As 2025 comes to a close, it’s helpful to look back at how the year unfolded. From coast to coast, property owners saw massive changes in how taxes were assessed, levied, and collected. Some saw large cuts thanks to exemptions being expanded, freezes strengthened, or legislative changes. Others saw their burdens reach heights never seen before, with crushing taxes growing rapidly. While not a riveting subject, property taxes certainly capture the minds of those involved.

We value feedback from our clients, as it lets us understand how you view the property tax world. This helps us understand what you wish to know and what motivates you to explore property tax appeals. We have begun sending out monthly surveys with our newsletter, and have received some strong insights into what you are thinking. In this article, we will review what you taught us this year and how people are dealing with the changes brought on by an unpredictable year.

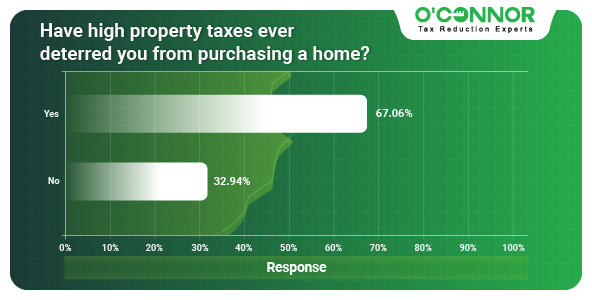

Do Property Tax Rates Keep You from Owning a Home?

This was an interesting one, as there is a homeownership crisis in America. However, aggressive property taxes are on the rise across the nation. Our main focuses are on New York, Texas, Illinois, and Georgia. Illinois, at least Cook County, has the highest property taxes in the nation, while Texas is sneakily one of the top offenders as well. With the ever-expensive New York in the mix, it is little wonder that our clients can see property taxes as a barrier to entry. 67.05% said that high property taxes deterred them from pursuing homeownership, while 32.94% said that taxes were not an impediment.

Cook County and the Chicago area are currently going through one of the worst property tax crises ever seen, with an overall jump of 16% in just the back half of 2025. Many homeowners have even seen 100% or more increases in their property taxes, with no end in sight. It is easy for people looking for a home to see their outlook colored by such situations. This can be especially difficult for first-time buyers who are purchasing in neighborhoods that are rebounding or even going through gentrification. This was a big issue in Chicago, where many people bought homes in areas, only to see their taxes double or more. This is why it pays to stay vigilant about your taxes and assessments, no matter your state or neighborhood.

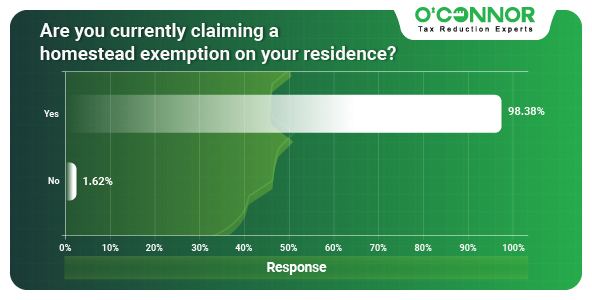

Homestead Exemption Claimed by 98% of Our Clients

In most states, the homestead exemption is the most basic thing a homeowner can do to protect their wallets. In both Texas and Illinois, the homestead acts as the base for all other exemptions. With the homestead exemption established, you are free to explore other options, such as those for people over 65, the disabled, injured veterans, and more. We always advocate getting your exemptions squared away first, then we can help you use appeals and corrections to lower things even further. Texas and Illinois even allow you to apply exemptions retroactively, using corrections of appraisal and certificates of error, respectively.

Texas recently had legislation which increases the power of the homestead exemption. Going from $100,000 to $140,000, it now produces even greater savings when it comes to paying school taxes. Taxpayers over 65 also saw an enhanced exemption. Thanks to this legislation, many older taxpayers are discovering that they do not owe any taxes related to schools at all, eliminating what had been the highest tax bill in the Lone Star State.

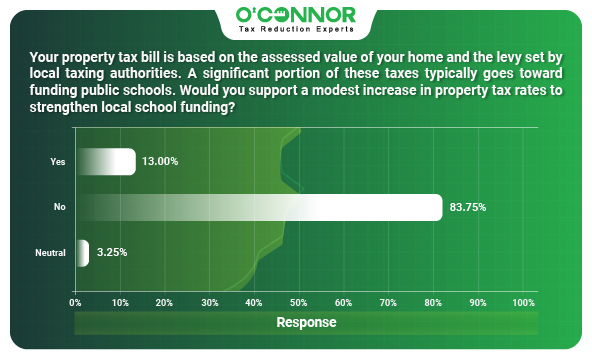

Paying More Taxes for Schools?

