The collar counties around Chicago offer some of the most diverse sets of demographics, economics, and terrain in the United States. Some are former industrial boom towns that transitioned to suburbs, while others are rural communities that became exclusive neighborhoods. No matter where you go in the region, you are going to find something different. Will County is perhaps the most eclectic of these counties, as it runs the full gamut of everything above. Joliet is still an industrial center, while Naperville, Plainfield, and Wheatland are all dynamic suburban and exurban communities.

Channahon Township is a well-kept secret in Will County. Situated southwest of Joliet, the township has become an in-demand living area for those that wish to escape the urban landscape. One of the wealthier townships in the area, Channahon boasts a high average income with a lower cost of living, making it the perfect place to settle down. This has attracted a strong influx of new people to the region, which has begun to push property values up. Coupled with aggressive valuations by the Channahon Township Assessor and longtime residents are starting to see larger tax bills. Property tax appeals are taking Illinois by storm and are the perfect way to counter these unfair values. However, there are only a few days left, as the final appeal deadline is set for September 8, 2025.

Taxable Value of Homes Increased 6% in 2025

One of the biggest boons of Channahon Township is that income is high while property values are relatively low. This is especially true when compared to neighboring townships like New Lenox, Plainfield, and Lockport. Like Channahon, these are all rural-suburban hybrids orbiting Joliet, each getting the best of both worlds. Channahon just happens to have better home values, even if they are climbing. In 2024, the total value of residential property in Channahon Township was $1.20 billion. This saw a large increase of 6%, reaching $1.28 billion in 2025. This is just another uptick in a growing trend, as the township becomes a popular alternative to other areas.

The working-class roots of the area can still be seen in how homes contribute value. The largest block of residences is those assessed from $250,000 to $500,000. Growing by 6% in 2025, these homes are now worth a combined $980.03 million. This is disproportionate to other Joliet suburbs, meaning there is still a strong core of modest homes in the area. This is good news for longtime residents, as things appear to be somewhat stable, especially by Illinois standards. In third place were homes valued under $250,000. These added 6% to their value as well, totaling $134 million.

In second place were homes worth between $500,000 and $750,000, which totaled $150.65 million after adding 7% to their overall total. This is the fastest-growing residential category, at least when it comes to taxable value. Unlike most of the collar counties, Channahon Township does not have any true luxury homes in the books. Instead, the highest homes are those worth between $750,000 and $1 million, along with those assessed at $1 million to $1.5 million. Those between $750,000 and $1 million increased by 7% in 2025, totaling $7.38 million, while the most expensive homes added 5% in value to reach a total of $3.74 million.

Home Value Increases were Below Other Will Townships

While the residential property values in Channahon Township clearly went above inflation, they were generally more restrained than in other collar counties. In Will County, many townships added even more value. Joliet homes saw a jump of 10%, while Plainfield added 8%. These were joined by Homer Township at 8% and New Lenox at 7%. Wheatland had another large increase of 10%, helping back up its reputation as a premier township. The entirety of Will County saw solid jumps in property values, with all of it being outside of reassessment. Reassessment isn’t the same concern outside of Cook County, since most of Illinois reassesses homes annually, making state-mandated reassessments rarely necessary. This means that the collar counties do not get big hits all at once, but instead see their taxes raised to high levels in smaller steps.

