Batavia Township is quickly becoming one of the top suburban areas of the Chicago area. Offering a calm atmosphere and rural flair to people looking to escape the urban sprawl of Chicago, Batavia Township has plenty to offer those looking to live, work, or play in one of the most competitive housing markets in America. Firmly established in the collar county of Kane, it seems that Batavia is destined to grow every year, in both residential areas and in businesses.

Batavia may not have the insane property values seen in Cook County, but thanks to the notorious policies of Illinois, it still suffers some of the highest property taxes around. While legislation to fix various property tax problems across Illinois is dead in the water, taxpayers still have the option of property tax appeals to ensure they are paying their fair share. The deadline for Batavia Township, August 4, 2025, is looming large. Once this date slips by, there are no other chances to lower property values. O’Connor will cover how high property values across the township have risen.

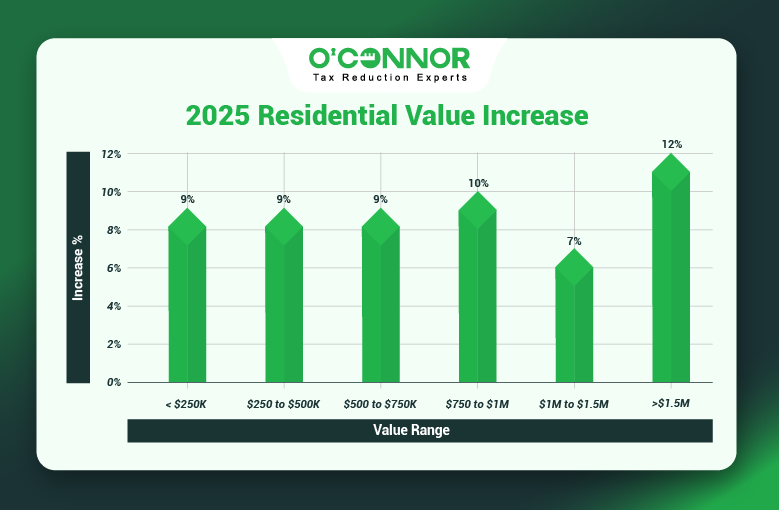

Batavia Home Values Climb 9%

In 2024, the Batavia Township Assessor estimated that all residential property value in the township combined for a total of $4.47 billion. While not in an official reassessment, the assessor still kept track of home sales and put the 2025 fair market value of all property at $4.88 billion, an increase of 9%. This is an astounding figure, putting value growth well above inflation or the standard home appreciation rate. This implies that property values are above what the home itself is worth. This is the textbook situation for a property tax appeal.

As a middle-class area, the bulk of home value is reserved in homes that are worth between $250,000 and $500,000. These homes jumped 9%, bringing their overall value to an estimated $2.86 billion. Homes worth between $500,000 and $750,000 were in the No.2 slot for total value and likewise saw a 9% increase, reaching a total of $1.35 billion. These categories are the bedrock of Batavia Township and were the main drivers in the increase of all value. Even the smallest homes, those worth under $250,000, saw a spike of 9%.

While only a small part of the total, larger and more expensive homes were not spared either. Residential property worth between $750 and $1 million experienced a jump of 10%. Those worth between $1 million and $1.5 million saw a smaller increase of 7%. It was the mammoth homes valued above $1.5 million that saw the largest value hike at 12%, though this affected the least number of homes. All strata of homeowners felt the burn of overinflated home values.

The Reason for the Increases

Many Illinois taxpayers associate reassessment with major jumps in their tax bills. While this is true for Cook County and other areas, many of the collar counties can expect their property to be reevaluated every year. The Batavia Township Assessor compares the value of homes sold over the previous three years, then uses this to formulate the new fair market value for comparable homes. This is also how the enigmatic equalization factor is calculated. While in theory, these evaluations should make everything fair, in reality, it seems that this only means higher values and taxes. Beyond the assessor, tax rates are often bumped up thanks to the demands of various taxing entities, such as school districts.

