While many collar counties have a strong relationship with Chicago, Dundee Township is truly joined at the hip with Cook County. As one of the top suburban areas in the region, Dundee Township has been seeing its fortunes rise every year, thanks to population migration and economic growth. Popular for getaways and as an alternative to busy city life, the area is quickly becoming one of the most popular in the entire region.

While being intimately connected with Chicago has plenty of advantages, Dundee Township is also starting to see plenty of spillover from the many issues in Cook County. The No. 1 problem is rising property values and taxes. These have been hitting record levels across all of Illinois, but the collar counties in particular have been at the heart of the storm. Property tax appeals have become an ever-popular way to fight rising prices, but the time to deploy one is almost up. The last day to file a protest in Dundee Township is August 14, 2025.

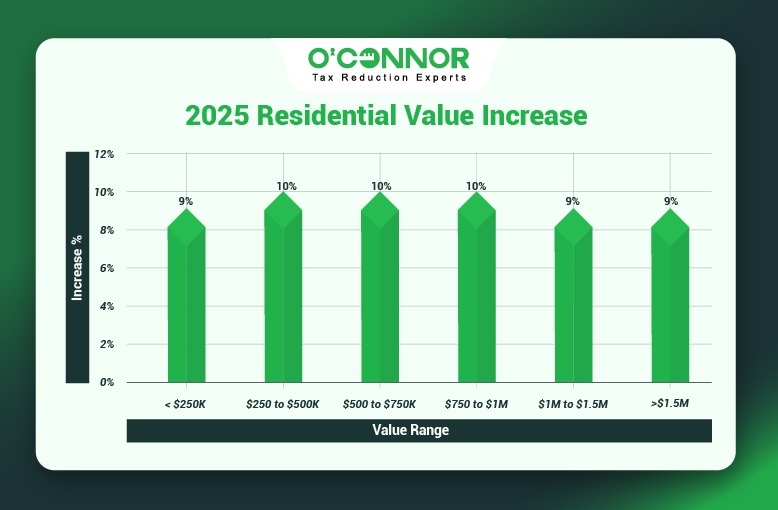

Dundee Home Values Soar 10%

With an increasing prominence as a suburb, it is little wonder that Dundee Township has a valuable housing market. Originally assessed at $5.74 billion in 2024, 2025 saw a large increase of 10%, taking the total to $6.29 billion. This was well beyond inflation and there was no township-wide reassessment. Home values all over Kane County, and the collar counties as a whole, have been increasing at a growing rate, but due to Dundee Township’s larger size, this growth has translated into even more value.

Homes worth between $250,000 and $500,000 generated the most value, with $3.91 billion in 2025. This was up 10% from $3.56 billion in 2024. Homes worth under $250,000 accounted for $1.48 billion in value, making them the second-largest block of homes. These modest houses saw a jump of 9% in 2024, taking them from a previous total of $1.36 billion. Homes worth between $500,000 and $750,000 rounded out the top three with a total of $796.53 million. These larger homes experienced a growth spike of 10%.

While the majority of Dundee Township homes were small-to-medium suburban residences, there was also rising value to be found for luxury homes. Residences worth between $750,000 and $1 million grew by 10%, achieving a total value of $69.12 million. Even the largest homes, those over $1.5 million, experienced a jump in value of 9%. When put together, this leaves Dundee Township with some of the highest home value totals in all of the collar counties.

A Continuing Trend in Kane County

We have covered many townships in Kane County, and while each has its own quirks and culture, the common trend is that home values continue to rise. Plato experienced an increase of 11% across home values, while Rutland Township saw a jump of 9%. Geneva and Batavia Townships joined Rutland with an increase of 9% each. Aurora Township, the largest in Kane County, also saw a spike of over 10%. It is clear to see that Kane County is growing in value at an unprecedented pace, no matter what township is involved. While some of this is thanks to population movement or construction, much of it is also due to overzealous property tax values, which need to be looked into.

