The 2024 reassessment of Chicago shook all of Cook County and Illinois as a whole. Targeting Chicago itself, this leg of the triennial reassessment saw record increases in both property values and taxes. Coupled with the devastating results from 2023, the 2024 outing was so severe that it pushed legislators across the state to action. Even the head of the Cook County Assessor’s Office (CCAO) encouraged diligence and even property tax appeals to bring things under control.

One of the largest victims of the 2024 reassessment was the township of West Chicago. Home values soared 21% collectively, while commercial property jumped a dazzling 34%. This was a blow to both home and business owners and instilled in the minds of many taxpayers that they had to do something in the future to protect themselves. In 2025, assessments are again showing an increase, albeit a tiny one relative to 2024. This opens up an opportunity for those looking to protest their assessment, as there is the possibility of stopping more increases while perhaps also getting back some of what was lost in 2024. In this blog, O’Connor will discuss what has increased in 2025 and how appeals can help taxpayers.

Homes Uptick Slightly in 2025

In a rare event for Cook County, the total home value in West Chicago only increased by 1% in 2024. This is certainly surprising, as the township is packed with people and property. Homes were assessed at a total value of $44.74 billion in 2024, rising to $45.06 billion in 2025. This is more in line with natural growth rather than an inflated assessment, which is typically what one would expect. One of the reasons for this is that mass property tax appeals have begun chipping away at the previous values. This is usually seen in townships that are three years removed from reassessment, such as Cicero, which shows how dedicated West Chicago homeowners were to protesting.

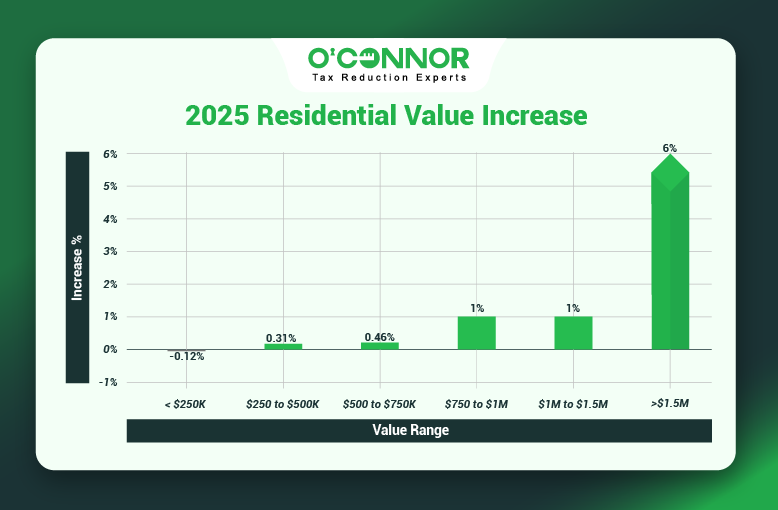

Key home categories saw tiny increases or even reductions. The largest collection of value was $13.93 billion, which was created by homes worth between $250,000 and $750,000. These properties only experienced an increase of .31% The next block was valued at $10.10 billion and was from residences worth $500,000 to $750,000, which grew by .46%. Homes worth less than $250,000 actually saw a reduction of .12%. These three categories are why the total number was so low. This indicates that middle-class and working families have a chance of keeping their homes.

Larger homes experienced higher rates of growth but also accounted for far less value. Those worth between $750,000 and $1 million increased in value by 1%, for a total of $6.55 billion. Residences worth $1 million to $1.5 million likewise grew by 1%, totaling $5.72 billion. At the top of the mountain, homes worth over $1.5 million saw a spike of 6%, as they added the most value to the total. West Chicago boasts some of the most diverse properties in the entirety of Cook County and this certainly showed.

The Impact of Reassessment and Appeals

West Chicago and Cicero are both excellent examples of how appeals can protect or lessen the effects of reassessment. A victim of the now-legendary reassessment of 2023, Cicero Township experienced a spike in home values of over 40%. By 2025, thanks to normalized assessments and a litany of appeals, Cicero saw total home values drop nearly across the board, with a 1% reduction for the total. West Chicago was impressive, able to reverse some of the damage in only a year removed from reassessment. This shows the impact that appeals can have and how they are quickly becoming commonplace across Cook County.

