When it comes to wealth in Illinois, only Lake County trumps DuPage County, but that margin is shrinking. These two titans have battled it out to be the premier suburban area of Chicago for decades and each brings plenty to the table. DuPage County was once an industrial center but has transformed into a great place to live for the wealthy and the working family alike. There are many great townships within the borders of DuPage, and the county is one of the hottest housing markets in the United States.

The crown jewel of DuPage County is Downers Grove Township. With a high population and the greatest amount of land, the township is one of the most prosperous areas in the entire United States. Close to Chicago but without a lot of big city problems, there is little wonder why it is a desirable place to live and work. This demand has made the Downers Grove area see some of the highest property taxes and values in the nation and these are both growing every year. As with Cook County and the rest of Illinois, property tax appeals are gaining real traction in the Downers Grove area. The time to file is almost up, and the last day to start an appeal is September 15, 2025.

Downers Grove Homes Increase 8% in Value

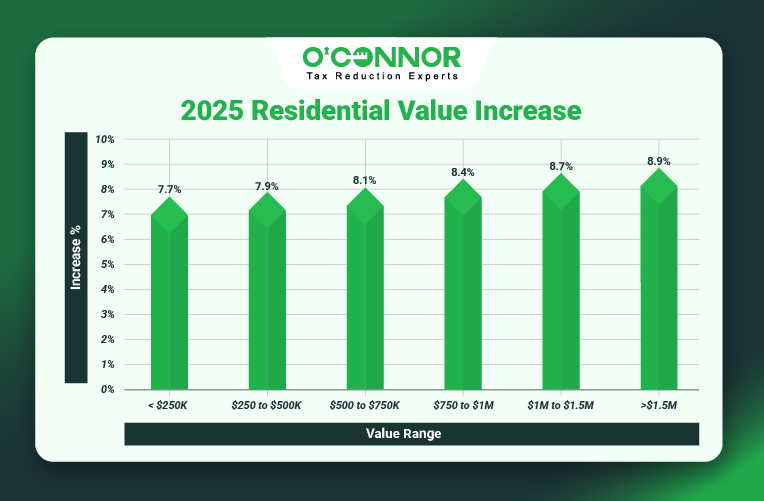

When seen on a balance sheet, the combined value of all residential property in Downers Grove Township is truly astronomical. In 2024, the combined value was $28.17 billion. In 2025, this was inflated by 8% to $30.50 billion. This is one of the largest totals to be found in the collar counties and is even higher than many found in Cook County itself. This spike was not the result of some kind of reassessment but rather is due to the assessor constantly adjusting value to keep up with yearly home sales. The equalization factor also comes into play in this situation.

Home values in the township do not follow the usual pattern when broken down into categories of worth. It is typical for one category to be well ahead of others. However, in this case, things are broken down relatively evenly. The largest block of value is from homes worth between $250,000 and $500,000, which totaled $8.31 billion. This was after an increase of 8%, a spike that was seen in most categories. This was followed by homes assessed from $500,000 to $750,000, which had a combined value of $6.94 billion. Despite Downers Grove’s reputation as a wealthy township, homes worth below $250,000 still combined for $1.42 billion in value and saw an increase of 8%.

The upper tier of homes was not far behind in overall value. $750,000 to $1 million homes experienced an increase of 8%, going to $3.95 billion. Residential property worth between $1 million and $1.5 million surged 9%, ending with a total of $4.66 billion. In a truly rare case, homes worth over $1.5 million came in third place for total value, combining for $5.20 billion after a jump of 9%. Residential property in Downers Grove Township truly ran the gamut, and every economic class looks to be getting a bigger tax bill.

Appeals and Exemptions

With home values already through the roof, many taxpayers can ill-afford another year of rises. This does not take into account that tax rates are often increasing as well, which are independent of assessed values. This means that taxpayers can get hit double and often are in Illinois. The two ways to fight back are exemptions and appeals. Exemptions should be filed as soon as possible, if they are not already applied. While exemptions help cut how much taxable value can be used for taxes, only appeals can reduce the value itself. This is why they make such a potent combination. Both of these methods should be deployed in high-dollar areas to protect homes and businesses.

