Can you assume that the Cook County Assessor’s estimate of market value for your home is accurate and reflects the actual market value? In many cases, the answer is no. Some homes are substantially overvalued based on recent sales transactions. Other homes are substantially undervalued. Please see the tables below. We provide the address for homes over-valued. If you know these homeowners, we encourage you to alert them of the problem

Homes Valued Too High or Quite Low?

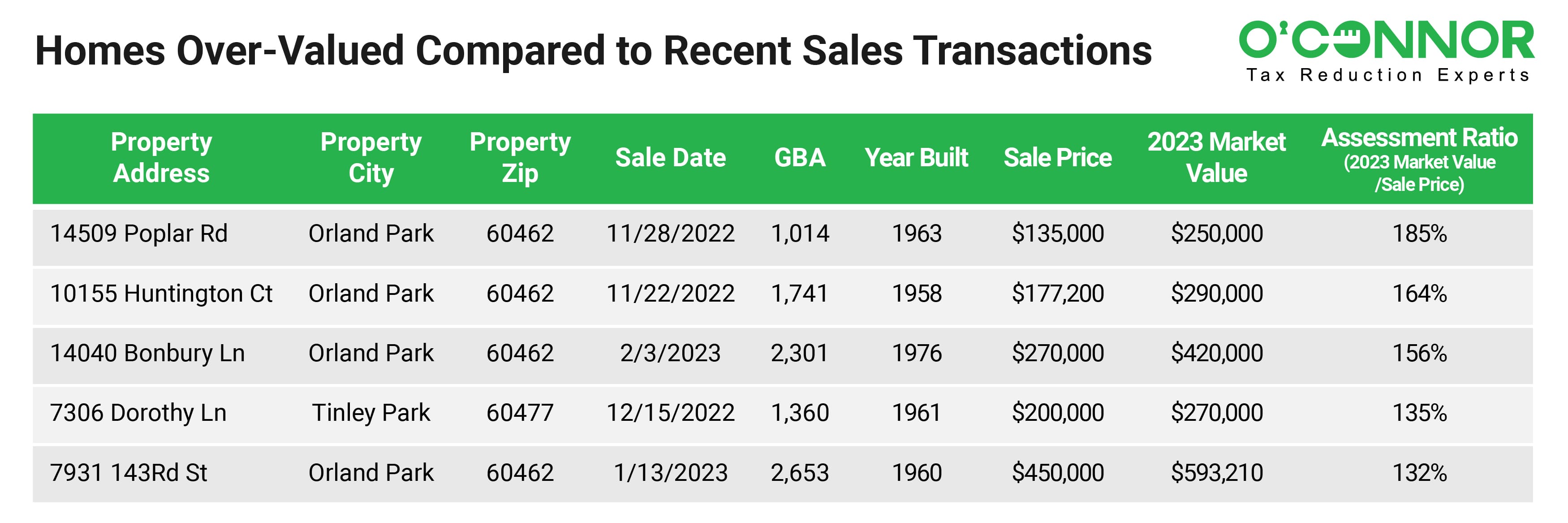

The homes in the first table are overvalued by 32-85% in comparison to sales transactions that occurred within 3 months of the valuation date (January 1, 2023). Unless these homeowners appeal their tax assessment, their property taxes will exceed a reasonable level of taxation.

