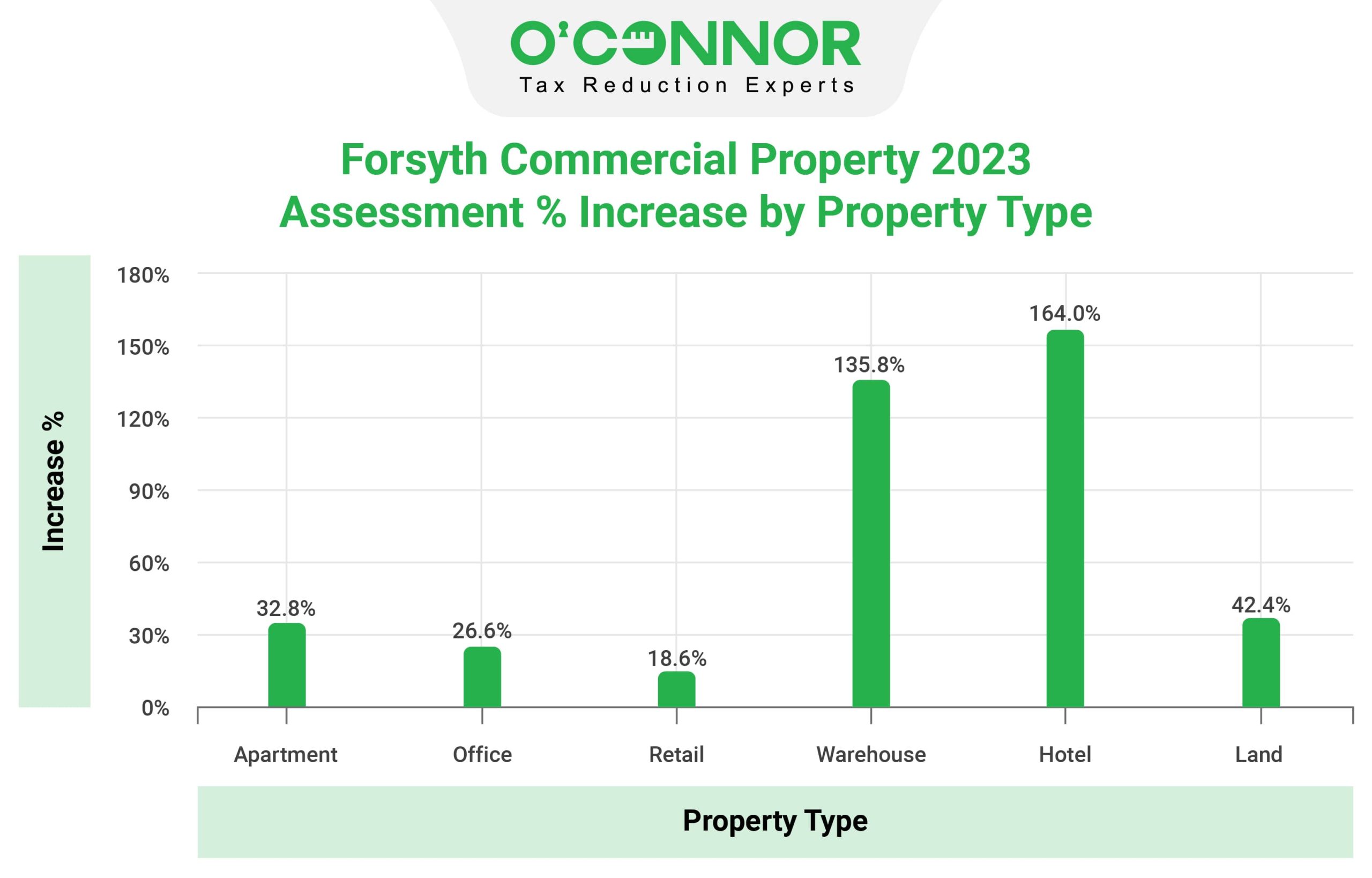

Commercial property owners in Forsyth were shocked to receive 2023 property tax assessments 35.8% higher than in 2021. Owners of hotels and warehouses received the largest increases; both over 130% in 2023. Property tax assessments for hotels rose 164% in one year; from $13.8 million in 2022 to $36.5 million in 2023. Property tax assessments for warehouses in Forsyth County increased by 135.8%; from $70 million in 2022 to $165.6 million in 2023. The value of all commercial property in Forsyth County increased from $1.83 billion in 2021 to $2.49 billion in 2023. This includes apartment, office, retail, warehouse, hotel, and land.

