When the Cook County reassessment was announced, Northfield was one of the primary targets. Along with the likes of Elk Grove, New Trier, and Maine, Northfield was set to feel the inquisitive gaze of the Cook County Assessor’s Office (CCAO). The people of northern Cook County held their collective breath, hoping that they would not see the infamous numbers that hit other parts of Chicago in 2023. While there were no 700% value rises to be found, the increases handed out by CCAO were substantial. Elk Grove saw an increase of 26% to the home value totals, while Evanston saw 30%. Maine, the most recent northern township to be assessed, experienced a rise of 25%.

Northfield has now been fully assessed, and it has fared about the same. Home values increased 30%, while businesses suffered an increase of 28%. But now that reassessment is finally done, now is the time to strike back. Residents of Northfield have until July 31, 2025, to file a property tax appeal with the assessor. While there will be a chance for taxpayers to take their appeal to the Board of Review (BOR), the assessor appeal, also known as an informal appeal, is the easiest step on the tax protest journey. O’Connor will review how things have increased across Northfield and address why every Chicagoan should appeal their taxes.

Northfield Home Values Jump by $5.56 Billion

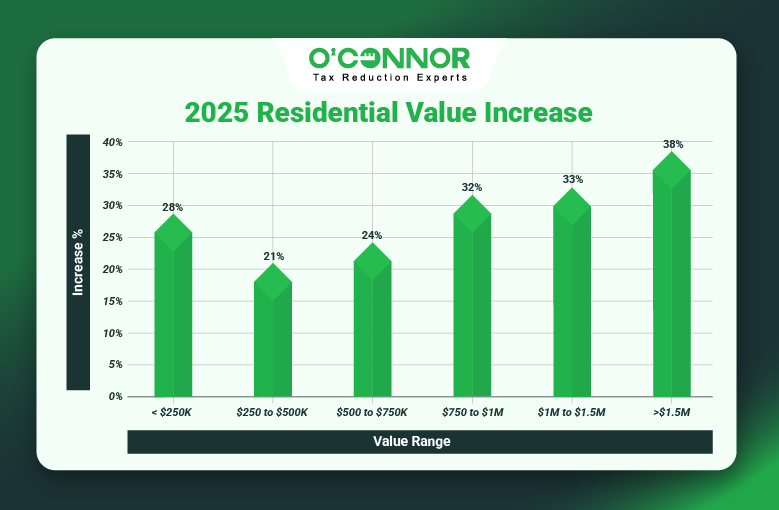

Northfield is somewhat unique, in that most property value is evenly spread among homes of different sizes and worth. Usually, a township or neighborhood will favor a certain size of home or a general value. In Northfield, when homes are compared by worth, we see that there is little difference in the total value that each category contributes. The lone exception is homes that are worth below $250,000. Totaling around $595.73 million, these small homes were still victims of a massive 28% increase to their taxable value. This could easily be an insurmountable expense for a working family wishing to stay in their home.

In the next bracket of homes, those worth between $250,000 and $500,000, there was an increase of 21%, pushing their collective taxable value to $3.04 billion. There has been a troubling trend across Chicago of homes between $200,000 and $500,000 becoming unaffordable for the families living in them. In many cases, these two groups of homes often bare the brunt of taxes that were deferred from commercial property. This does not seem to be the case so far in Northfield, but this is a scenario that must be looked for. This is why middle-class homes and those of working families are tailor-made for property tax appeals. They have the most to lose and everything to gain when it comes to challenging their taxes.

Each valued between $5 billion and $5.6 billion, the next three housing brackets all received large increases. Those worth between $500,000 and $750,000 grew by 24%, those between $750,000 and $1 million 32%, and those between $1 million and $1.5 million 33%. Fittingly, it was the biggest homes that saw the biggest increase. Homes worth over $1.5 million saw their taxable value increase by 38%, which translated into a jump in value of $1.20 billion.

Why Taxes and Values Always Increase

Property taxes have increased in Illinois every year for decades. While some of this is from population growth and genuine increases in wealth, CCOA and other assessors continually have their finders on the scale. Assessors are required to find money to feed the hungry beast that is made up of all of the various Illinois and Chicago governmental bodies. From overextended pensions to school districts, hundreds of organizations have their hands out. CCOA does not set tax rates, but they do set the assessed values on which every tax is predicated. Property values and taxes will also go up outside of reassessment, though usually at a more gradual pace than the bursts created every three years by reassessment.

Northfield Commercial Property Handed Increases of 28% or More

While the story of homes becoming unaffordable makes the headlines, spikes in commercial property values are equally important. Some of the worst effects of the 2023 reassessment were against businesses, especially in working-class areas and those near public works. Northfield’s own reassessment has brought some large increases to business owners across the township. It needs to be considered that apartments are rolled into commercial property as well, which can influence rent a great deal as well. This also means that office buildings and strip centers will raise rents on businesses to cover costs.