Commercial Properties Soar 17%

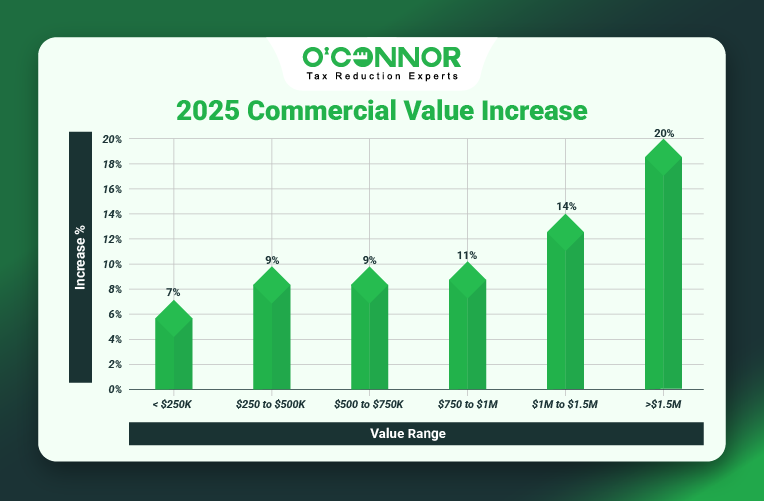

While all eyes are focused on homes, commercial properties across Illinois are reaching new heights. With so much controversy surrounding rising home values, many assessors are trying to put a higher burden on businesses to share the load. This is the new policy in Cook County, though few collar counties are following suit. This might not be the case in the Downers Grove region, as the overall total for commercial property exploded by 17% in 2025. This brought the grand total for business real estate to $5.06 billion.

Rural, suburban, or urban, the core of commercial value in Illinois is always found in properties worth over $1.5 million. It is not uncommon to find these properties making up over half of the total. This is certainly the case in Downers Grove Township, where the largest of businesses were responsible for $3.81 billion in value. These big businesses saw a corresponding mammoth increase of 20%. This translated into a jump of around $628.89 million in taxable value in one year. That is an astounding figure and could represent a huge blow to both businesses and customers.

Commercial properties worth between $1 million and $1.5 million were in second place with $403.91 million, which was accomplished after a spike of 14%. Business real estate assessed from $750,000 to $1 million climbed by 11%, for a total of $192.50 million. Those worth between $500,000 and $750,000 came in third place with a total of $324.86 million, while growing by 9%. Even the smallest businesses were not spared the increases, with those assessed from $250,000 to $500,000 adding 9%, while those worth under $250,000 added 7%.

You Have Until September 15 to Protest Your Taxes

Both businesses and homes are skyrocketing in value, and taxpayers are being pressed on all sides. If history is anything to go by, these rates, along with taxes, are sure to rise annually. There are many reasons for the constant increases. First, people are moving to DuPage County and the other collar counties to get away from the various problems of Cook County. In some cases, that is crime, in others it is gentrification, and others are simply looking to start a better life. This has forced property values up. Also, it is not uncommon for township assessors to put their thumbs on the scale to inflate property values. This issue has been exposed several times lately in Cook County, for instance.

Property taxes are vital for the functioning of the Illinois government, so there is a lot of pushback whenever there are proposals to lower them. Recent legislation backed by the Cook County Assessor to install a “circuit breaker” to help homeowners went nowhere, as did various other plans to slash taxes. With no help on the horizon, it seems that taxpayers must use property tax appeals to ensure they are paying their fair share. The two main options to do this are assessor appeals and Board of Review (BOR) hearings. Informal appeals to the assessor are the basic step, but can pay big dividends, especially when there are blatant errors. BOR hearings allow for a wider net when it comes to appeal criteria but also require more evidence.

The collar counties are in a weird limbo. They are tied to Cook County economically but separate politically. They are also completely at odds with the rural counties outside of them. While the collar counties and Cook County share some of the highest taxes in the country, they differ greatly on how to protest them. Cook County has multiple deadlines for protests, spread over months. All other counties, including DuPage, have one solid deadline for both informal and BOR appeals. This means that these taxpayers have only one shot to get it right. In Downers Grove Township, this final date is September 15, 2025.

O’Connor is Ready to Support Your Appeal

Taxpayers are feeling the pinch in Illinois like never before. With record property tax appeals across the state, perhaps Illinois is finally due for a reckoning that will see reforms that benefit the people. Until then, appeals are the only option to fight back. You can certainly appeal your values yourself, but there are always barriers to this. You need to gather evidence, keep abreast of deadlines, know the sales records for comparable properties, and to make whatever hearings that are required. If this is too much to take on, we at O’Connor are here to help.

For over 50 years, we have been supporting taxpayers and their attorneys in their struggle against appraisal districts, assessors, and more, all to help innocent people. We started long ago in Texas, where property taxes are some of the worst in the country. But these issues pale in comparison to Illinois. We have been active in Chicagoland for years now, as the outrageous values have driven us to action. In fact, we are so focused on the area that we opened a branch office in Auroura. This allows us to utilize local experts in the fight against unfair taxes. Our Illinois team consists of attorneys, tax experts, and researchers, all with years of experience. Illinois is not an easy place to navigate legally, and our Aurora-based team knows all of the tricks.

As one of the largest property tax firms in the nation, we can funnel resources through our local team to get you the best deal. While your legal team represents you in hearings, we will advise on evidence, analyze data, and keep up with all the deadlines. Once you enroll with us, we will also coordinate protests for your taxes every year. The assessors are constantly raising rates, so your defense should be active as well. This will not only help lower current rates but will also build a foundation for later protests. Once we establish a fair market value for your property, you and your legal team can use it as evidence for every appeal afterward. Best of all, there are no upfront costs to join O’Connor. We will only get paid a contingency fee from your winnings if your taxes are lowered, otherwise you pay nothing.