As we have covered before, Illinois property taxes can increase in years outside of reassessment. While the quadrennial cycle can bring the value and tax spikes that Illinois is known for, property values can still be raised substantially in off years. While the people of Illinois will not experience reassessment until 2027, there have already been several property value hikes spotted across the state. The newest one is in Geneva Township of Kane County.

The Geneva Township Assessor recently released an announcement of increases across the board, though this is not widely published. This means that most taxpayers will be struck by surprise increases when their tax bill comes next year. O’Connor will discuss the updated statistics for property values across Geneva, and how you can possibly lower these to better help your tax burden.

Geneva Home Values Rise 9%

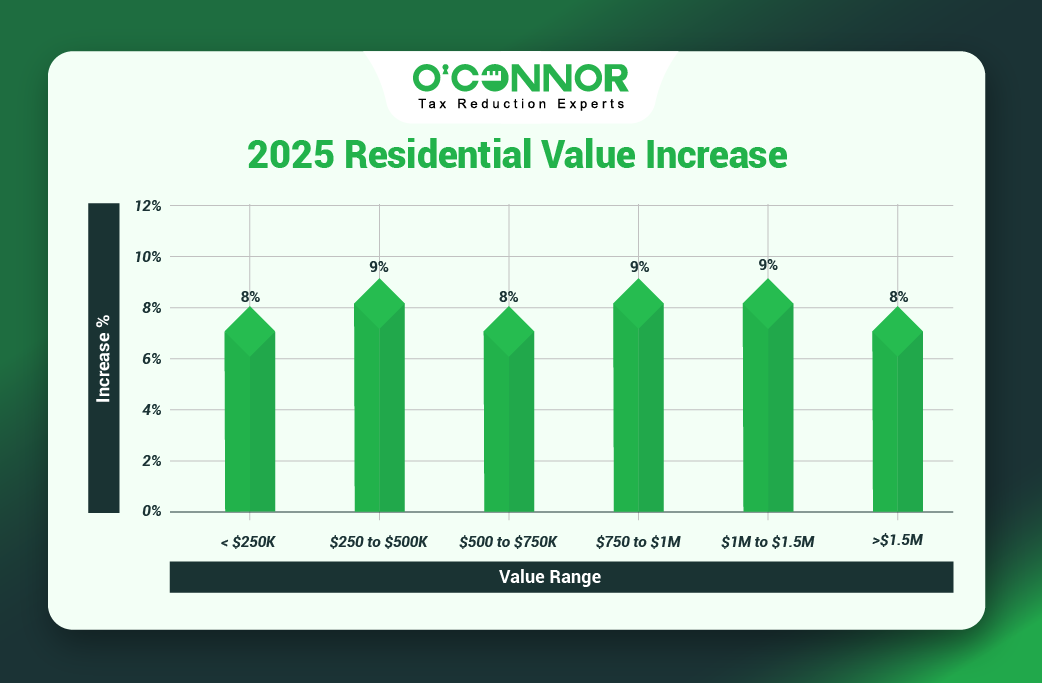

No matter the size or worth of a residential property, it seems that all will be seeing a value increase. The total assessed market value for Geneva homes in 2024 was set at $4.06 billion. In 2025, that number increased by a staggering 9%, going up to $4.41 billion. This rise is not limited to the enormous homes of the wealthy or your local McMansion but universally applied to every home in the area.

When we dig down to see how this has affected homes based on their total worth, we can see how this increase is spread across the township. Homes worth between $250,000 and $500,000 are the largest cross-section of value, with a 2024 total of $1.92 billion. With an increase of 9%, this shot up to $2.08 billion. The same trend hits the No. 2 category of homes, those worth between $500,000 and $750,000. With an increase of 8%, these homes are now valued at a combined $1.56 billion. These two categories are the main reason for the excess valuation as a whole, but the same treatment is being extended to smaller categories.

Homes worth less than $250,000 are a fraction of the total value, but even they were not spared a cost bump, with the average going up 8%. On the opposite end of the spectrum, homes worth over $1.5 million were hit with an increase of 8%. While homeowners with large properties can afford an 8% increase, the same cannot be said for those who are just getting by. The phenomenon of older people and working families being priced out of their homes has struck Chicago and every suburban community in the past few decades, often transforming them entirely.

Why are Home Values Increasing?

Illinois property tax trends can be hard to get a handle on, and there are many arcane and esoteric formulas working behind the scenes. While Geneva is not in a reassessment, the township assessor is constantly making adjustments based on the sales of homes over the previous three years. This helps shape both home values and the equalization factor. The 2025 equalization factor for Geneva is 1.0850 for homes and businesses and will be applied to home values to help calculate tax bills. Home values, tax rates, and the equalization factor are constantly in flux, though usually they are always increasing. This seems to be the case with Geneva Township. It does warrant exploration with a property tax appeal however and could be a great opportunity to reduce taxable home values.