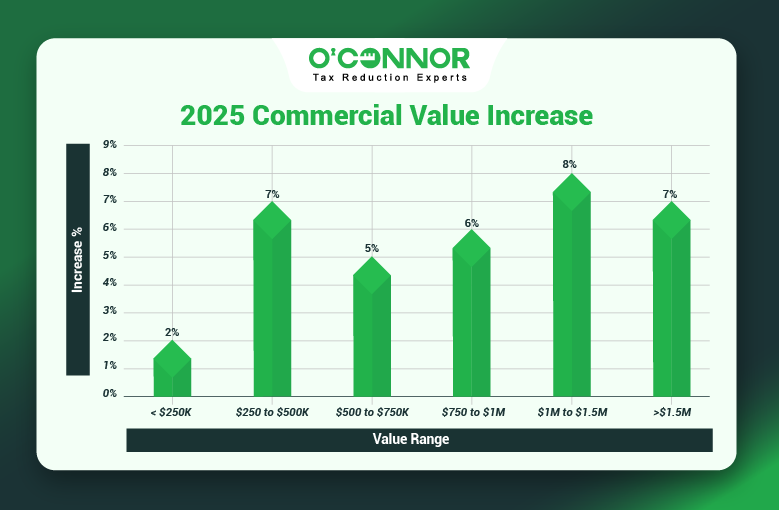

Batavia Commercial Property Rose 7%

Property tax hikes are universal, and businesses often see themselves as one of the primary recipients of out-of-control values. Commercial properties are worth a lot individually, and a few rate increases can mean major money for taxing bodies. 2024 saw the total commercial property of Batavia Township be valued at $667.28 million. This number got boosted 7% to $716.68 million in 2025. While below the value of residential properties, each business that suffers a value spike can lead to a devastating cascade for employees and clients.

The majority of value and value increases were associated with the largest commercial property types. It is typical for the most expensive business properties to be worth the most combined, acting in the opposite direction of residential properties. Commercial properties worth over $1.5 million were responsible for $474.41 million in 2024, before growing 7% to $509.60 million in 2025. Controlling over half of all value, it is easy to see how this category steered the total value of commercial property the most.

Commercial property worth between $1 million and $1.5 million had the second-highest total, while also growing by 8%. In third place, businesses with a worth between $750,000 and $1 million experienced a growth of 6%. Even commercial properties worth less than $250,000 felt a value increase, albeit just 2%. While some positive growth in value is always good for investors or owners, the numbers being seen in Batavia Township look to be inflated, especially larger for businesses.

August 4, 2025, the Last Day to Appeal

Property values and taxes are perennially on the upswing in Illinois, especially around Chicago. As aggressive tax policies push more residents into the suburbs, the collar counties are going to feel a housing pinch like any other suburban area. Unlike smaller townships like Richmond, Batavia boasts a lot more housing opportunities and amenities that attract refugees from Chicago. This means that Batavia Township could be the next hot suburb for those looking for fair housing. While this does create a seller’s market for those looking to offload their house, it also makes it more difficult for homeowners and renters to keep their homes, ones that have possibly been in the same family for generations.

As populations soar and property values increase, there are few options to protect homes or businesses from accelerating growth. Property tax appeals are the only legal way to stop this trend and bring some normalcy to the situation. Cook County and Illinois are both seeing record tax protests and property taxes are seen as the No. 1 issue facing Illinoisans in every county. Even county and township assessors are encouraging taxpayers to appeal by any means necessary. While this is a tense situation, there is still hope for those that wish to fight their assessed property values.

The first step is an informal appeal directly to the Batavia Township Assessor. This can be as simple as a phone call and is an easy way to fix smaller issues. The next option is a formal appeal to the Board of Review (BOR). Formal appeals can either follow formal ones or serve as the jumping-off point for a protest journey. No matter what you chose, know that you only have until August 4, 2025, to file your appeal. The people of Cook County have multiple deadlines, but everyone else only has one. This varies from township to township, but it is always a hard line. This means you only have a short amount of time to build your case, which includes gathering evidence and finding other properties to compare yours to.

Let O’Connor Help:

Many liken a good property tax appeal to having a second job. While it can be rewarding, not everyone has the time to put together evidence, compare properties, and set up a meeting with the assessor or BOR. If you need a team of experts at your side, please feel free to reach out to us at O’Connor. For over 50 years, we have been fighting appraisal districts, assessors, and various boards to get our clients the savings they deserve. We help over 185,000 clients in 45 states every year, but made an effort to open a branch office in Aurora. From this local office, we can help people in Chicago, the collar counties, and beyond.

O’Connor not only brings experience to the table, but also a litany of resources from being one of the largest property tax firms in the United States. We have tax experts that know every law, researchers that can find any information, and a curated database of home sales that is top of the industry. When we bring our full arsenal to bear for our clients, we always get results.

When you sign up with us, we will protest your tax values annually, so you never miss a deadline. Illinois is notorious for sneaking in rate hikes and never informing the public, so it is good to have someone watching the back channels and always keeping on top of things. Best of all, there is no cost to join. You will never see an upfront fee or a hidden cost and will only pay if we are able to lower your taxes.