Earlier this year, O’Connor discussed the Elk Grove Township reassessment increases and how the 2025 reassessment is affecting property values in the township. At the time, we were not sure when the deadlines for property tax appeals would occur, as the Cook County Assessor’s Office (CCAO) has a wide range of dates, with each township having a different cut-off date for appeals. With the summer almost over, it has finally been confirmed that the final deadline for protests in Elk Grove township is September 16, 2025.

This deadline is for appeals to the Board of Review (BOR) only, as informal appeals with the CCAO already had a deadline pass earlier in the summer. If you missed that initial date, there is nothing to worry about, as you can still file an appeal with the BOR. BOR appeals are generally favored in Cook County, as they usually provide the most tax relief. The BOR in Cook County also has a reputation for siding with homeowners over the CCAO, which opens up things for people trying to protect their houses. Commercial properties do well in these hearings too, making them the perfect opportunity to reduce business taxes as well.

Our initial article covered how Elk Grove Township was doing under the reassessment, so we will not go into detail here, but we will still do a brief recap and go over what has changed in the months since the first article was published. There have been some developments that may benefit taxpayers in their appeal efforts and should at least be considered.

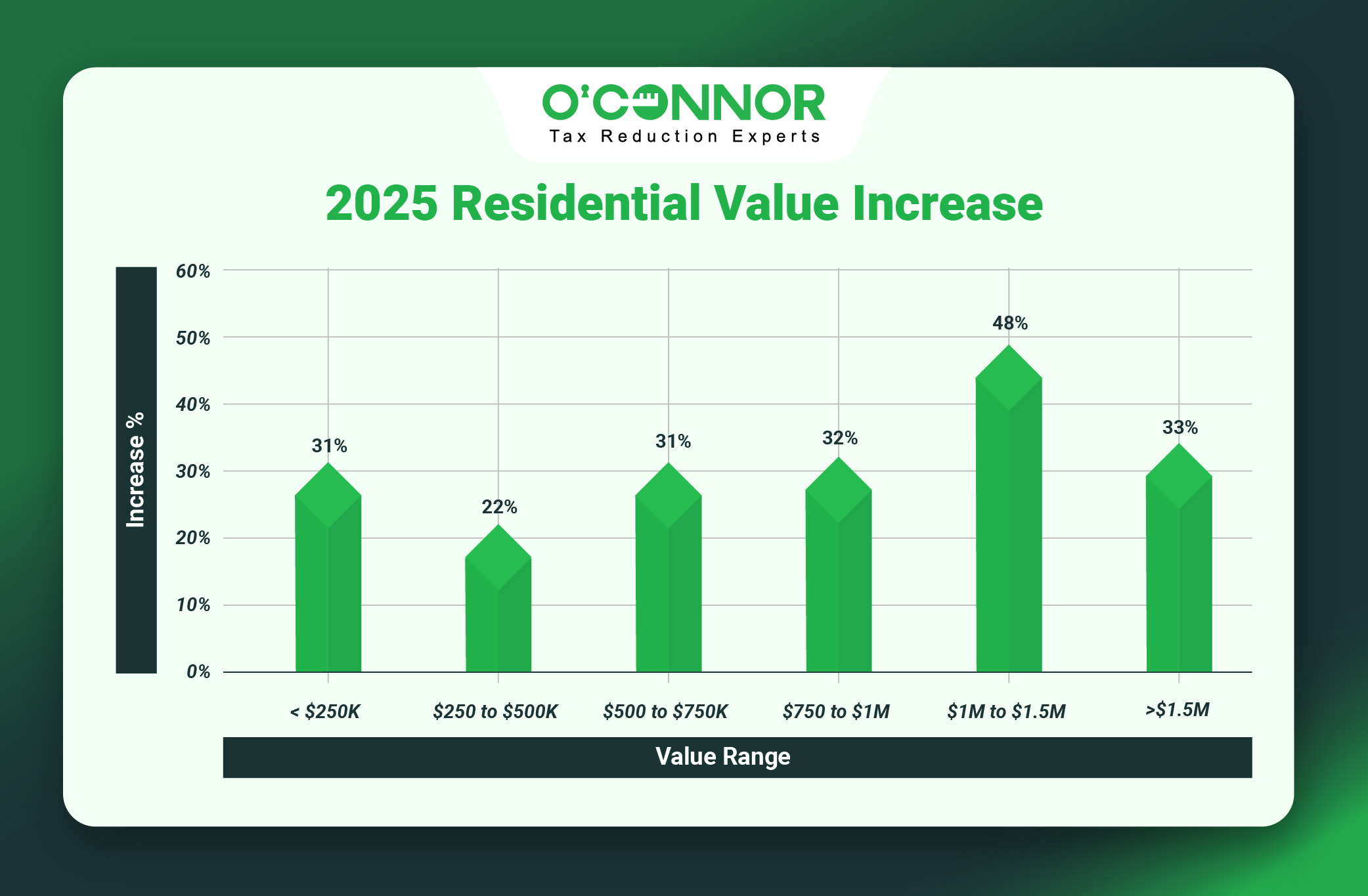

Residential Property Added 26% in Taxable Value

Before the 2025 reassessment, all residential property in Elk Grove Township was believed to be worth $8.07 billion. Once the CCAO was through with their assessment, this shot up by 26%, bringing the total to $10.15 billion. The most valuable category of homes was those worth between $250,000 and $500,000, which totaled $5.83 billion after a jump of 22%. This was followed by homes assessed from $500,000 to $750,000, which spiked 31% to total $2.19 billion. The largest increase by percentage was for homes worth between $1 million and $1.5 million, which saw a combined value of $1.07 billion.

