic apartments, with $11.71 billion in value. High-rise apartments are No. 2 with $3.13 billion, while low-rise apartments have $423.60 million. Each apartment subtype saw value increases over 30%, with low-rise apartments netting 43.7% more in value.

Office Value up 15.9%

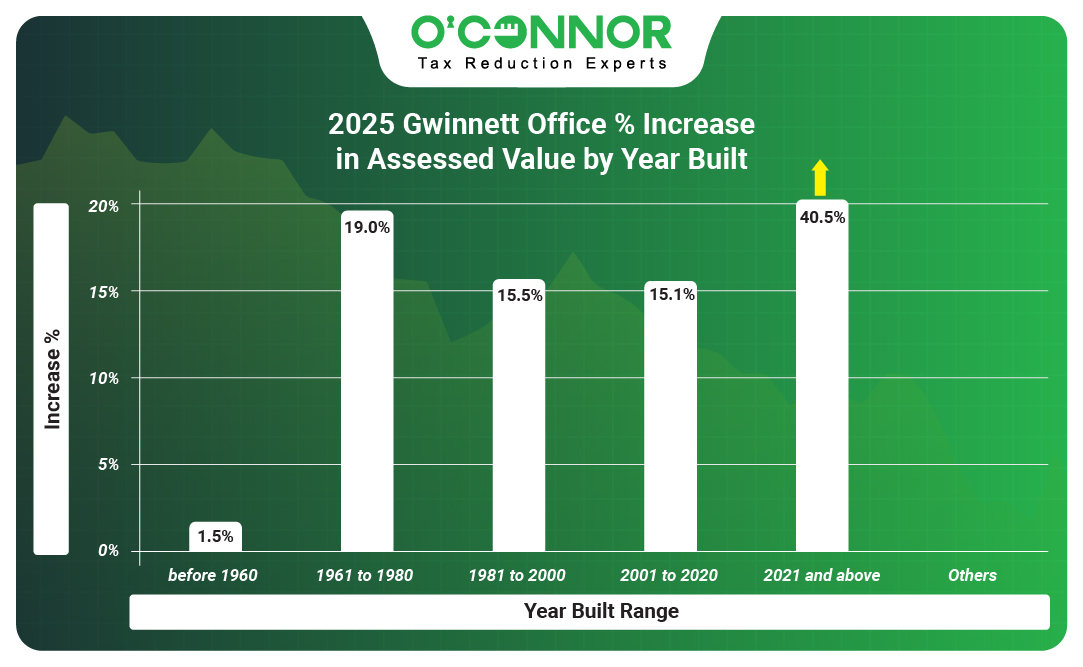

Offices are making a comeback after the pandemic, and Gwinnett County is a shining example. The assessed value of offices climbed 15.9% in 2025, achieving a total of $3.88 billion. 60% of all value was built between 1981 and 2000, which saw an increase of 15.5% in 2025. While only 2% of all office value, new construction jumped by 40.5%. It is estimated that offices added a total of $533.22 million between 2024 and 2025.