Geneva Commercial Property Valued at 7% Higher

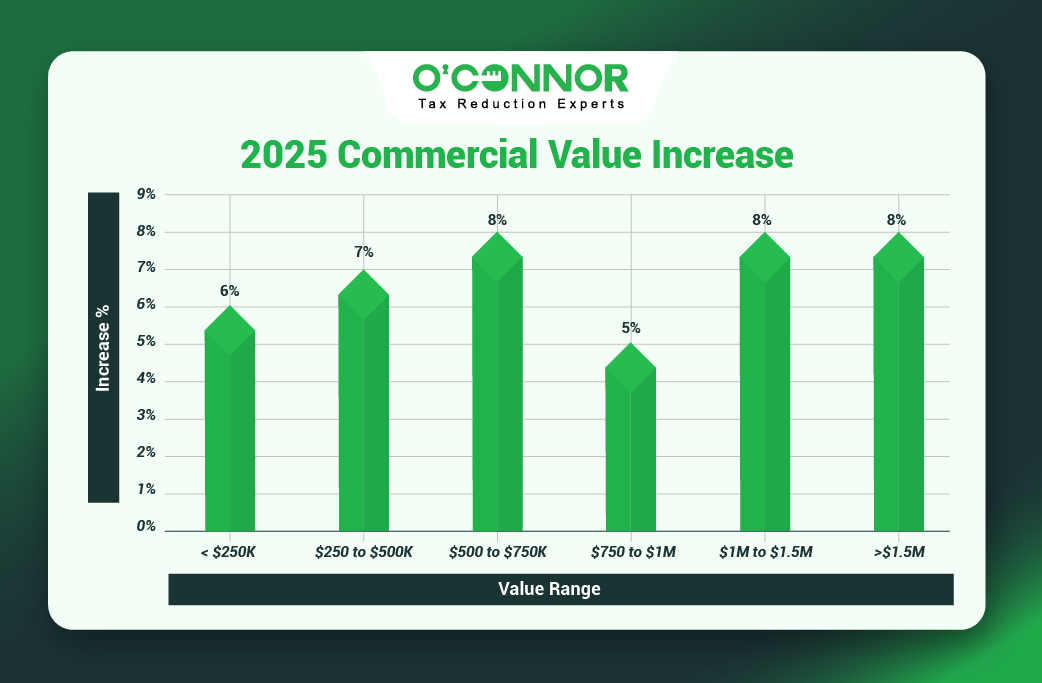

While taxes and property values increase in Illinois, it is typical for more of the burden to be put on homes rather than businesses. This may be the case in Geneva Township as well. While commercial properties are seeing their total value being raised by a dramatic 7%, it is still lower than that of homes. This becomes more evident when we explore how values are being increased when compared to the value of commercial properties.

In 2024, the total for commercial properties across Geneva Township was assessed at $1.37 billion. With the 7% increase, this number jumped to $1.48 billion. The largest contributor to this was businesses worth over $1.5 million, which were responsible for creating $1.19 billion of the total. Bigger businesses usually command the largest share of value, putting them in opposition to the typical residential pattern. With so many eggs in this one basket, the increase in this one category was enough to shift the value of the entire township.

Businesses worth between $1 million and $1.5 million likewise saw a jump of 8%, going from a total value of $83.44 million to $90.02 million. The lowest growth rate was 5% for businesses worth between $750,000 and $1 million. Commercial properties with an estimated worth of under $250,000 saw an increase of 6% added to their noticed value. Out-of-control values for businesses can be just as devastating to a community as those for homes, as owners are forced to raise prices or possibly face closure. This has been seen in many towns across Illinois in the past 20 years, as property taxes began to enter their zenith.

Geneva Township Appeal Deadline is July 14, 2025

The only way to protect your property is with a property tax protest. Unfortunately, the window is rapidly closing, and the deadline for appeals is set for July 14, 2025. This date and the property value increases are typically not widely available, and usually pass without a taxpayer knowing about them, if they are even aware of property tax appeals at all. The current deadline is for informal appeals directly to the Geneva Township Assessor and those to the Board of Review (BOR).

Informal appeals are quick and relatively easy. These are filed directly with the township assessor and can sometimes be resolved in minutes. You will need evidence on your side and a reason for the appeal, beyond thinking you are simply paying too much. These reasons include uniformity with similar neighboring properties, market value discrepancies between sold homes and assessed value, errors in the description and size of the property, and even if the property is vacant or not.

Formal appeals to the BOR are more complex and require greater evidence to get a reduction or settlement. On the other hand, you will be dealing with an impartial body that will judge your case on its merits alone, one that does not have a dog in the fight. If your informal appeal is rejected by the assessor, then this is your best option. If the BOR gives you an inadequate settlement or none at all, then your final recourse is to take things to the Property Tax Appeal Board (PTAB) in Springfield.

O’Connor Can Help

With less than a week to put your appeal together, you will need an expert by your side, or better yet, a team of experts. We at O’Connor have been fighting appraisal districts, assessors, and taxing bodies for over 50 years across the entirety of the United States. Our operations in Illinois are run from our Aurora office, giving us great insight into Kane County and every township within. Our tax experts, researchers, and attorneys have contacts within every township assessor’s office and know exactly what evidence the BOR prefers. In short, we are the best ally you could ask for if you want to reduce your taxes.

Due to the time crunch, it could mean that it is too late to put together an appeal for the 2025 values. While this may not be an ideal situation, it is far from the end of the road. When you join us, we will protest your taxes annually. You will not have to keep up with deadlines or experience surprise tax increases. We will fight for you every year, taking your appeal to the appropriate level. Better yet, each victory builds upon itself and solidifies evidence and momentum for future cases, making it easier each time your property must be defended.

Illinois has the second-highest property taxes in America, and that looks to be continuing as legislation to fix the problem continues to stall. With reassessment set for 2027, now is the perfect time to begin your property tax quest. We can get a head start building evidence and getting to know your property and situation, so that we will be ready when the massive ordeal of reassessment comes down the pike. With your case squared away, you can rest easy and be ready for whatever tax shenanigans are thrown your way.

About O’Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, New York, Texas, and Georgia. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.