Aurora is the most populous township in Kane County and one of the biggest in Illinois. Becoming something of a capital for the collar counties surrounding Chicago, Aurora embodies the growing hybridization of suburbia and urban development. Armed with all the amenities of a big city and tinged with a suburban feel, Aurora is attracting more residents and businesses than ever before and is becoming an economic powerhouse.

This success and the proximity to Cook County has not been all wine and roses, however, and Aurora Township is beginning to see a huge impact from rising property values. While some increase is evidence of healthy economic growth, there have been many spikes in the region that are above inflation and the expectations of experts. This means that the Aurora Township Assessor could be overvaluing properties in an attempt to raise revenues. The only way to counter these aggressive policies is with property tax appeals. The appeal deadline is set for August 22, 2025. This will be the last chance for both informal appeals to the assessor and formal appeals to the Board of Review (BOR). O’Connor will cover how property values have climbed in 2025 and why you should appeal.

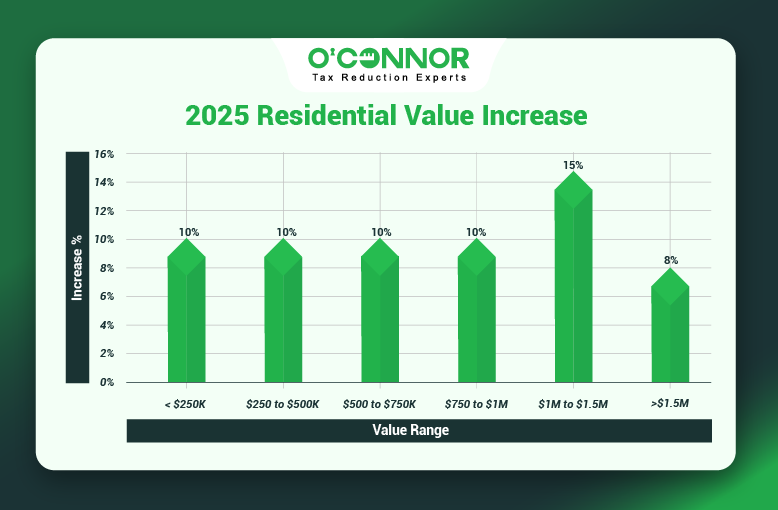

Aurora Home Values Soar 10%

While there was no official reassessment in Aurora Township in 2025, the assessor was busy adjusting property numbers to match the alleged fair market value. Initially assessed at $7.49 billion, the grand total for all residential property was raised 10% to $8.23 billion. This put Aurora’s increase somewhere between the typical Kane County township and that of a Cook County township that is under active reassessment. This is a major blow for many homeowners, as a 10% increase in the span of only a year can be quite a shock, especially on top of over recent hikes.

Most residential value in Aurora Township is concentrated in modest homes. The largest block of residential property in the township comes from homes worth between $250,000 and $500,000, which totaled $4.46 billion after growing by 10%. In second place were homes worth $250,000, which created $3.37 billion in total value after also seeing an increase of 10%. The 10% trend continued with residential properties worth between $500,000 and $750,000, though these only totaled around $368.20 million.

There were some fluctuations in the growth rate when more expensive residences were accounted for. Those worth between $1 million and $1.5 million saw the largest increase at 15%, though this ended up translating into only $5.45 million. Truly massive residences, those assessed at over $1.5 million saw an increase of 8%. The only outlier were homes worth between $750,000 and $1 million, which grew at the typical 10%.

Kane County is Seeing Record Growth

While Aurora Township is the crown jewel of Kane County, the entire area has been seeing extensive value hikes. Dundee Township, which shares many characteristics with Aurora, saw a 10% growth in home values. Rural communities saw even higher increases in some places. Rutland and Plato experienced growth of 9% and 11% respectively, while Batavia and Geneva each grew by 9%. One of the primary reasons for this trend is that more people are fleeing Cook County every year, pushing up demand. There is also strong evidence of values being inflated by township assessors, but the intentionality of this is questioned.