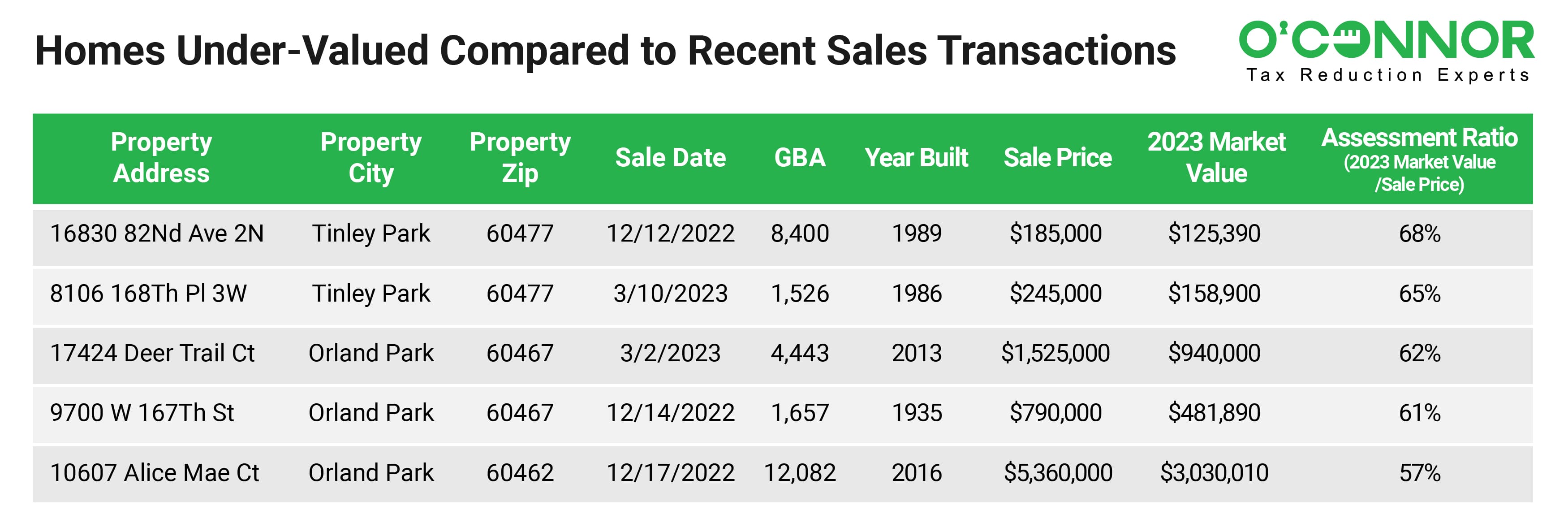

On the other hand, the undervalued homes have market values estimated at 57-68% of market value, based on sales which occurred close to the January 1, 2023, effective date. These homes are listed in the second table, without the street number.

How Many Homes are Over or Under Valued?

Some homeowners make assumptions that cause them to pay more than their fair share of property taxes:

- The assessor’s estimate of value is accurate (only 34% of Orland Park values are between 95 and 105% of market value),

- If my value is at market value or low, there is no benefit to protesting,

- You can’t beat the county; there is no point in protesting property taxes.

Property Tax Myths Exploded

Myth 1 – the assessor’s values are accurate.This simply is not true. The below examples of properties over and under assessed represent the extremes. However, only about one in three homes are accurately valued, based on a ratio study of 1,952 recent home sales in Orland Park. The ratio study contrasts the 2023 property tax assessment with the recent sales price. 66% of homes are valued at more than 105% of market value or less than 95% of market value.

The assessor uses the least reliable method of appraisal, the mass appraisal approach. Inaccurate property data, inaccurate property valuation factors, and an incomplete model to generate initial values are all characteristic of the mass appraisal approach which opens up opportunities property owners to decrease their taxes.

Myth 2 – if the assessor’s value is high or low, there is no benefit to protesting your property taxes. In fact, if the value estimate by the Cook County Assessor is high, low, or accurate, your protest is highly likely to succeed in the triennial year in which the Cook County Assessor revalues your property. In Cook County, the assessor revalues property every three years. In the year when your property is revalued, the probability of succeeding with a property tax appeal is almost 100%. This is true regardless of whether the noticed value is low, about right, or high. We believe over 95% of appeals in the revaluation year are successful. Those are really good odds!

Myth 3 – appeals don’t work. You can’t beat the county. This simply is not true. Virtually all appeals in the revaluation year are successful; probably over 95% succeed. The chance of success is lower in the two years after the revaluation.

However, a review of commercial tax appeals for the following townships (Barrington, Berwyn, Calumet, Hanover, Oak Park, River Forest, Riverside, Rogers Park, Lemont, New Trier, Orland, and Schaumburg) reveals that protests are successful in the revaluation year and the two subsequent years. As an example, data for the referenced townships shows that commercial property assessments were reduced about 17.7% each year, regardless of whether it was an official revaluation year or not.

- Appeal tactic 1 – protest that the assessors value estimate exceeds market value. In most townships, the assessor over-values about 50% of the properties, particularly houses. The assessor targets 100% of market value. With a median of 100%, half of the homes are above 100% and half are below 100%.

- Appeal tactic 2 – protest unequal appraisal for houses. An unequal appraisal protest is premised on similar nearby homes having a lower assessment by the Cook County Assessor. Experience shows it is possible to document unequal appraisal in the vast majority of cases for homes in Cook County.

Evaluating Whether You Have a Basis to Protest in Cook County

To evaluate your likelihood of winning a protest, you can review unequal appraisal, market value and the assessor’s description of your property.

- You can check unequal appraisal at: cutmytaxes It is free to use. Just enter your property address and it will prepare an unequal appraisal analysis.

- Market value can be evaluated by reviewing comparable sales on Enriched Real Estate. Access to review comparable sales is free. Just enter your property address and it will search for relevant comparable sales

- The accuracy of the assessor’s property description can be reviewed at the Cook County Assessor’s website.

Don’t delay. Check now at no cost to see if your property taxes should be lowered. Remember, virtually all first-year appeals are successful!