Property taxes are the primary way most school districts pay for public schools. This goes for Illinois, Texas, New York, and Georgia, along with countless others. As mentioned above, the largest tax bill you would typically see in Texas came from public schools. We asked our clients if they would pay slightly more in property taxes to grant better funding to public schools. Overwhelmingly, the response was against raising any taxes, with 83.75% being opposed. 13% of those surveyed said they would accept a rise in taxes to pay for better schools.

Public school funding has been a sticky wicket for many states. As mentioned, Texas reduced funding for schools via a homestead exemption enhancement, with the state of Texas responsible for covering the budget shortfall. While good in current economic conditions, this could be disastrous if things change. Illinois legislators are currently in disagreement over public school funding, as a powerful teachers union, growing pensions, and rising populations stress the budget. Chicago is currently unable to pass a city budget, and could be facing a government shutdown over the issue, along with others. Most taxpayers do want better schools, but just want a different way to pay for it. State lotteries are a favorite avenue that has shown some success.

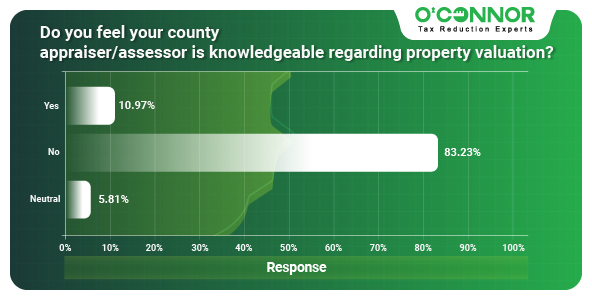

Is Your Appraiser or Assessor Knowledgeable?

Illinois township assessors, Texas appraisal districts, and other such bodies wield some of the most power in their respective states. As they determine what can be taxed, they can control the narrative and also who pays the most. While performing an important function, they also draw the ire of taxpayers with inaccurate values, excessive taxes, and sometimes an unhelpful attitude. So, it was not surprising that those surveyed had a poor opinion of their local assessors and appraisers. 83.23% of those surveyed said that these government officials were not knowledgeable in valuing real property. Only 10.97% believed that they were truly competent.

While no one likes taxes and disliking those responsible is a natural response, it is not all sour grapes. Cook County in Illinois is currently in a death spiral of rising budgets and almost unpayable taxes due to incompetence at the highest level. A computer issue caused taxes to be late, forced school districts to take on loans, and blocked refunds resulting from appeals. To top it off, astronomical values were issued across the county, though the most egregious were targeted at minority and working-class neighborhoods, potentially benefiting large companies and wealthy neighborhoods. The Cook County Appraiser’s Office is also notorious for listing properties incorrectly, such as saying an empty lot is a mansion. Texas appraisal districts are often tiny compared to what they must assess, leading to cost-cutting, shortcuts, and blind estimates.

Expert Appeals and Analysis are More Important Than Ever

2025 has been an interesting year when it comes to developments in real estate. While the housing crisis continues, people are hesitant to become homeowners due to rising costs and unpredictable tax obligations. Texas has experienced taxes doubling in the past decade, while recently providing tax relief with exemptions. New York City could be facing dramatic changes thanks to new leadership, while Georgia increased protections for seniors. The property tax world is ever-changing and can be hard to keep track of, even in the best of times. In most states, tax bills for 2026 have been sent out or will be shortly.

We at O’Connor are here to help, no matter what state you call home. With property taxes becoming more complex by the year, it helps to have veteran experts by your side. We have been in this game for over 50 years and know how to deal with appraisers and assessors across the country. While we are based in Houston, we have branch offices across Texas, ready to help with some of the highest property tax burdens. We also have offices in NYC, Cook County, and in the Atlanta area, loaded with local talent to help in those hot spots.

While minding your exemptions should be your first priority, it is imperative that you also explore property tax appeals. These are the only way to ensure that you are paying fair market value for your home or business. If these are not challenged, then you are stuck with an inflated bill, one that will grow every year. Appeals can nip this growing problem in the bud, saving you money for years to come. In places like Georgia, your property values will be frozen for multiple years if your appeal is successful. In addition, we will analyze your assessment every year, protesting your taxes to the highest level necessary. While we cannot represent you directly in Illinois, we can provide expert analysis and evidence to help you and your legal team achieve the best possible outcome. In other states, we will gladly stand by your side when it matters the most.