Lake County trails only DuPage County when it comes to the collar counties around Chicago. Like many of its collar county brethren, Lake is a combination of suburban areas, rural communities, and post-industrial towns. Fremont Township embodies this varied economic and cultural tapestry well, while having a charm all its own. Like most of the county, Fremont Township walks a line between being independent and being influenced by Chicago.

One thing that Fremont Township cannot escape is rising property values and taxes. Thanks to the growing mess in Cook County and the general state of taxes across Illinois, both homes and businesses are seeing their values spike. As populations, demographics, and economies shift, this may become a larger problem every year. The collar counties have turned to property tax appeals to balance things out, and Fremont is no exception. O’Connor will explore how values are being impacted and how taxpayers can fight back.

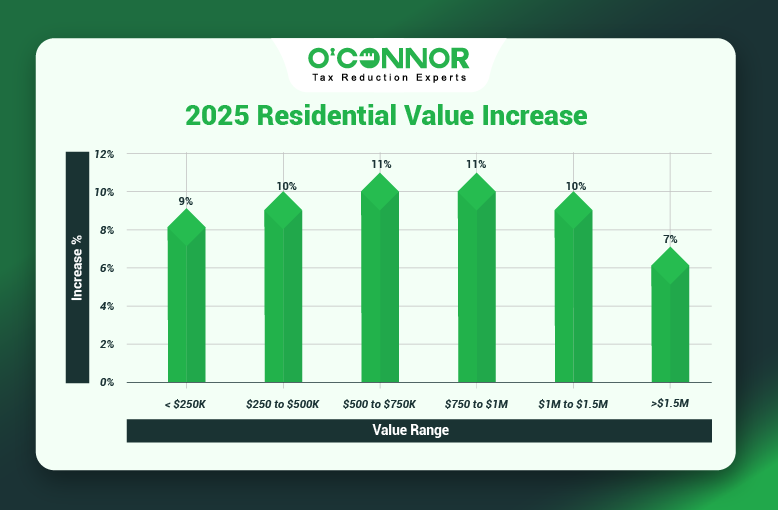

Home Values Increase 10% in 2025

Like much of Lake County, Fremont Township is mainly a suburban community. This makes housing a bigger slice of the economy than urban areas. In 2024, all homes in Fremont were assessed at a combined total of $4.40 billion. This was increased by 10% in 2025, reaching $4.85 billion. This had nothing to do with an official reassessment but was done thanks to constant work by the Fremont Township Assessor, who is constantly comparing home sales and values, then adjusting assessed value accordingly. A 10% increase is well above inflation, and the sudden rise could be grounds for a property tax appeal. The possibility should be explored by homeowners, even if it is just to ensure that they are paying their fair share.

When homes are categorized by their assessed worth, we can see that Fremont is a solidly middle-class community. The largest block of homes were those worth between $250,000 and $500,000, which totaled a value of $2.68 billion. The residential properties increased by 10%, leading the charge for the rest of the area. Homes worth between $500,000 and $750,000 increased by 11%, reaching second place with $1.30 billion in value. Homes assessed at under $250,000 experienced 9% growth, though they only totaled $290.96 million.

Luxury homes are becoming more of a factor in Fremont Township, though not as much as some Lake County neighbors. The largest block of these were homes worth between $750,000 and $1 million, which achieved a value of $428.53 million after an increase of 11%. Large homes assessed at $1 million to $1.5 million grew by 10%, totaling $131.12 million. The most expensive houses in the township only increased by 7%.

The Shared Burden of the Collar Counties

It is not only Lake County that is seeing big increases across the board. Kane and McHenry Counties are experiencing similar or even larger numbers. In Kane County, Batavia Township saw a general home value increase of 9%, while Dundee surged by 10%. Geneva, Rutland, and Plato all saw 9% growth. In McHenry, all townships experienced large flurries of growth as well. Chemung added 9%, while Richmond spiked by 11%. Dorr Township also saw a large jump of 11%. While these numbers pale in comparison to Cook County townships currently under reassessment, they are actually higher than many suburbs of Chicago.