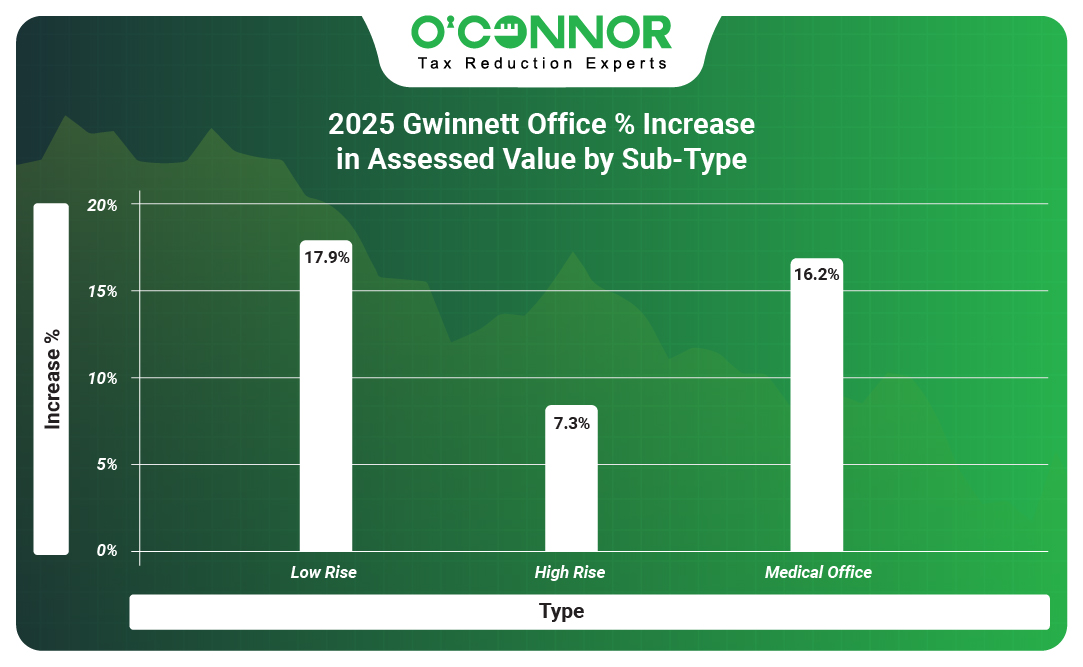

Gwinnett County offices are divided into three subtypes to help categorize them. Low-rise apartments are the primary type in the county, with $2.57 billion. Low-rise offices added to their lead thanks to an assessed value increase of 17.9%. Medical offices added 16.2% more value in 2025, while high-rise offices netted 7.3%.

Retail Experiences a 29.4% Jump

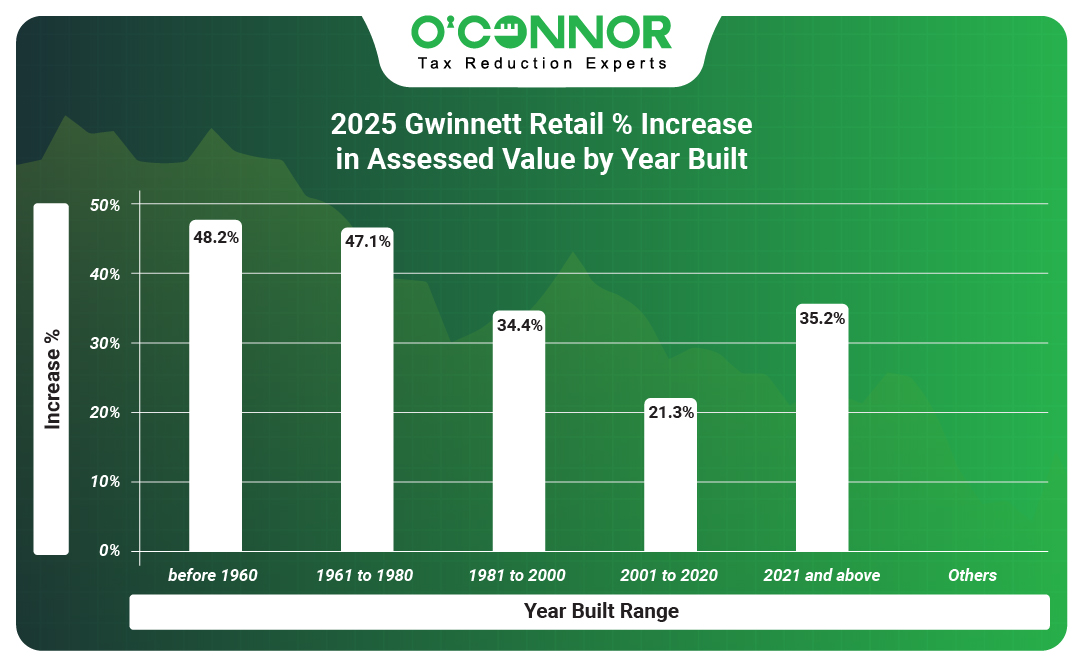

It looks like retail outlets are also on the way up, as they netted a giant increase in value with 29.4%. When attributions are broken down by the construction age, it seems that growth is quite universal. Retail properties built between 1981 and 2020 accounted for 50% of all value, while those from 2001 to 2020 produced 41% of the value. These properties experienced 34.4% and 21.3% growth respectively. New construction already makes up 2% of all retail, growing by a thundering 35.2% in 2025. Even older properties saw their taxable value go up by over 45%.

