The 2023 reassessment of Chicago’s southern and western suburbs was one for the history books and one that has left a lasting legacy across all of Cook County. This was the event that brought property hikes and questions about the competency of the Cook County Assessor’s Office (CCAO) to the forefront. When the numbers began to be known publicly, taxpayers across the Chicago area were terrified. Average increases of 50% for residential properties, with some individual homes seeing jumps of 500% or even 700%. Some neighborhoods and townships saw figures that were certain to cause mass gentrification.

The outrage was felt beyond these areas, and a demand for accountability and change swept through Cook County and Illinois. Various legislative means were tried, but all failed due to political infighting. All the while, the other two thirds of Cook County knew that they were on borrowed time, as they would face reassessment in 2024 and 2025. It was the 2023 reassessment that also brought property tax appeals to the forefront, with even the CCAO encouraging their use. While 2024’s reassessment, which hit Chicago itself, was devastating in its own right, people were more prepared.

Now, the triennial pattern is starting again, and the western and southern suburbs will be reassessed in 2026. Cicero Township is among those to be targeted. In 2023, Cicero saw a 40.30% increase in home values and a 35.20% spike in commercial properties. These were just general numbers, and many individual properties saw increases of 100% or more. These outlandish numbers drew the attention of taxpayers and politicians alike and helped inspire the largest boom of property tax appeals in Illinois history, one that is going even stronger today.

The Ascension of Appeals

The 2023 reassessment and the investigations that followed firmly proved that if taxpayers wanted to protect their properties, they had to do it themselves. The appeal became embraced by not only people in Cicero Township and the other hard-hit areas, but everywhere in Cook County. Property tax protests enable a second look at assessments and are an easy way to fix glaring mistakes. This can be such egregious errors as classifying an empty lot as a home or recording a business as twice the size it actually is. They can also be used to ensure equality, so that two similar properties are not valued light-years apart. In 2023, some neighbors saw a difference of 100% or more thanks to assessment errors.

While informal appeals to the CCAO became popular, it was formal hearings to the Board of Review (BOR) that saw record numbers. This impartial body is used to judge between taxpayer claims and the CCAO’s arguments, with the owner of the better evidence coming out on top. The BOR is increasingly siding with the taxpayer, especially homeowners. In many townships, including Cicero, they have become the go-to option when it comes to appeals and have brought home savings that have never been seen before. Protests are becoming key to keeping the CCAO honest and have shown fantastic results when used correctly.

Cicero Outside of Assessment

While it is typical for property values to climb even outside of reassessment, this was not the case for Cicero in 2025. Some of this was due to things balancing out after 2023, while another major factor was appeals cutting into the inflated numbers that were established almost three years ago. Protests have been proving their worth across Cook County, but Cicero Township is a great case study for their efficacy. Let’s take a look at how home and commercial value fared in 2025 and how it could set the stage for 2026.

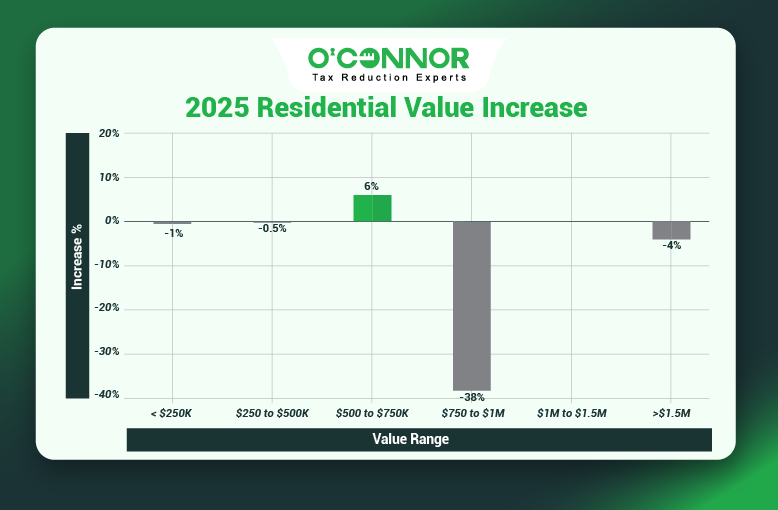

Home Values Fall 1%

It is unusual to find a negative number in Cook County when it comes to home values, but Cicero saw plenty, including a 1% decrease in the total value of homes. Homes were assessed at $3.22 billion in 2024 but dropped to $3.19 billion in 2025. This was partially thanks to high-end homes. Residences worth over $1.5 million fell in value by 4%, while those worth between $750,000 and $1 million saw an astounding reduction of 38%. In the middle of these two categories, homes worth between $1 million and $1.5 million managed to hold steady.

