Much of McHenry County is in a state of flux. As one of Chicago’s collar counties, McHenry is both independent and influenced by what happens in Cook County. Out of all the townships, Richmond is one of the areas that is closer to its roots. Loaded with rural charm, Richmond Township has a lot of small town grace to go along with plenty of scenery. Richmond Township may be a quiet place to live, but every property owner must still deal with the epidemic of Illinois’ constantly rising property taxes and values, which are only amplified by being close to Cook County.

Whether it is Richmond Township or anywhere else in Illinois, the only option available to those looking for lower property taxes is to file a tax appeal. There is only a short window every year in which residents can pursue a property tax protest, one that will shut for Richmond Township on July 28, 2025. O’Connor will discuss how much residential and commercial values have increased in the past year and why residents should exercise their rights to protest. While official reassessment is not until 2027, most township assessors continually examine their charges, attempting to keep things in line with market value.

Richmond Township Residential Property Increases 11%

Residential property value in Richmond Township saw a significant increase in 2025. While the total value of all of Richmond Township’s homes was $876.40 million in 2024, it increased 11% to 971.65 million in 2025. This seems to be an unusually high number for a rural township, superseding the 9% mark for Chemung Township easily. While this pales in comparison to some of the outlandish rises coming out of Cook County’s reassessment, 11% is still a devastating change to a tax bill.