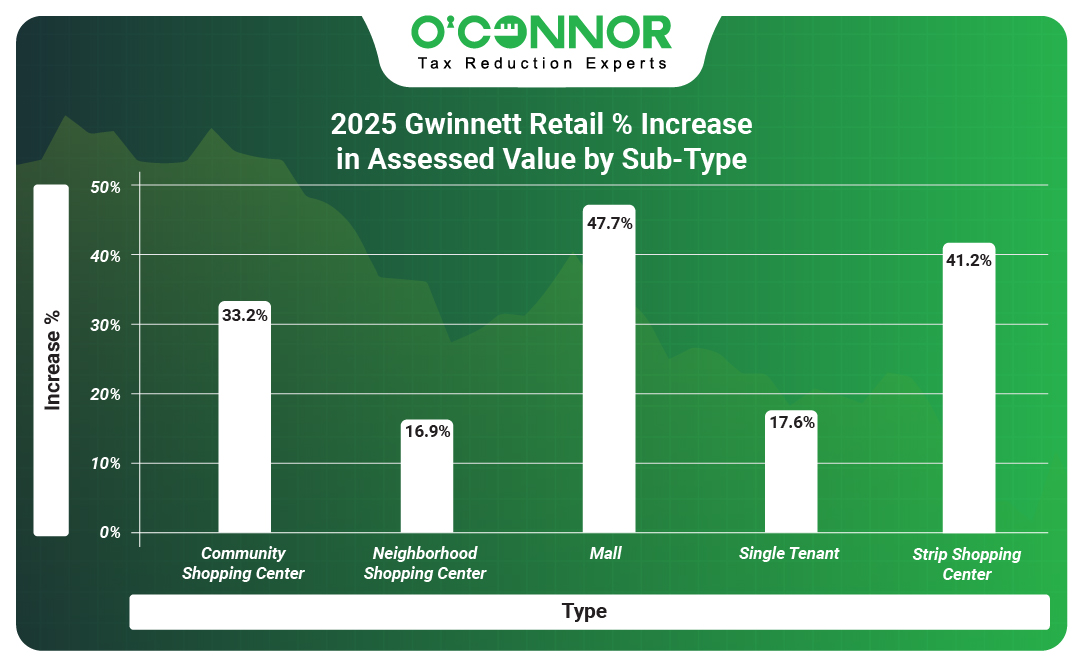

Retail properties are helpfully broken down into several subtypes. Strip shopping centers kept their top spot with a giant increase of 41.2%. Single-tenant retail, also known as big box stores, stayed at No. 2 while adding 17.6%. The largest increase was seen with malls, which added 47.7% to the assessed value. All commercial subtypes gained at least 16% more value in 2025.

Warehouses Retreat Slightly

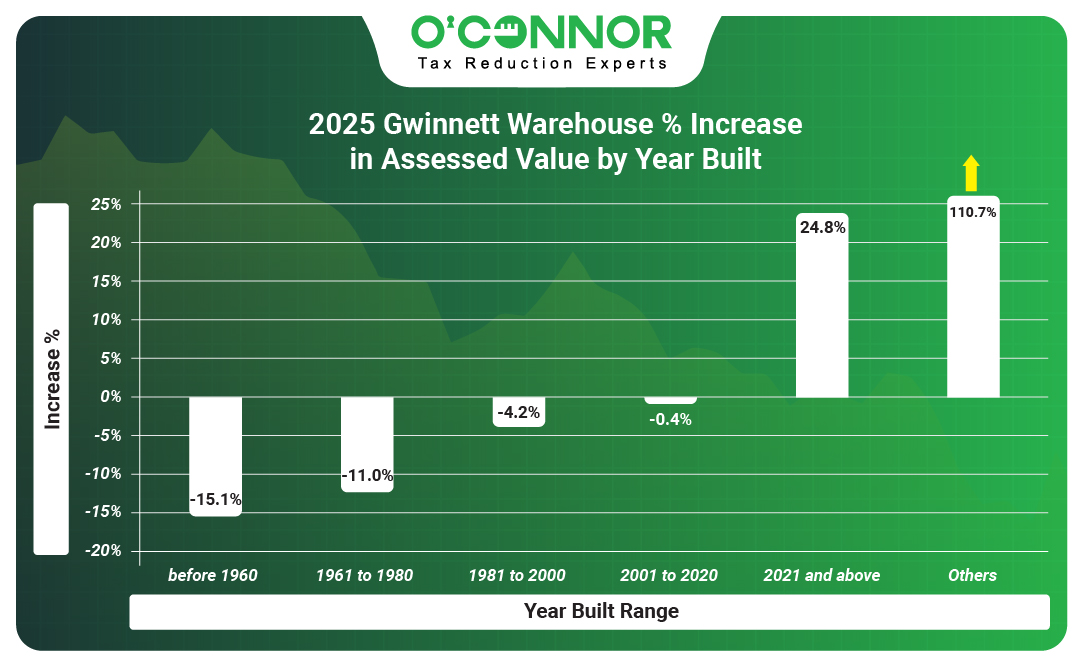

The only commercial property type in Gwinnett County to show any kind of loss in value was warehouses. Usually, these humble structures are always growing, especially in economic boom conditions. Warehouses diminished by a greater percentage as they aged, with the oldest warehouses losing 15.1% of assessed value. The only positive number was 24.8%, which was added by new construction. Warehouses built from 2021 to the present now account for 9% of the value. This may illustrate a shift from older properties to newer ones. Warehouses in the “other” category had a 110.7% increase, but only accounted for 1% of all total value.