This data has been compiled by O’Connor, the nations largest property tax consultant.

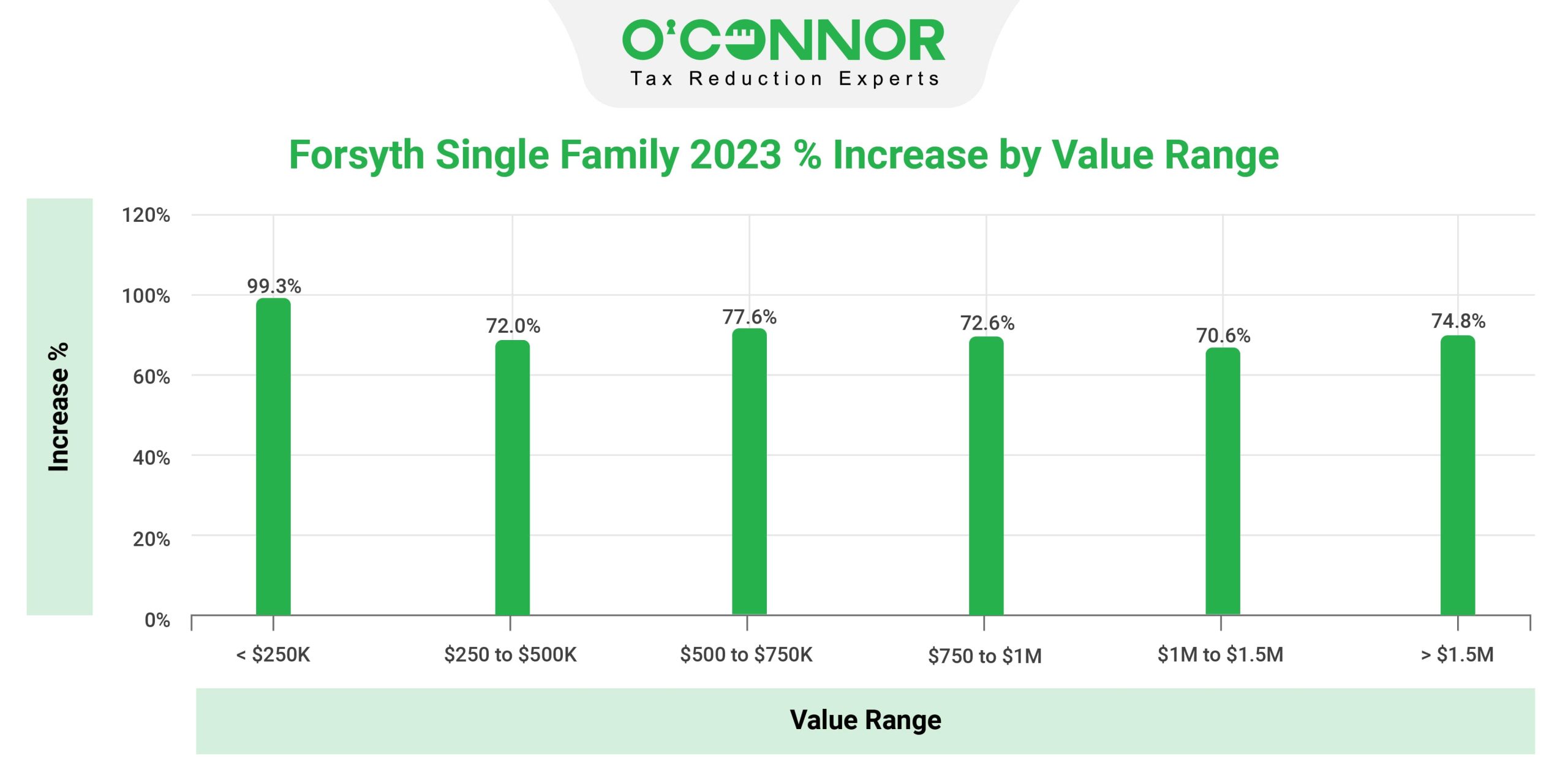

While the commercial owners no doubt feel stunned by these increases, they are modest compared to the increases for homeowners in Forsyth County. The Forsyth County Tax Assessor’s value for houses rose 75%, from $26.8 billion to $46.9 billion, an increase of $20.1 billion versus the increase of $0.66 billion for commercial property.