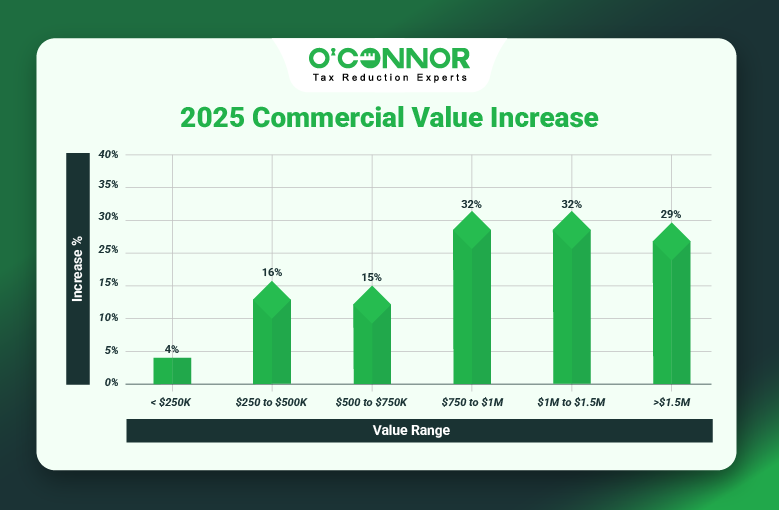

The total assessed value of commercial property in Northfield exploded by 28% from $3.85 billion in 2024 to $4.94 billion in 2025. Unlike homes, most of the value and increase came from one category of businesses. The largest commercial properties, those worth over $1.5 million, experienced a spike of 28%. As they already represented $3.44 billion in value, this meant a jump of $991.12 million. This had an outside impact on the total value of all commercial properties.

While the largest businesses felt the strain, all types of commercial properties experienced giant increases. Those commercial properties worth between $1 million and $1.5 million experienced a jump of 32%, while those worth $750,000 to $1 million likewise climbed 32%. Even commercial property worth less than $250,000 experienced a small increase of 4%. While the increases in commercial value were not as pronounced as those for residential properties, it will still cause issues across Northfield.

Why Appealing Residential and Commercial Values Matters

While not the doomsday scenario experienced in other parts of Chicago in 2023, these numbers in Northfield can still be devastating. And these are bulk numbers, not outliers that could mirror the worst of the Cook County reassessment. The escalation of property values and the corresponding taxes has gotten so out of hand that even the chief Cook County assessor has both campaigned for legal reform and encouraged property owners to appeal their taxes. Property tax appeals are currently the only way to protect homes from aggressive taxes and values and must be used to keep legacy families in their homes and help neighborhoods retain their culture.

Commercial properties are the lifeblood of neighborhoods and townships. Even if most of the population is employed elsewhere, local businesses are needed to keep things running. Local closures can force great commutes on residents or create phenomena like food deserts. Local businesses also tend to be owned by people in the community, building stronger ties among everyone involved.

Property tax protests benefit both individuals and the community. They are also the only way to keep the CCAO honest, as record appeals helped expose numerous abuses and errors across Cook County. This includes mansions and vacant lots being given the same taxable value, working homes being transferred tax burdens from large businesses, and other issues that straddle the line between incompetence and corruption. Property tax appeals remain the only option for both business owners and homeowners to fight for fair taxation and reduce the burden.

Get an Ally in O’Connor

Things are starting to get dire in Northpoint and Cook County as a whole. With any and all legislation ground to a halt, it is becoming apparent that only taxpayers can save themselves from outrageous taxes and values. The appeal process in Cook County can be arduous, especially if you want to take things to the BOR. Evidence must be compiled, typically not just of your property but of other homes or businesses that closely match yours for comparison. With so many demands for your attention and with a lot riding on the appeal, things can be overwhelming. Especially with the deadline of July 31, 2025, looming for informal appeals.

We at O’Connor are here to lend you a helping hand. We are one of the largest property tax protest firms in the United States and have been fighting for taxpayers for over 50 years. We have set up a branch office in Aurora to help the people of Cook County and the surrounding collar counties fight some of the most extreme property taxes we have ever encountered. This local team gives us insight into the market that we would normally miss, while we are able to give them our full support, which includes researchers, attorneys, and a database that can compare home sales across the nation.

Let O’Connor help you on your road to victory. We will protest your values and taxes every year, meaning you will never be ambushed by another deadline or find yourself paying a tax bill that is way too high. Plus, each victory in appeals builds upon the previous one, creating a portfolio of evidence that can be used to create greater savings. There is no upfront fee to join, and you will only pay if we are able to lower your taxes. There is no risk in giving us a try, but there is plenty to gain by protecting your home or business from aggressive taxation.