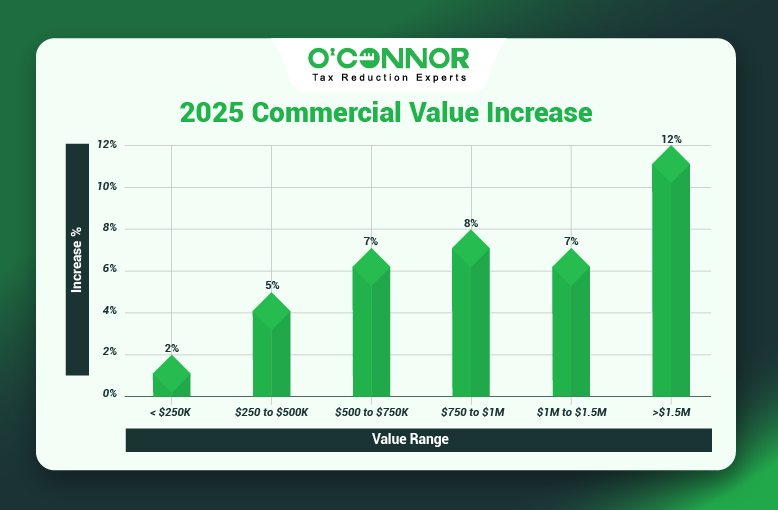

Fremont Businesses Add 11% in Assessed Value

Like homeowners, business owners can also become victims of rising values and the damage to communities can be just as bad. In 2024, it was estimated that all commercial property in Fremont Township was valued at $638.26 million. In 2025, this was increased 11% to $706.42 million. Like homes, this jump is not in line with inflation, and while it could represent sudden economic growth, it more likely points to overassessment by the local government.

Like the rest of Illinois, most commercial value in Fremont came from the most expensive businesses. Commercial property worth over $1.5 million contributed $564.14 million to the total value. This was a 12% increase from 2024, which had already been the previous record. Thanks to the outside impact of this category, the total value skewed upwards. No other commercial property category reached the double digits.

Commercial property worth between $1 million and $1.5 million was in second place in terms of overall value and saw an increase of 7%. Totaling $34.31 million, businesses worth between $750,000 and $1 million increased 8%. The third-largest category according to value was for commercial properties worth less than $250,000. These modest businesses totaled $27.82 million and saw a small increase of 2%. Hopefully, limiting most property value increases to elite properties will spare smaller businesses both now and in the future, as these high-end properties are usually the first to go under due to market pressure.

The Appeal Deadline is August 25, 2025

As we have seen, value increases are battering both homes and businesses. This could mean that companies are forced to raise prices, which then stresses homeowners on top of the financial strain with higher taxes. Property values and tax rates are independent of each other, and it is typical to see both a value increase and a tax levy bump. Illinois is hungry for revenue, as each township has dozens of agencies with their hands out and each must be sated. This means that taxpayers can often get it with both barrels. This is one of the reasons that Illinois only trails New Jersey when it comes to high taxes.

To lower the value of a property, the only two methods are exemptions and appeals. These two pair well together and can produce significant savings. Appeals have come to the forefront of Illinois’ collective consciousness thanks to the 2023 reassessment of Cook County. This disaster showed the rest of the state how severe values could really get and how appeals were the only way to stop them. Since then, the collar counties have led the charge in contesting taxes.

While they may not have to worry about 40% increases like some Cook County communities, the people of Fremont Township do have a disadvantage when it comes to deadlines. In Cook County, informal appeals and those to the Board of Review (BOR) have different timetables. In the rest of Illinois, there is only one date, which differs by township. For Fremont, this is August 25, 2025. Any appeals, whether they are in formal or BOR, must be filed by this date. This is a hard line and missing it means paying unfair taxes for yet another year. The race is on to protect homes and businesses.

O’Connor has Local Expertise

In many parts of Illinois, property taxes have increased every year for over 30 years. All sides of the political aisle have tried to fix the problem in recent years, each meeting defeat. While exemptions help, the only way to truly fight against the tide is to protest your taxes annually. If they are going up each year, then it is only fair that you fight fire with fire. We at O’Connor have preached this strategy for years, and we do it for each of our 185,000 clients. It has been proven that annual appeals bring the best results and that cumulative victories are the best protection against future tax hikes.

We are one of the largest firms in the United States that focuses on property tax issues, and we have clients in over 40 states. While we have national reach, we are also dedicated to gaining knowledge and expertise that only locals know. We opened a branch office in Aurora solely to build a local knowledge base that can serve our clients directly. These local lawyers, tax consultants, and researchers understand the complexities of the Illinois tax system more than any national chain could, and they also have plenty of connections with both assessors and the BOR.

When combined with our national resources, our Illinois team is uniquely equipped to deal with the rigors of combating Illinois property taxes. We will not only protest your taxes every year but will do it for free. You are never charged anything upfront, even on multi-million-dollar homes or businesses. You are only charged a contingency fee if we lower your taxes. This means that you have nothing to lose and everything to gain by joining us in our mutual fight against unfair taxation.