The two largest categories in Cicero Township are for the most modest of homes. Homes worth under $250,000 were the largest block, with $1.92 billion in value. This was after a 1% drop from 2024. Homes assessed at between $250,000 and $500,000 held steady with a combined value of $1.25 billion. It was only homes worth between $500,000 and $750,000 that saw any growth, rising 6% to $8.14 million. It takes a small miracle for residential properties to cut value in Cook County, but Cicero Township was able to achieve it.

Commercial Average Holds Its Ground

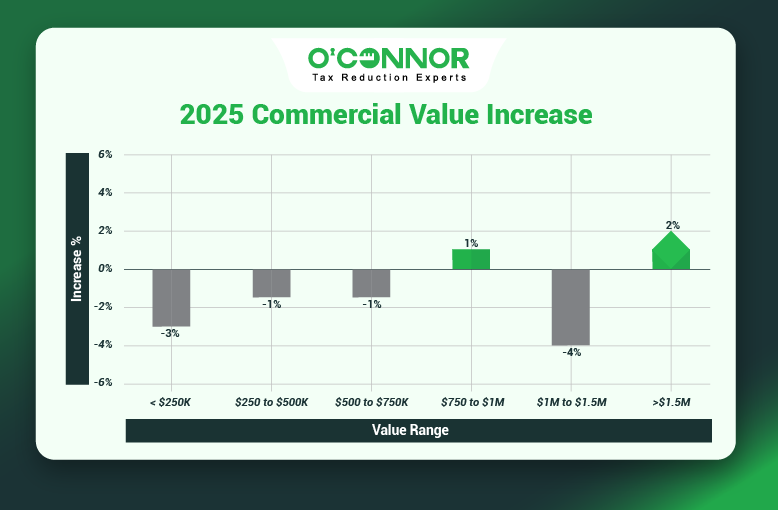

2025 has seen commercial properties bare more of the load, a concerted effort by the CCAO to protect homeowners. This does not seem to be the case in Cicero, as the combined value stayed roughly even, with only a gain of around $2 million. Considering the grand total is $848.05 million, this is a drop in the bucket. Most categories of commercial property broken down by worth actually registered reductions, which was thanks to diligent taxpayers and their appeals.

Large commercial properties make up the majority of value generated, as is typical across Illinois. Properties worth over $1.5 million accounted for $470.47 million of the total. This was an increase of 2% from 2024, and unlike many Cook County numbers, could be legitimate growth rather than CCAO chicanery. Commercial properties that were worth between $1 million and $1.5 million saw a cut of 4%, a significant drop as they were in second place in value. Those worth between $750,000 and $1 million managed a slight increase of 1%.

Protests as a Preventative Measure

While Cicero Township did not see any increases of real note, that does not mean taxpayers can rest easy. Appeals are great for reducing insane values, but they are also useful for maintaining an established value in the face of other factors. This is one of the reasons that Cicero was able to tread water. The ability for protests to keep values stable will come in handy in 2026, as the triennial reassessment returns to Cicero Township yet again. Values can easily spike in a similar fashion to 2023, as no fixes have been made to prevent it and some evidence shows that the CCAO is off in their assessments like never before, partially thanks to a run of computer errors that put all assessments into question. With reassessment looming in only a year’s time, it is imperative that all taxpayers protest in 2025, as a way to build a base of value to defend in the future.

Informal Appeal Deadline set for August 19, 2025

The one saving grace for Cook County taxpayers is that they have several appeal deadlines, unlike the rest of Illinois. The cut-off date for informal appeals with the CCAO is currently set for August 19, 2025. Once this date passes, the only option will be the BOR. While the BOR is generally favored, informal appeals can be quite useful and can get strong results, especially for cases involving blatant errors. There is generally a lower evidence threshold for informal appeals, requiring less prep time. Also, BOR hearings will not start for a few months, causing a delay in possibly lowering the assessment number.

O’Connor Helps You Protest Annually

As this blog hopefully showed, property tax appeals are best used every year, even in cases where the assessment has not increased. A solid appeal can either reverse some previous gains or can serve as a protective foundation for the future. With reassessment on the way, now is a great time to get started. We at O’Connor will protest your taxes for you automatically every year, ensuring that you will never miss a deadline while also establishing a hard value for your property.

We at O’Connor have been doing this for over 50 years and represented 185,000 clients across the nation in 2024 alone. As one of the largest property tax firms in America, we have the people and resources to take on any appeal. We also have a branch office in Aurora, filled with experts that know Illinois law intimately. With a national presence and local experts, we believe we have the best team possible to protect your property now and in the years to come.