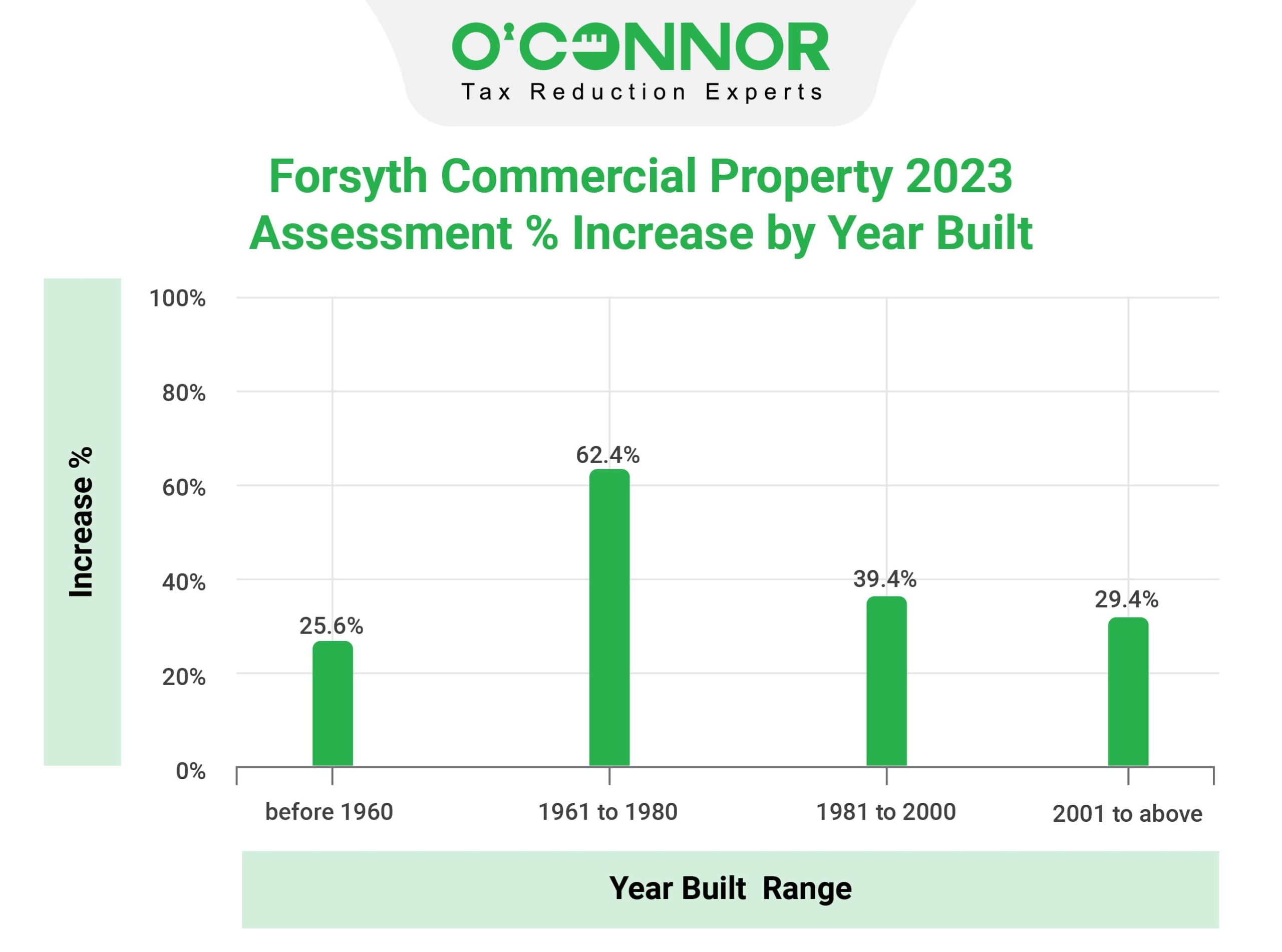

Apartments of all ages incurred increases in assessed value of more than 25%. Forsyth County apartments built before 1960 had assessment increases of 25.6% while those built in 1960 to 1980 were increased 62.4%

The following graph illustrates assessment increases based on year built:

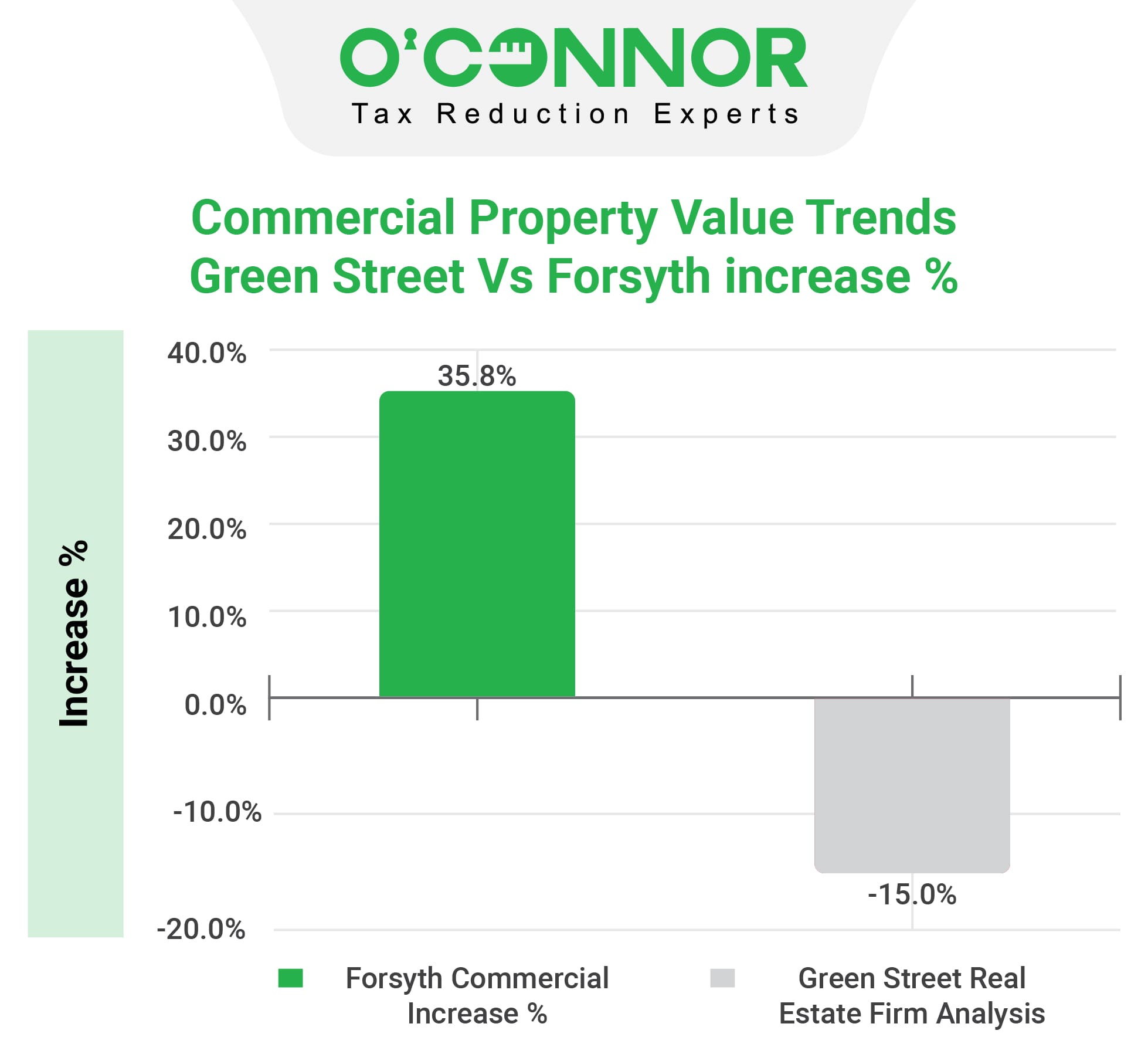

The large increases in assessed value for commercial property are inconsistent with value trends reported in the Wall Street Journal by the Green Street real estate firm. Green Street reports commercial real estate values are down 15% versus the 35.8% increase in assessments applied by the Forsyth County Tax Assessor.

The Forsyth County Tax Assessor increased the value of warehouses 93.2% overall. However, the assessed value of warehouses built between 1960 and 1980 increased 173.9% and warehouses built between 1980 and 2000 were increased 158.4%. Warehouses built before 1960 saw assessment increases of 23.9% and those built after 2000 were increased 76%.