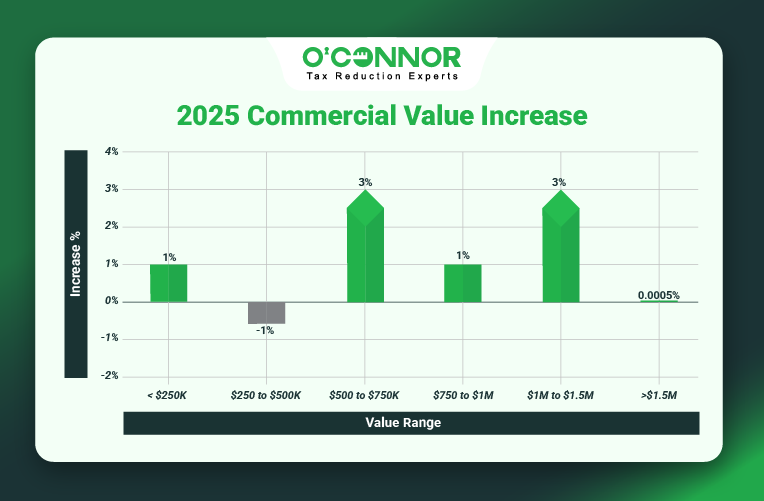

Minimal Increases Seen in Commercial Properties

With close ties to Joliet, Channahon Township has traditionally had some industrial capacity. From factories to warehouses, the township is still in touch with these roots, if not to the extent of its glory days. This puts the township in a unique place when compared to any other in Will County. The value of commercial properties is actually higher than that of homes, something we have yet to observe in our studies of the county. In 2025, all business properties combined for a value of $1.52 billion. Despite a large base, the total value only increased by .08%, which at first seemed like a mystery.

When we dig deeper, we see why the total growth was so small. Like the rest of Illinois, the majority of value comes from business real estate worth over $1.5 million. In the case of Channahon Township, these large businesses totaled $1.42 billion. These properties saw a miniscule increase, one so small that it was statistically insignificant. With the main category of value being stagnant, this meant that any gains in lesser properties would be washed out, which is exactly what happened.

While the remaining businesses had little impact on the total value, they all did contribute in their own way. Businesses worth between $250,000 and $500,000 were in second place for value in 2024 but dropped to second after experiencing a reduction of 1%. Those worth between $500,000 and $750,000 jumped to second place thanks to an increase of 3%, bringing their total to $23.71 million. Commercial property that was assessed from $1 million to $1.5 million added 3% in value for a total of $18.77 million.

The Tax Appeal Deadline is September 8

While both commercial and residential properties may be assessed lower than other collar county townships, that does not mean that taxpayers should rest on their laurels. On the contrary, there is no better time to strike. A 6% or more hike for homes is still outrageous and would be seen as a major increase almost anywhere else in the country, so these should be appealed regardless. Even if a property is assessed lower than that, tax appeals can be a boon for any taxpayer. With the aid of protests, a real estate owner can see their true property value established.

This is especially true in growing communities like Channahon Township, where land of all types will keep increasing. Protesting now not only sets a fair value but can even add reductions to it. If a taxpayer has never appealed, then they could have been paying over fair market value for years, so protests are a good way to cut these past excessive values down. If trends are anything to go by, the value of property in the township will only increase, as it is across all of Will County, so a preemptive protest will help futureproof any other incoming hikes. This is why we at O’Connor recommend annual appeals, as the cumulative effect can produce real savings as the years go on.

The final date to file an appeal is September 8, 2025. While this typically differs for every township, Will County has set this cut-off date for every jurisdiction. While Cook County taxpayers get several deadlines to appeal, the people of Channahon Township get only one. This includes both informal assessor appeals and formal Board of Review (BOR) hearings. With only a couple of days left, taxpayers are going to have to hustle if they want to meet this hard stop date.

O’Connor is Ready to Help

While it is enshrined in your rights, protesting your taxes can be daunting. Not only do you need to face the BOR or the appraiser, but you need to research, gather evidence, find documentation, and dozens of little things. This is where tax experts like us at O’Connor come in. For over 50 years, we have been supporting clients across the country in their noble goal of getting fair taxation. This is our core value and our pushback of unfair taxes is one of the many reasons that we have focused on the Chicago area.

To help us in this task, we have opened a branch office in Aurora for the purpose of serving the community. Dedicated to Chicago, Cook County, and the collar counties, our branch office is staffed with local experts that know all of the little tricks needed to navigate Illinois’ inscrutable tax laws. This team includes tax professionals, lawyers, and researchers. We bring our national team and prestige to the cause as well. As one of the largest property tax firms in the United States, we have the staff and resources to throw behind our clients.

We helped over 185,000 clients in 2024 and are looking to help even more. We use our proprietary database and tap our experienced experts to create useful data for your legal team, allowing them to represent you with a full arsenal of evidence. This can be key in giving you the edge in your case, and we will support you the entire way. Even better, you only pay us with a contingency fee, meaning you pay nothing unless your taxes are lowered.