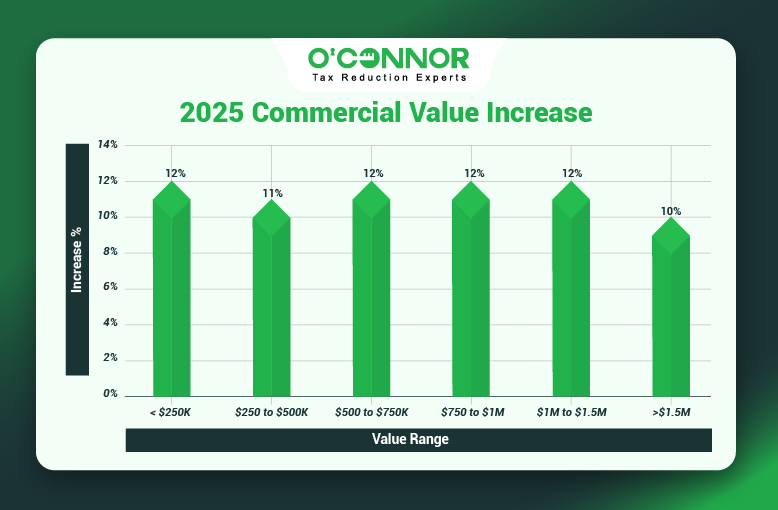

Commercial Property Grows 10%

Aurora Township is one of the largest economies in Illinois. Just like residences, businesses across Kane County are seeing numbers never experienced before. Aurora Township has the largest commercial property total out of all of Kane County, with only Dundee Township being close. In 2024, commercial properties were assessed at $3.23 billion. In 2025, this number rose 10% to $3.36 billion. This put Aurora in the same tier of growth as most other townships.

When it comes to total value, it is usually the largest properties that generate most of it. This is certainly true in Auroura, where $2.70 billion in value was created by properties worth over $1.5 million. This was a 10% increase from 2024 and the primary reason for the overall uptick. With so much money packed into these properties, any change in value for them will create massive windfalls for assessors. These mammoth pieces of real estate were not the only group to see their taxable value increase, however, and there were spikes across the board.

Commercial properties worth between $1 million and $1.5 million generated $217.21 million in value after increasing by 12%. Those worth between $750,000 and $1 million likewise grew by 12%, as did those in the range of $500,000 to $750,000. With $220.56 million in value, business property worth between $250,000 and $500,000 was in second place, growing an additional 11%. Even the smallest of commercial ventures experienced an increase of 12%.

The Property Tax Appeal Deadline is August 22, 2025

There are not many options in Illinois to defend against the state’s infamously high property taxes. As tax rates are decided by bodies like school districts, there is no central agency to be protested. There have been several legislative attempts to fix the problem, with both parties putting forward ideas. So far, this has come to nothing, as funding is still required in record numbers. Outside of exemptions, the only mechanism left to taxpayers is property tax appeals.

Appeals can be used to reduce the taxable value of a property, making taxes consequently lower as they are based off of the assessed value. Property tax protests have been growing across Illinois every year and are currently breaking records in just about every township. More taxpayers are aware of their rights than ever before, and it seems that the latest round of tax increases may finally be the straw that broke the camel’s back.

There are informal appeals to the township assessors and then there are formal hearings with the BOR. In Cook County, each of these appeal levels have different deadlines, but this is not the case for the rest of Illinois. Even though there is a close proximity to Chicago, Aurora Township still has a single deadline, which is August 22, 2025. If this deadline is missed, then taxpayers will be stuck with their current property values for another year. As Illinois property taxes keep climbing every year, this means that values will only increase in 2026. If taxpayers wish to protect their property, now is the time to act.

O’Connor Helps Taxpayers

The deadline is quickly approaching and there is not much time to spare. Since Auroura taxpayers have only one shot a year, the pressure is truly on. While you could protest your values yourself, you could always turn to a professional for help. Illinois has some arcane property tax laws and there can be some pitfalls for laypeople. We at O’Connor can steer you around the traps and get you the reductions you deserve. After all, that is exactly what we have been doing for over 50 years.

We helped 185,000 clients in 2024 alone in their quest to reduce their taxes and have only grown since then. As one of the largest property tax firms in the nation, we have the resources needed to bring the fight to the township assessor and BOR. We are not just a national company, but we have plenty of local expertise in the area. We have a branch office in Auroura that is filled with local experts that know what evidence is needed to get you a win on your taxes.

There is no cost to sign up with us, and you will only be charged if we are able to lower your taxes. Best of all, we will automatically protest your taxable value for you every year. That means that there will be no more missed deadlines or surprise tax bills with an outrageous demand for money. We are passionate about protecting our clients and their properties and have made it our mission to help the people of Illinois defend themselves from unfair and unequal taxation.