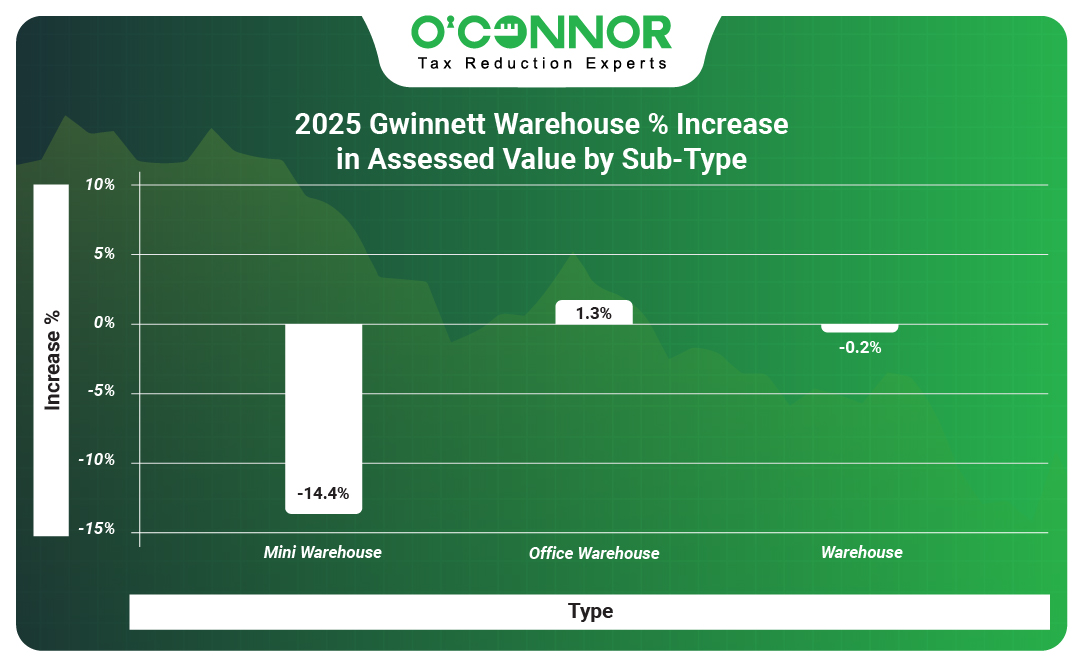

There are three warehouse subtypes according to the Gwinnett Board of Appraisers. The standard warehouse is the largest holder of value with $8.32 billion, though it experienced a drop of .02%. Mini warehouses had the greatest drop, with a decrease of 14.4% in 2025. Office warehouses sat in the middle, with a total of $2.84 billion and a small growth of 1.3%.

Gwinnett is the Perfect Case for Tax Appeals

Gwinnett County certainly lives up to its reputation as a community on the rise. With skyrocketing values for both residential and commercial properties, Gwinnett County is clearly far more than just a suburb of Atlanta. These are not empty percentage increases either, as real value is being raised across the board. This seems to be a good economic indicator of things to come, and new construction is booming as well.

This makes Gwinnett County the perfect place for a property tax protest. Not only are there things like demographic shifts and gentrification to think about, but there is the property tax freeze exclusive to Georgia. With the property tax freeze, any successful property tax appeal freezes values to the appeal verdict for the next three years. This was once easy to achieve, as any appeal would result in a freeze. However, thanks to wealthy property owners constantly trying to game the system, it was refined to only successful campaigns.

This means that you will need expert help to land both a reduction and a tax freeze. Thankfully, O’Connor is here to watch your back. For over 50 years, O’Connor has battled high taxes across the nation. With so much money on the line, especially in a county that will only get more expensive over time, you need to lock in your tax freeze while you can. As one of the largest property tax firms in the country, O’Connor is the perfect partner to get you all that you deserve.