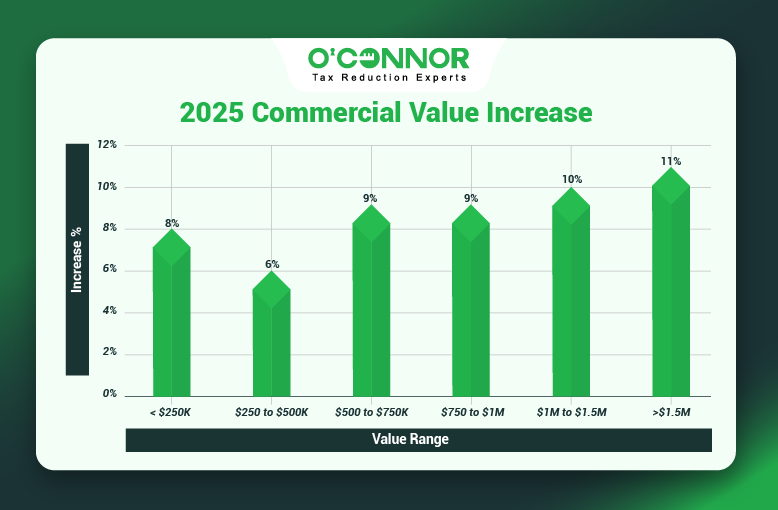

Dundee Commercial Property Surges 11%

The increases in Kane County have not been isolated to homes, as commercial property has also been around the same level as residential. With a total value of $3.12 billion in 2024, Dundee had more business value than most Kane County townships. This was thanks to its size and proximity to Cook County. This large overall number was quickly grown by 11% in 2025, bringing the total to $3.46 billion. This is a significant jump that can be too much for many businesses to handle. Like homes, it is also much higher than inflation or other realistic growth factors.

Like most areas, the majority of Dundee Township’s commercial total was thanks to the largest of businesses. $2.99 billion of the overall total came from commercial properties worth over $1.5 million. These commercial properties were also handed an assessed growth rate of 11%, acting as the primary driver for the overall spike. This is an astounding level of one-year growth for an area that is primarily suburban. These large commercial properties were responsible for around 86.34% of the grand total, one of the highest percentages in Kane County.

Commercial properties worth between $1 million and $1.5 million were in second place with $177.61 million, thanks to a jump of 10%. This was followed by properties worth between $750,000 and $1 million, which contributed $91.27 million after an increase of 9%. Even the smallest of commercial properties, those worth less than $250,000, saw a strong increase of 8%. These totals put Dundee well ahead of most Kane County townships, with the exception of Aurora.

Appeal Deadline Scheduled for August 14

With commercial and residential property values reaching levels never before seen in Dundee Township, taxpayers are looking for a way to control prices before it is too late. The only option in Illinois to lower property values and taxes is to use a property tax appeal. While these cannot lower tax rates, they can decrease tax burdens by reducing taxable value. Property tax appeals are becoming the new normal in Illinois, as taxes are only increasing every year. There have been many plans to reduce this trend, but every effort to stop the increase of property taxes has failed so far. This leaves appeals as the only option.

The sudden growth in both homes and businesses makes Dundee Township a choice spot to deploy property tax appeals. If the growth is artificially pumped up by assessors, then appeals will reveal the truth. If there really is a giant upswing, then appeals can compare similar properties and help taxpayers find relief through a different path. Whether they are targeting inaccurate information or uniformity, property tax appeals can help bring values back down to reality.

Taxpayers in Dundee Township are running out of time, however, and they need to take action right away. The deadline for property tax appeals in Dundee Township is August 14, 2025. This applies to all protests, which means that if a taxpayer wishes to contest their values, this is their only chance. Cook County might get separate deadlines for informal appeals and formal hearings before the Board of Review (BOR), but other Illinoisans do not. This means that taxpayers must strike now if they wish to protect their properties in 2025.

Join O’Connor Today

With time running out, if you want to protest your taxes, then your best option is to join forces with a consultant that knows the process like the back of their hands. We at O’Connor are here to help. For over 40 years, we have been protesting taxes from coast-to-coast, representing taxpayers in 49 states. In 2024 alone, we helped over 187,000 clients cut their taxes down to fair levels. As one of the largest property tax protest firms in the United States, we have seen and done it all.

Illinois has become a focus for us because of how outrageous and unfair taxes are. Things in and around Cook County have gotten so bad that even the Cook County Assessor’s Office has asked taxpayers to protest. This has spread throughout the entire state, and while the rest of Illinois is not seeing Chicago-level issues, they are still paying the second-highest property taxes in the country. We have set up a branch office in Aurora specifically to help the area around Cook County, especially the collar counties like Kane.

We will protest your taxes annually, meaning you will be prepared for even the dreaded assessment. This will ensure that you do not miss any more deadlines or find yourself facing a high tax bill that comes out of nowhere. Best of all, there is no charge to you unless we lower your taxes. Whether you have a commercial property, home, or a collection of properties facing high values, we can help.