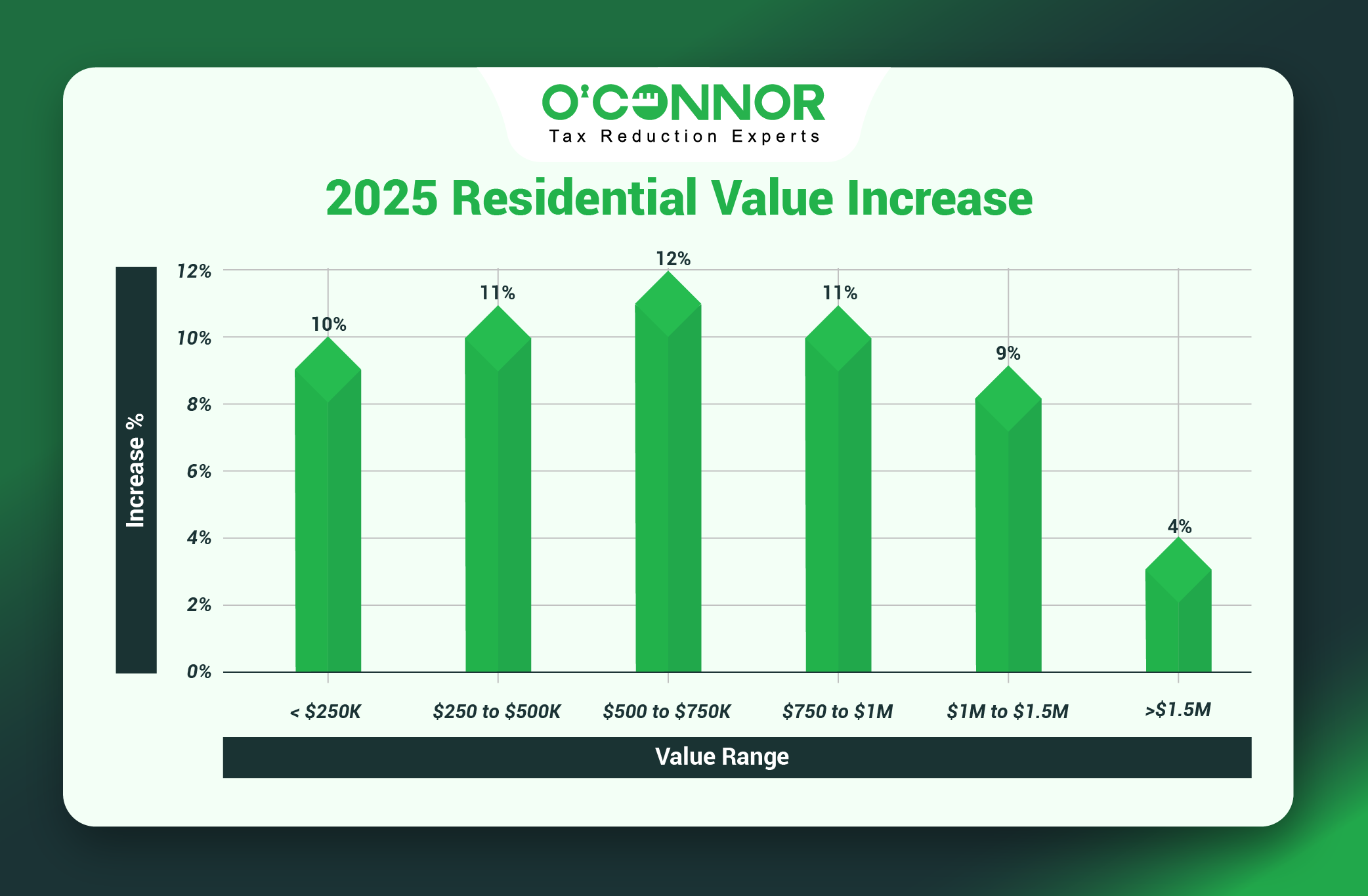

While beautiful, Richmond Township is a no-frills community. $551.73 million of the total home value comes from homes worth between $250,000 and $500,000, while $265.50 million is attributed to residences worth between $500,000 and $750,000. These two categories saw the brunt of the increases, going up 11% and 12% respectively. Homes worth under $250,000, the next largest block, saw a bump of 10%, achieving a total of $103.50 million. This puts all of the burden on working and middle-class taxpayers.

While larger homes are rare in Richmond Township, these also saw increases, albeit for much smaller totals. Homes worth between $750,000 and $1 million received an increase of 11%, for a total of $27.57 million. Homes worth between $1 million and $1.5 million increased 9%. The largest homes, those worth over $1.5 million, experienced an increase of only 4%. These three categories of elite homes combined generated less of the township’s total value than that of homes worth below $250,000. These numbers seem to confirm the smalltown and rural nature of Richmond Township.

Why are Home Values Spiking?

Taxpayers in Illinois are used to seeing increases, after all, they pay the second-highest property taxes in the United States. These numbers are usually tied to the statewide reassessment, which comes every four years, with another one scheduled for 2027. Many townships do not wait for this official date and do their best to stay current. This means comparing the past three years of home sales to what has been assessed. If this number increases, then all homes will see their values rise as well. This is an effort to tax homes at their current fair market value. Then there is the equalization factor, a nebulous calculation that seeks to make all homeowners pay a fair amount. This multiplier fluctuates every year and can increase home values and taxes.

Commercial Properties Soar 11%

The burden of increased taxable values is not limited to just homes; businesses must also face this ordeal. Typical of many communities, especially rural ones, Richmond Township’s residential property is worth more than commercial. All commercial property totaled $199.07 million in 2024, before jumping 11% to $220.38 million. While some of this growth can reflect new construction or renovation, these increases are usually just at the discretion of the Richmond Township Assessor. Calculating the fair market value of a business property is done in a similar manner to how homes are determined.

