Cursed with the second-highest property taxes in the United States, the people of Illinois know that it’s a gamble when another reassessment of their property arrives. As one of the many counties surrounding the Chicago area, McHenry County gets to experience the out-of-control values and taxes first-hand. While they are thankfully outside of the bizarro world of Cook County, there is still plenty of spill-over that crosses the border. As more people flee Cook County for the surrounding collar counties, they bring higher property values with them.

Chemung Township may be a good ways from Chicago, but even they are beginning to experience some bloat in their values and taxes. Though the official reassessment of Illinois is not until 2027, the Chemung Township Assessor is still actively examining all property and adjusting assessed numbers for supposed fair market value. As these climb, so do possible tax burdens. The people of Chemung Township have the right to protest these values, but they only have until July 21, 2025, to do so.

Chemung Home Values Rise 9%

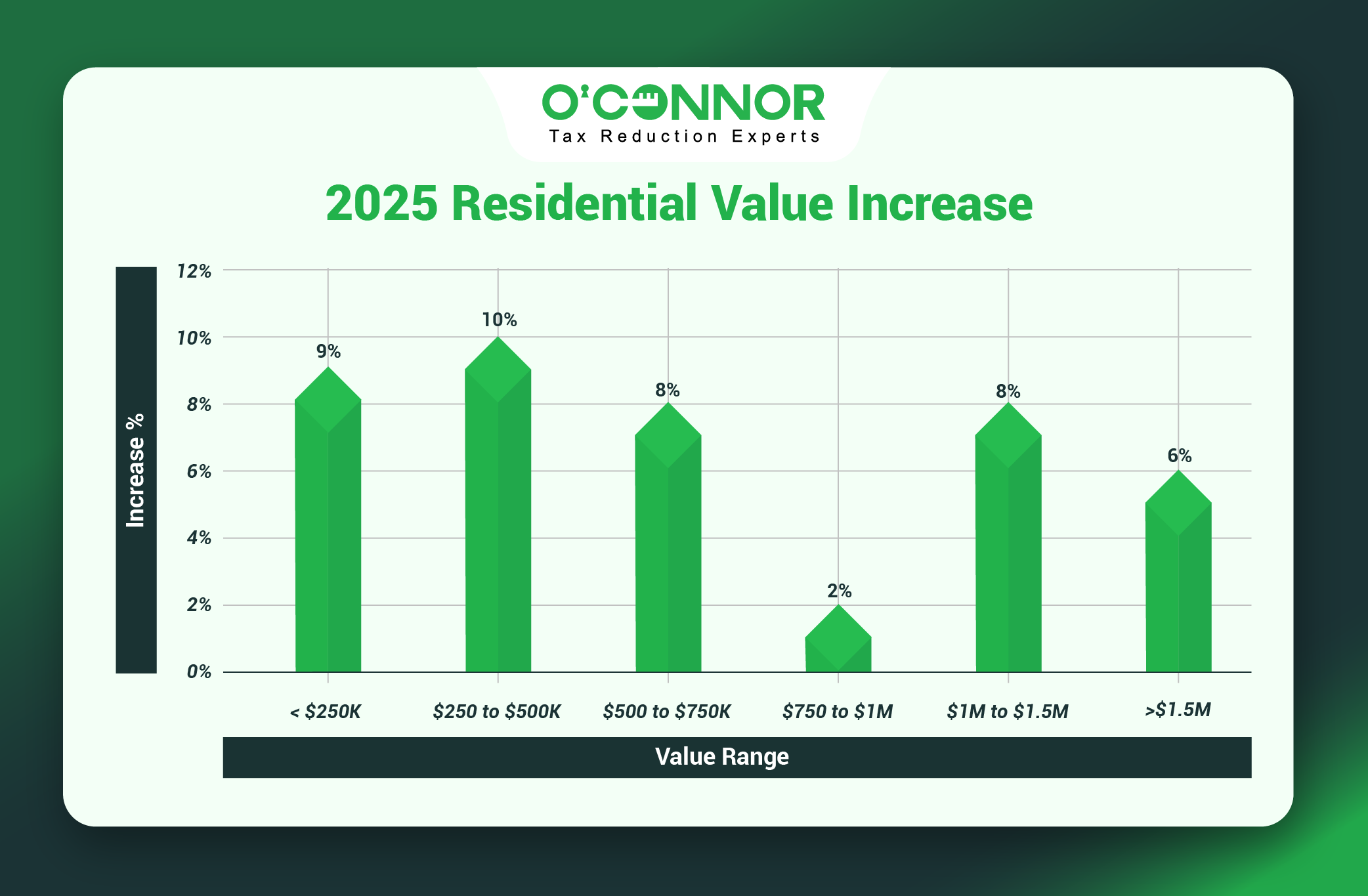

While Chemung may not have the biggest influx of people from Chicago, they still deal with the Illinois phenomenon of constantly increasing home values. In 2024, all residential property in Chemung Township was assessed at a combined $521.23 million. The Chemung Township Assessor has recently set the new value at $567.66 million, an increase of 9%. While this is relatively tiny compared to recent rises, such as Maine Township in Chicago, this would be seen as an obscene value jump in any other state.