Commercial Property Surges 11%

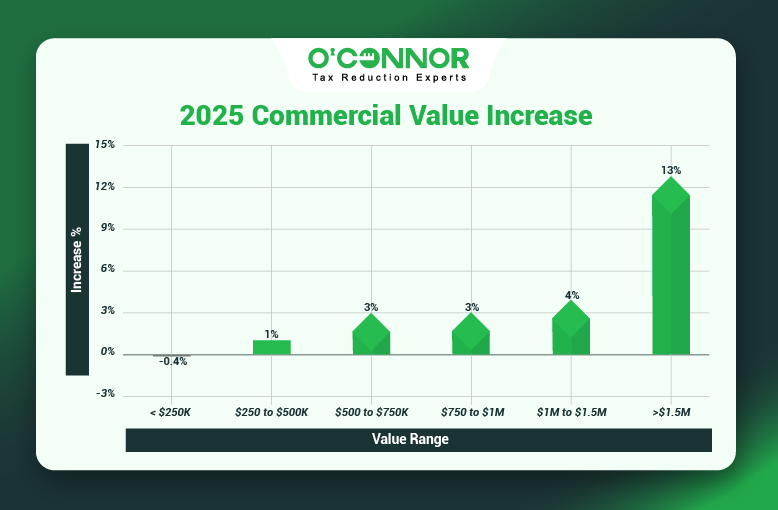

While home values managed to hold their ground, the same cannot be said for commercial or business properties. Initially assessed at $23.43 billion in 2024, businesses added 11% in total value to reach $28.02 billion. The CCAO stated that they are trying to put the burden of property taxes on businesses instead to spare homeowners, and the numbers in this article could be partially due to that action.

Another reason is that so much value is tied to one category and any movement in it will sway the entire total. Commercial properties worth over $1.5 million accounted for $21.09 billion of the total. These large businesses experienced a jump of 13% in 2025, which was more than all other categories combined. Business properties of this size are usually the No. 1 source of value in any given township, but those of West Chicago have an especially outsized impact on the total.

For all other commercial properties, the growth rate was much more subdued. Those worth between $1 million and $1.5 million were in a distant second place with a total of $1.51 billion, which was a 4% increase from 2024. Those between $500,000 and $1 million grew by 3%, while those worth from $250,000 to $500,000 increased by 1%. Businesses worth less than $250,000 were the only category to see a negative, experiencing a reduction of .4%.

You Must Appeal in Cook County

Whether you own a home or a business, the only way to properly protect them from rising costs is to use a property tax protest. While exemptions should always be the first step, it should be evident that appeals and protests are now a requirement in Cook County. It was thanks to record protests across the Chicago area that some damage from the 2024 reassessment was reduced. Taxpayers cannot wait for legislative change or for the CCAO to get their act together, you must handle things yourself.

Protests can be used to not only fix mistakes but help keep them from happening. Things may be alright for now, but values can go up outside of reassessments. This is not even counting changes to the equalization factor or tax rates. Property taxes should be appealed every year, an edict that both the Board of Review (BOR) and the CCAO both endorse. This not only stops the bleeding from large rises but establishes a foundational value that can be used to prove your case in the coming years. Think of it as future-proofing your property.

Informal Appeal Deadline is August 20, 2025

Unlike the rest of Illinois, taxpayers in Cook County do not need to complete their appeal filings in one go. Informal appeals to the CCAO and formal hearings with the BOR have two filing dates. While the current BOR dates are unknown, the last day for filing informal protests is August 20, 2025. The BOR is quickly becoming the target for most taxpayers, but informal hearings can produce solid savings themselves. Not to mention, the BOR hearing season is not scheduled yet and could be months away. Even if you want to go to the BOR, you can still try to get results from the CCAO. There are lower evidence thresholds for informal appeals, so it can be an easier path.

O’Connor Protests Annually

Hopefully we have established the importance of annual appeals, as they have paid dividends for countless townships. We at O’Connor have been big proponents of this strategy and will automatically protest every year for each of our 185,000 clients. We believe that it builds a solid baseline for the future and that cumulative wins are easier to achieve thanks to this process. This is our method of choice when it comes to high-tax areas like Cook County, and we have seen monumental success with it.

We are one of the largest property tax firms in the nation, but we also have local expertise in Cook County. We opened a branch office in Aurora specifically to deal with Cook County and the surrounding areas. We utilize local experts that have spent their whole life in the area and know what evidence is required by the CCAO and the BOR to achieve the best results. When you join with us, we will represent you in hearings, give you advice on your case, and ensure that you never miss a deadline again. Best of all, you will never pay us unless you win. You will only be charged if we can lower your taxes, otherwise you will never see a fee, hidden or otherwise.