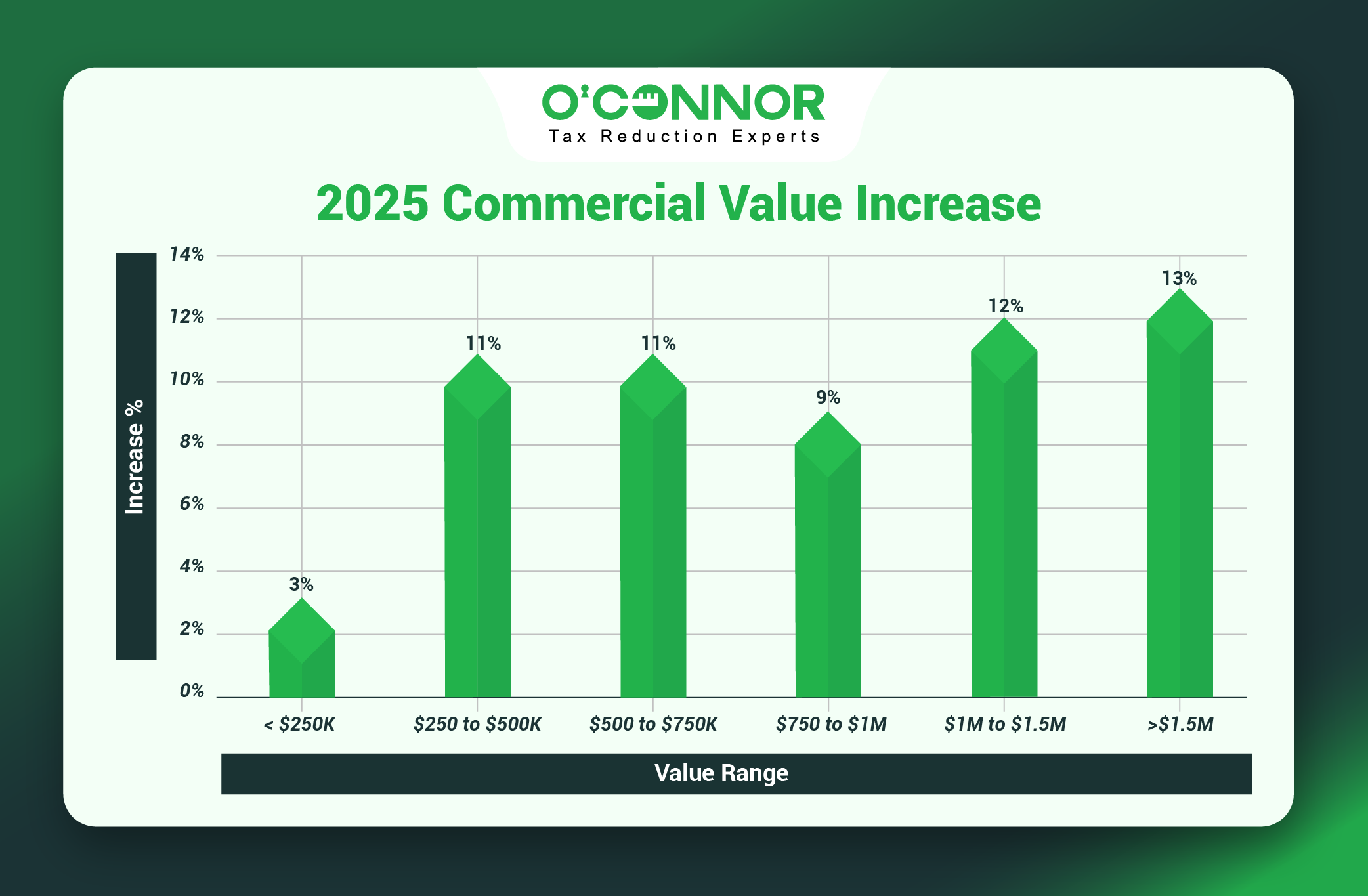

Commercial property value is usually the inverse of homes. While residential property value is built from the bottom up, business value is typically weighted towards the most expensive buildings. This is true in Richmond Township, where $84.12 million of the total value was created by businesses worth over $1.5 million. These large commercial properties were handed the largest increase in both percentage and hard value, with a 13% increase that translated into a rise of $9.69 million. Commercial properties worth between $1 million and $1.5 million were in the No. 2 slot for total value, while also being handed an increase of 12%.

Commercial property worth between $250,000 and $500,000 saw a jump of 11%, as did those worth between $500,000 and $750,000. Businesses worth less than $250,000 only saw an increase of 3%. These increases can cause many problems for both property owners and customers, as costs are usually passed on. This can be doubly impactful for renters, as they face hikes thanks to owners getting bombarded with increased taxable value.

The Deadline for Appeals is July 28, 2025

The 11% increases for both homeowners and business owners are significant, especially for smaller communities. They can have an outsized impact, and with the aggressive taxation expected in Illinois, it could mean taxes will be going even higher. With both values and taxes going up every year, property owners are getting it with both barrels. While tax rates cannot be cut, values can be, but only if the property owner takes action. Property tax appeals are the only way to lower values, which then influences tax bills.

While Cook County has several chances to protest their taxes, the rest of Illinois is not so lucky. Whether you want an informal appeal with the Richmond Township Assessor or want a formal hearing with the Board of Review (BOR), you need to have your appeals filed by the deadline of July 28, 2025. Once this cutoff passes, you will be stuck with your current assessed value and will not be able to do anything about lowering your tax bill until 2026. If history is anything to go by, then this bill will likewise be higher. As you can see, it is quite easy to get caught in this feedback loop.

This is why it is imperative that you file early and accurately. There is still time to prepare for your appeal, so make sure that you have everything correct on your end. You will need evidence of unequal appraisal, inaccurate value, or a related issue. You cannot get a reduction by simply claiming your value is too high, you need to be able to prove it. This goes double for BOR cases, where the requirements for evidence are stricter.

O’Connor Offers Local and Professional Help

The assessors exist to raise money for the township, representing several taxing bodies. It is only right that taxpayers also have a representative to ensure that they only pay what is fair. That is where O’Connor comes in. As one of the largest property tax firms in the nation, we have been taking on high taxable values in 45 states, with over 187,000 clients in 2024 alone. While we are wide-reaching, we have made Illinois a special project of ours. We have a headquarters in Aurora that specializes in the collar counties around Chicago.

We not only have size, experience, and local talent on our side, but we also have connections with the BOR and the assessors of every township. We know what evidence is needed to get the best result. We also have a one-of-a-kind database that tracks home sales throughout the region, allowing us to pinpoint similar properties to expose unequal valuations. This means that we will have all bases covered for every step in the process, making sure that every aspect is covered.

Also, when you sign up with O’Connor, we will protest your values every year. You will never have to worry about a missed deadline or an unexpected valuation ever again. You can rest easy knowing that you have a caring expert in your corner. Best of all, each yearly victory will build on the previous one, netting larger discounts as the years go on. You will never be charged an upfront fee and will only need to pay if we save you money. There is no risk in joining forces with us, but the rewards are many.