Being a small, tight-knit community, Chemung Township’s residential value is mostly found in modest homes. $352.97 million in home value comes from residences that are worth under $250,000, a rarity in Illinois. This group of houses was hit with an increase of 9%, which makes it the hardest hit out of all residential properties. Homes between $250,000 and $500,000 may have gotten a 10% increase, but they account for a much smaller piece of the whole. This means that the homes of working families are under threat, as property taxes often represent the largest bill a family has.

Despite being worth more, the most expensive homes in the township actually saw lower value rises than those for working and middle-class families. Homes worth over $1.5 million only saw an increase of 6%, while those worth between $1 million and $1.5 million got a bump of 8%. While this does represent only a fraction of the total, it still seems to be unequal. Homes worth between $750,000 and $1 million only saw a jump of 2%.

Knock-On Effects of Value Increases

Jumps in property value can affect a wide variety of things in a community. It makes homes harder to buy, sell, or keep, especially for older families. This puts legacy homes at risk and could threaten the homes of people that are of lower income. This also translates into higher rents, which makes it even harder for people. Rising taxes have become such a problem for working families, that there are several different bills in the legislature trying to find a solution, from a “circuit breaker” to senior freezes. Currently, the only option to stop runaway taxes is to protest, but hopefully this will not be the case in the future.