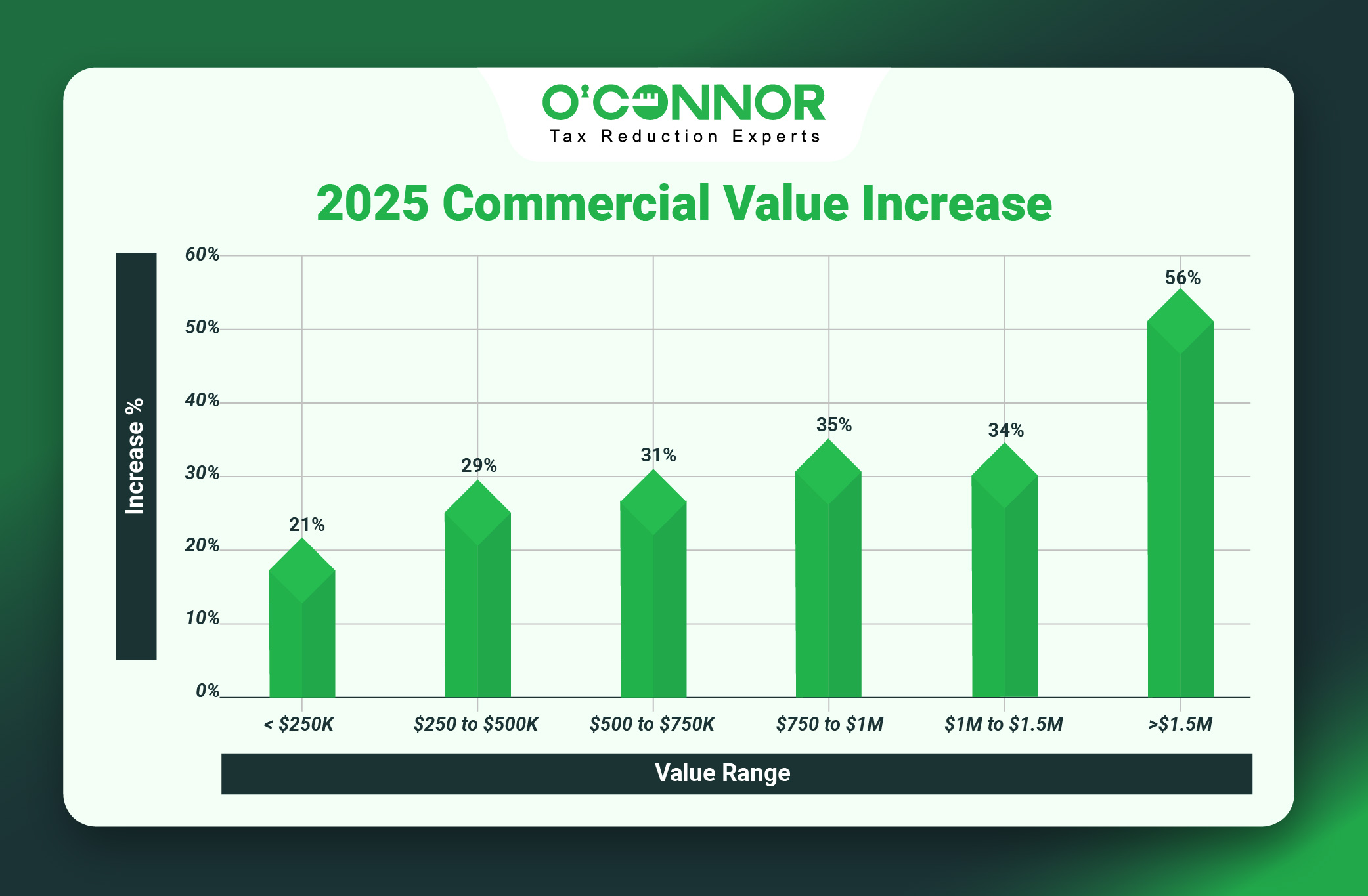

Elk Grove Business Real Estate Spikes 52%

While homeowners, especially middle-class ones, took a beating, Elk Grove business owners saw some of the highest increases in all of Cook County. Thanks to a massive increase of 52%, the overall value of commercial property skyrocketed by $2.97 billion, achieving a total of $8.63 billion. The majority of this increase fell on the top-tier business properties in the township, those worth over $1.5 million. Typically, the largest source of value for businesses, these commercial properties saw a staggering increase of 56%, which brought their total to $7.64 billion. While dwarfed in size by the top properties, all other categories likewise saw giant jumps in value, with the three following categories rising over 30% each. Even the smallest of properties, those worth under $250,000, saw a giant increase of 21%.

CCAO Puts Burden on Businesses

One reason for the huge increase in elite commercial properties in Elk Grove, and across Cook County, is an initiative to move the onus of property taxes from homeowners to businesses. After the disastrous 2023 reassessment, it came to light that many property tax appeals were removing the burden from larger commercial properties and then transferring them to homeowners, especially working-class and minority owners. This drew plenty of justified outrage and forced the CCAO to act. This new focus on large businesses seems to be somewhat true, as the taxable value of such properties across Cook County has increased, even in places outside of reassessment. This provides both homeowners a fairer chance in appeals, while giving more fodder for unfair assessment to business owners when it comes to protests.

Computer Issues Rocked the 2025 Tax Season

One of the main developments in the past few months was a large series of computer errors that hit Cook County. The CCAO has been attempting to modernize their data system for years, leading to several problems. The largest occurred this summer, when massive delays caused a cascading number of issues for both the CCAO and taxpayers. These problems wrecked systems that linked the CCAO, the County Clerk, and the BOR. This meant that property values could not be properly assessed, taxed, or protested. This gridlock caused a chain reaction throughout the entire county, as government bodies waiting on funds had to go without a cashflow or had to resort to expensive loans. Infighting among the various organizations also cast even more doubt on the veracity of the numbers that the CCAO has been using, opening things up for possible future appeals.

No Legislative Help is Coming