Tax assessment increases by year built for Forsyth County warehouses are illustrated below:

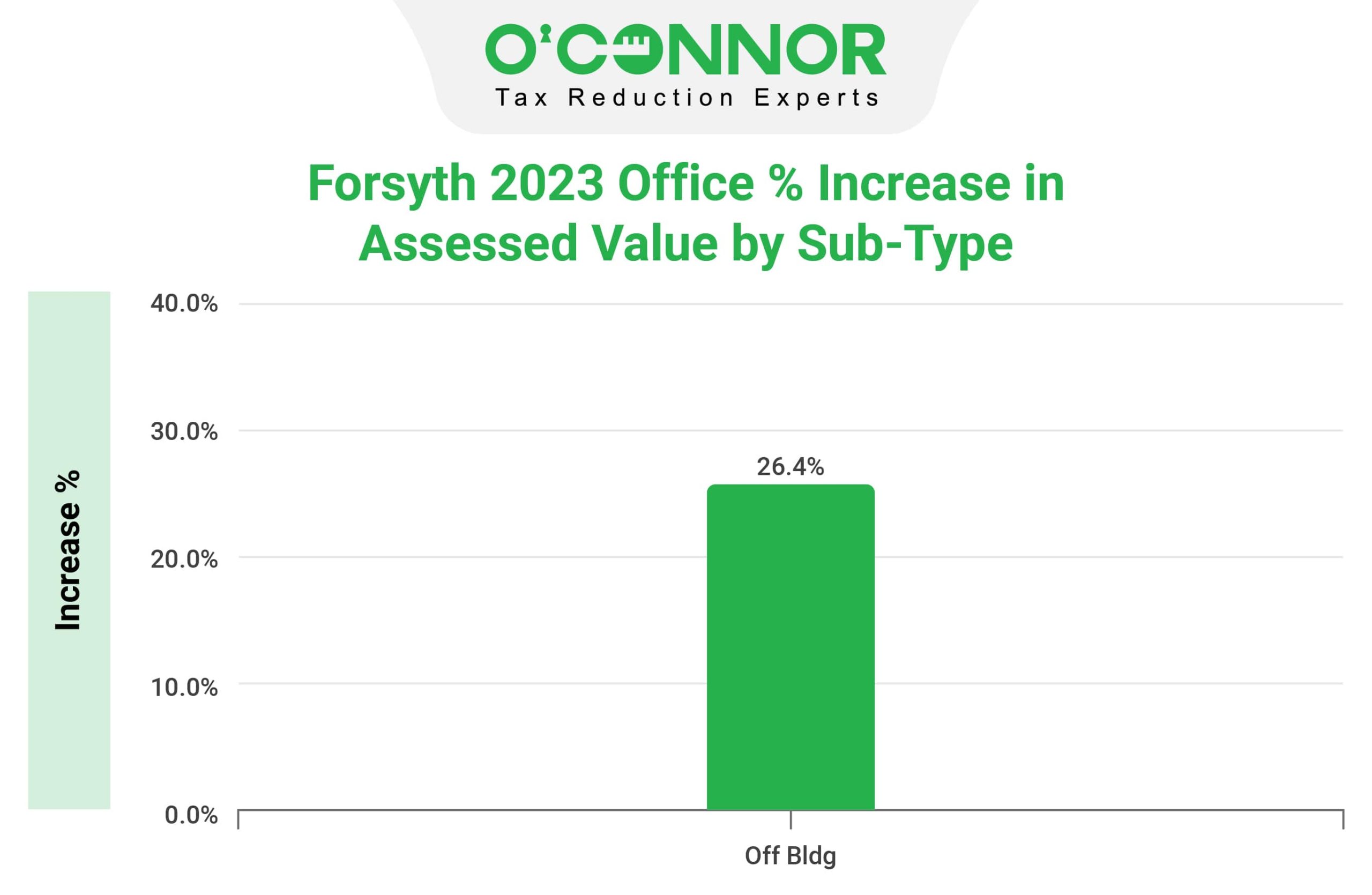

Office building in Forsyth County had tax assessment increases of 26.4%. This increase is surprising since the value of office buildings has been plummeting due to post COVID work from home policies. Office occupancy rates are slowly declining in virtually every market.