Chemung Businesses Feel the Pinch

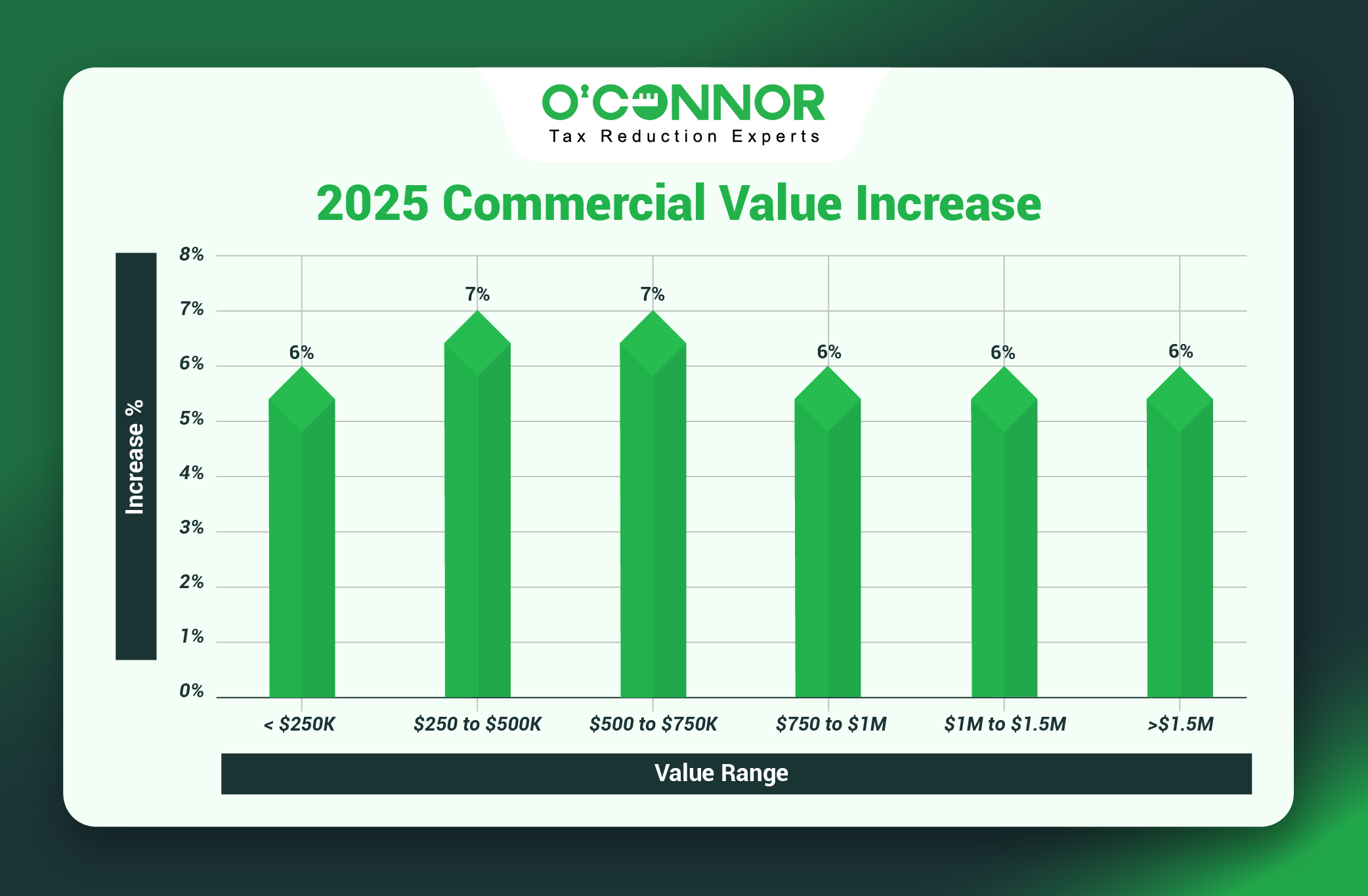

Of course, property value spikes do not just impact homeowners, commercial property owners are usually victims as well. While 2024 saw all of Chemung Township commercial property valued at $140.35 million, this was bumped 6% to $148.92 million in 2025. While increases in the value of a business are typically welcomed, jumps of this size are generally overinflated, especially over a whole community. If this goes up too quickly, it can cause major problems for businesses, especially smaller ones.

The largest commercial properties in the township got the most increased value, as is typical. Properties worth over $1.5 million saw their value bumped up by 6%. As these buildings represent the largest holding of value in Chemung Township, this means that the 6% increase is usually felt across the entire community. Commercial properties worth between $750,000 and $1.5 million likewise saw a 6% increase.

On the opposite end, much like residential property, it was the little guys that got the most thrust upon them. Commercial property worth less than $250,000 totaled $42.84 million, only ranking behind the largest of businesses when it comes to combined value. Despite being in the No. 2 spot, these small businesses got a 6% increase as well. While this is a minor jump when looked at on a balance sheet, this rise can be much more devastating to small businesses.

Chemung Appeal Deadline is July 18, 2025

The best and only way to protect your property from raging values and taxes is to protest them. Every Illinoisan has the right to dispute the values handed to them. While you cannot change your tax rate or your equalization factor, you can lower your taxable value. If this is achieved, then it will make your tax bill lighter. In some cases, a successful protest can be all that stands between a homeowner and a foreclosure. While this is seen all the time in Chicago, it can happen anywhere in Illinois.

While the people of Cook County get several bites at the apple, everyone else in Illinois gets one deadline. This is done by the local township assessor and is a hard line in the sand. Whether you are looking for an informal appeal to the Chemung Township Assessor or want a formal hearing with the Board of Review (BOR), you must file the appeal by the same deadline.

The deadline for Chemung Township is July 18, 2025. If you miss your chance to appeal, then there is nothing you can do to pay lower on your 2025 tax bill. Informal appeals and BOR hearings both require evidence, but the BOR is stricter on what they will accept. The main advantage of a BOR hearing; however, is that they are an impartial arbiter of the case and have no allegiance to the township assessor. This typically means that you will get a better deal from the BOR than you will by a simple informal appeal.

O’Connor is Here to Assist You

We at O’Connor love a challenge, especially when that is lower property taxes for working people and business owners. For over 50 years, we have been helping people across the country fight to keep their property, pride, and money. We opened a branch office in Aurora solely because we have seen so much demand in Illinois, especially in the collar counties. No taxpayer is in more need of our help than the people of Illinois.

Our branch office knows Chicago and the collar counties well and has dealt with assessors and BORs in every township in the area. They know what evidence is required and how best to get a reduction. They also have access to our proprietary database, which allows us to compare home values across the region to find the perfect match to use as evidence for your appeal.

Please join us and get the best deal you can on your home or business taxes. One primary advantage when you join O’Connor is that we will protest your taxes annually. You do not have to worry about keeping up with more deadlines or being handed a tax you never knew had risen. We will take care of everything for you, allowing you to relax all year round. Even when the dreaded reassessment comes around or if you missed the deadline this year, we will have you ready for victory in 2026.

About O’Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, New York, Texas, and Georgia. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.