Another factor that should encourage taxpayers to appeal is the fact that there is no official fix to the property tax situation on the horizon. Initially, it was hoped that a CCAO-backed bill to install a “circuit breaker” on property taxes would bring a permeant fix to the situation. Unfortunately, due to both partisan issues and pushback from taxing entities, this was stalled in the legislature. Many other solutions have been brought up across Illinois, only to meet the same fate. This means that the only way to currently lower taxes is to use exemptions and appeals.

Final Appeal Deadline is September 16, 2025

While the reassessed areas in Cook County are grabbing all of the attention, much of the state is also beginning to embrace appeals like never before. The BOR is seeing appeals in record numbers in 2025, and with many townships nearing their deadlines, this caseload is only going to grow. The heads of several government agencies, including the CCAO, County Clerk, and the BOR are all asking taxpayers to appeal to confirm that the assessed numbers are accurate. As the BOR goes over the numbers, it is becoming clear that many, if not most, are not accurate.

With such high value spikes and tax rates, it is imperative that the people of Elk Grove Township take their taxes to the BOR. Not only is this the last chance of the year to lower taxes, but it could pay huge dividends for years to come. While another reassessment is not set until 2028, property values continue to grow outside of assessment, not to mention changes in tax rates and the equalization factor. Lowering the value put forward by the reassessment would be a boon in the coming years, as Illinois taxes are expected to only increase.

Let O’Connor Lead the Way

There is not much time left to go before the final deadline passes. The BOR is a great option for homes and businesses but typically requires more evidence to win a case. Evidence includes photographs, documentation, and sales records for comparable properties in your area. While it is certainly possible to protest your taxes on your own, it is always good to have support on your side. We at O’Connor are always happy to help, as protecting our clients and making sure they get affair deal is the whole reason we were founded.

As one of the largest property tax consulting firms in America, we can bring plenty of firepower to your fight against the CCAO. We were able to help over 185,000 clients across dozens of states in 2024 and are looking to assist even more in 2025. To spearhead our efforts in Illinois, we opened a branch office in Aurora. Our Illinois staff brings insights that only locals could have about the complex system of taxes, governmental bodies, and appeal quirks. With our national resources and local experts, we believe we give you the best chance to succeed. Enrolling with us is free, and you will never see a fee from us unless your taxes are lowered. We will review your taxes every and coordinate a protest, ensuring you meet every deadline and are prepared for any sudden increase that might occur unless we lower your taxes. We will also protest your taxes every, ensuring you meet every deadline and are prepared for any sudden increase that might occur.