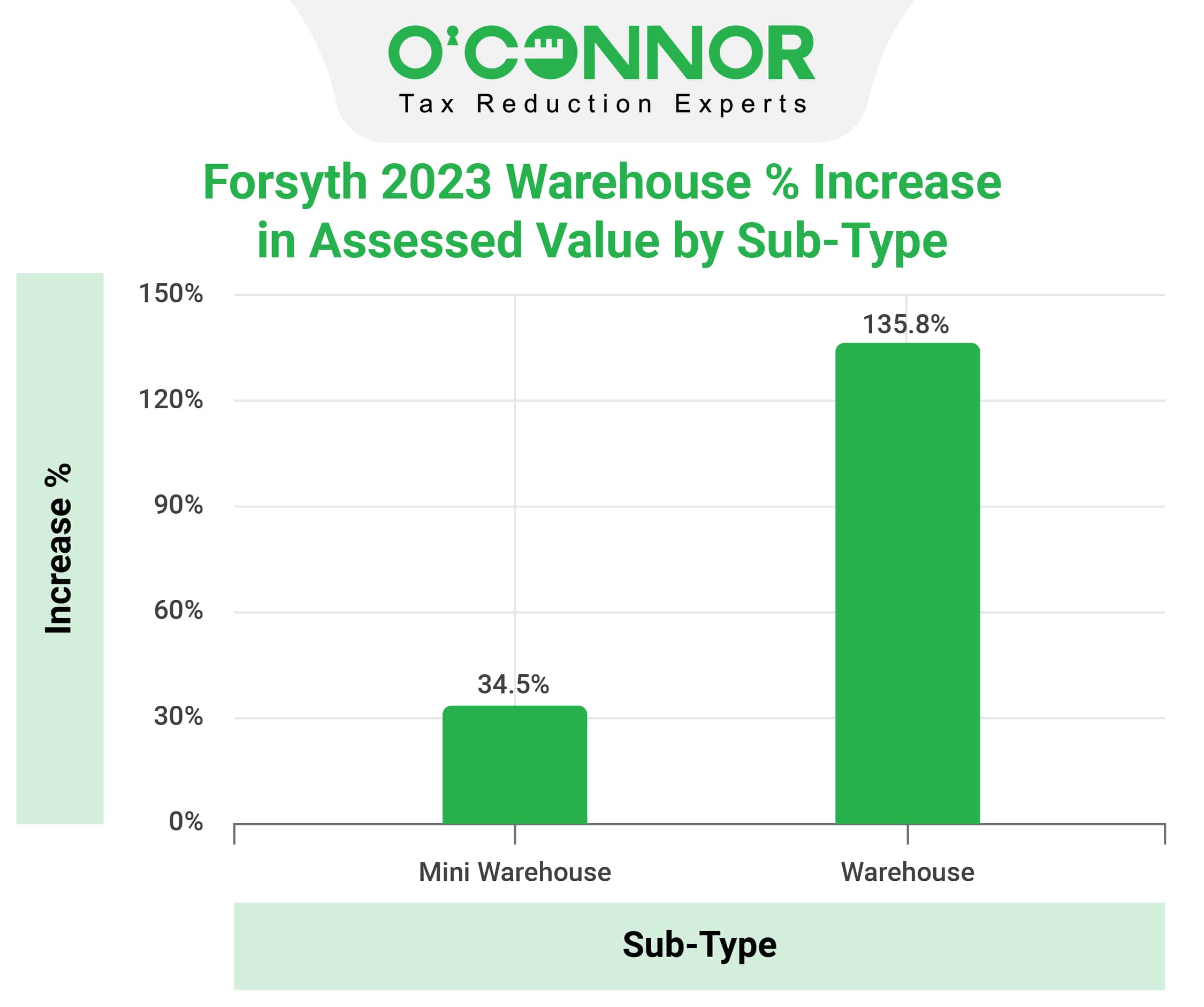

Both warehouses and mini-warehouses (aka self-storage) incurred sharp increases in assessed value in Forsyth County in 2023. However, the warehouse assessment increases of 135.8% overshadowed the 34.5% increases for mini-warehouses.

Forsyth County property owners are encouraged to review protesting their property tax assessment annually, but particularly in years when values are reassessed. The assessor’s valuation team works hard to accurately and equitably value property. However, the size of the staff is small compared to the challenge they face in maintaining accurate detailed records for every property and accurately valuing a variety of types of property.