Rogers Park is thankfully outside of Cook County’s infamous triennial reassessment in 2025, but it still bears the scars from being whacked by the Cook County Assessor’s Office (CCAO) in 2024. During that reassessment, Rogers Park saw residential home values surge up 24%, while commercial properties experienced an astronomical growth of 38%. These rises in taxable value translated into record tax bills, causing much financial strain throughout the most diverse township in all of Cook County.

Being outside of reassessment does not mean that Rogers Park was safe from increases in 2025, though they were minor. It does illustrate the tidal wave that reassessment can do to a community when the increases are compared together. This does raise an opportunity for the people of Rogers Park to protest their current taxable value, as there is a chance of not only neutralizing the gains of 2025 but also clawing back some of the record increases from 2024, especially if you did not protest last year. The deadline to appeal your values is August 5, 2025, meaning there is not much time left.

Small Home Value Increases Leave Room to Reduce

Rogers Park suffered an increase of 24% to total home value in 2024. In 2025, outside of reassessment, the township only saw an increase of 0.2%. This is much more manageable, to say the least, and is somewhat in line with inflation. This brought the total value from $6.04 billion to $6.05 billion. While this change is infinitesimal compared to the 2024 reassessment sledgehammer, it is still worth protesting to ensure that it is accurate. The real benefit is that a protest could also help undo some of the 2024 damage, if it can show that your home is overvalued.

Homes worth between $250,000 and $500,000 were the backbone of Rogers Park and were responsible for the largest slice of value in the township. These homes saw a small bump of 0.1% in 2025, bringing their total to $2.26 billion. Homes worth between $500,000 and $750,000 were in second place with a value of $1.62 billion, after seeing an increase of 0.2%. Fourth place was reserved for homes worth under $250,000. These residences were fortunate to have a small decrease of 0.1%.

Large homes, fittingly, saw large increases. Homes worth between $750,000 and $1 million experienced a value increase of 1%, while those worth between $1 million and $1.5 million jumped 2.3%, which put them in third place for total value, surpassing homes worth less than $250,000 for the first time. Homes worth over $1.5 million saw an increase of 1.4%, though they only made up a small part of the total.

The Power of the Triennial Reassessment

To illustrate the outsized influence that Cook County reassessment has, we will compare Rogers Park to parts of the county going through active reassessment, which are all in the north. Evanston is seeing home values up by 23%, while Northfield is going through an astounding 30% increase to total home value. Maine saw homes jump by 25%, while Elk Grove weathered an increase of 26%. This should demonstrate why Cook County residents should always be prepared for reassessment years, though Rogers Park shows that property values can still go up when the attention of the Cook County Assessor’s Office is elsewhere.

Rogers Park Commercial Values Rise 3.8%

While homes were relatively stable, commercial properties experienced much higher increases. There is supposedly a movement inside CCAO to move tax burdens away from homes and onto businesses, and recent statistics across Cook County seem to be bearing this out. The total commercial value in Rogers Park grew by 3.8%, going from $2.28 billion in 2024 to $2.37 billion in 2025. While many townships undergoing reassessment are currently seeing numbers over 30%, it is important to remember that Rogers Park saw a burst of 37% in commercial value increases in 2024, meaning that number is now being compounded upon by lesser gains.

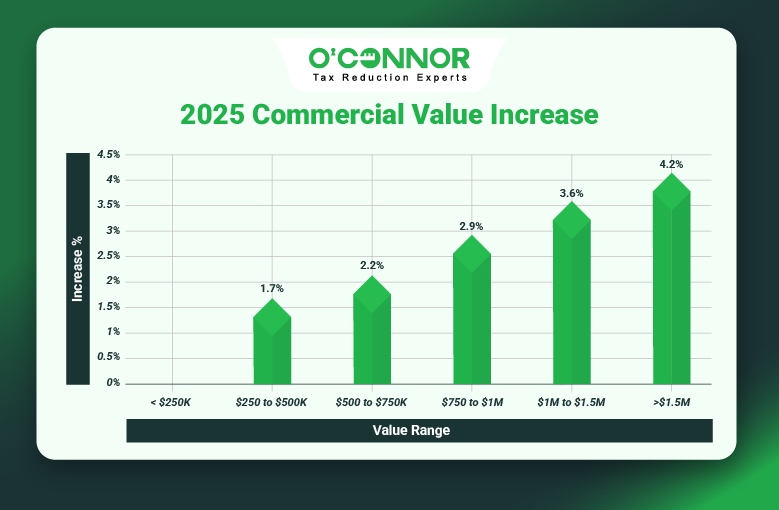

Like most townships across the whole of Illinois, the largest subset of commercial value was found in business properties worth over $1.5 million. These commercial properties were assessed at $1.75 billion in total value after a rise of 4.2%. These same commercial properties had seen a giant spike of 38% in 2024. This makes protesting the current values even more important, as it can erase 2025 increases and possibly cut into those from 2024 as well. Thankfully, the Cook County Board of Review (BOR) seems to favor larger businesses in appeal cases.

Commercial properties worth between $1 million and $1.5 million did little better, seeing a jump of 3.6%. Those worth between $750,000 and $1 million were hit by an increase of 2.9%. The increases began to fall off as the commercial properties decreased in size, until businesses worth less than $250,000 saw no gains at all. This is a relief, as these commercial properties lower on the spectrum had all been hit hard in 2024.

The Perfect Time to Appeal

While it might not seem like an opportune time with increases in Rogers Park being rather low, now could be the perfect time to strike with a property tax protest. Whether it is a home or business, Rogers Park was whacked with a reassessment in 2024. A protest now could counter the whole of the 2025 increases and maybe even rollback some of the damage done in 2024. There have been many developments in the past year that open the door to current and future protests.

After failing to get legislation passed, the head of the CCAO recommended that all people across Cook County protest their taxes. In addition, a series of computer errors has delayed bills and put many assessments into doubt. Doubt is the perfect fuel for a property tax appeal and could be just the weapon that is needed to get a significant cut. The BOR is also encouraging everyone in Cook County to appeal their taxes, even outside assessment, as numbers are not considered reliable. This opens the door to protests across Chicago and beyond.

Rogers Park Deadline set for August 5, 2025

While the chance for informal appeals before the CCAO passed months ago, there is still time to file a protest with the BOR. This window closes on August 5, so it is imperative that you do not delay. The BOR has been consistently giving property owners a fair shake, making these appeals especially effective. With tax rates and the equalization factor always going up, property values should be protested every year. If the CCAO is constantly increasing rates, then you should constantly be trying to lower them.

O’Connor Stands Ready

We at O’Connor have stood up to high property values and taxes for over four decades. After getting our start in Texas, we have now become active in 49 states and even a few foreign countries. The complexity and inequality in Illinois spoke to us so much that we opened a branch office in Aurora to just deal with Chicago and the collar counties. This has given us local knowledge and insight into how things work in Illinois and our attorneys, tax experts, and researchers know how best to deal with CCAO and the BOR.

We have long been proponents of annual protests, which, as mentioned above, are tailor-made for Cook County. If you enroll with us, we will represent you and protest your property values every year. This does not matter if you are currently in reassessment or trying to play catch-up. Annual protests allow you to build a foundation and a fair price with every victory, making it easier to win with each passing year. This is especially important to establish between assessments, as it constructs a base value with a pedigree that CCAO cannot deny and helps protect against later aggressive assessment. Best of all, there is no risk. Protests cannot raise your property values, and you will only pay us if you win.