Will County dwarfs the majority of Illinois counties when it comes to population. A heady combination of suburban, rural, and exurban communities, Will is the most versatile and unique of the collar counties around Chicago. This has led to a diverse economy where one can find farms, urban sprawl, and mansions all within the borders of the county. There is a complicated and intertwined history with Cook County that goes back over a century, with Will County being both independent and influenced by Chicago. Unfortunately, one of the things this relationship has bestowed upon Will County is high property values and taxes.

Joliet Township is the crown jewel of Will County and personifies it in a lot of ways. With the city of Joliet acting as a hub for transportation, industrial production, and suburban living, the township has a strong economy and a solid housing market. Straddling the line between being a suburb of Chicago and its own entity, Joliet Township has seen a growing demand for homes and businesses in recent years. This has caused assessed values to rise for both, which puts economic pressure on traditional owners. As with the rest of Illinois, property tax appeals are becoming a common way to deal with overzealous taxation and are seeing more use than ever before. O’Connor will explain how things have grown in 2025 and what property owners can do to lower their tax burden.

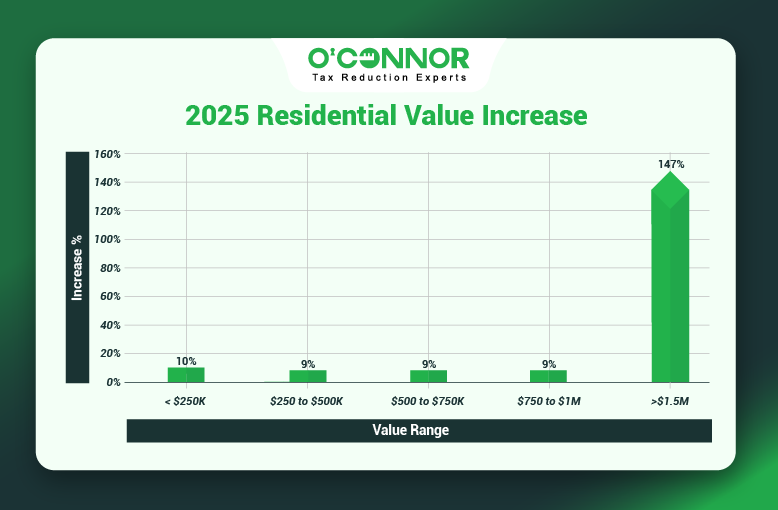

Home Values Surged 10% in 2025

No matter where you go in Illinois, the specter of rising home values is sure to appear. Illinois has the second-highest property taxes in the United States, and they have been increasing every year for decades. This is especially true in the collar counties, where population movement from Chicago has spurred growth in the housing market. Joliet Township saw a rather large jump in assessed value for homes in 2025, which resulted in a 10% increase in total value. This brought the combined value of all residential property from $4.48 billion to $4.91 billion, the highest ever seen in the township.

In a rarity for the collar counties, the largest category of value was homes that were assessed at under $250,000. These modest residential properties accounted for $3.26 billion after seeing a growth spike of 10%. In a distant second place, homes worth between $250,000 and $500,000 totaled $1.61 billion after growing 9%. These two combined categories are the primary reason that the overall value surged. Joliet Township has a long history of being a working-class stronghold and this was certainly reflected in how property was distributed. Sudden value changes in this tier of properties can have disastrous consequences for homeowners, which is why this cross-section in particular should be targeted for tax protests.

There were relatively few high-dollar properties in Joliet Township, but this appears to be a growing sector of the housing market. Those assessed from $500,000 to $750,000 added 9% to their value for a total of $39.85 million. This next step in the chain also added 9%, for a paltry $3.32 million. Homes worth over $1.5 million spiked an astounding 147% in 2025. While this looks impressive on a graph, in reality the total value of such properties was only $1.91 million. This probably means that a second home in this category was constructed within the tax year.

How Joliet Measures up to Other Townships

The collar counties may orbit Chicago, but each has its own economic, residential, and cultural wrinkles. All have seen a large jump in the demand and cost of housing, which is a common theme across the whole United States. Increases around the 10% mark are commonplace. In Kane County, Aurora Township experienced a housing value increase of 10%, while Batavia, Geneva, Rutland, and Plato all grew by 9%. Dorr and Richmond in McHenry County each climbed 11%, while Chemung added 9%. Lake County likewise saw increases across the board, including 10% for Fremont Township, 8% for Waukegan, and 7% for Wauconda.

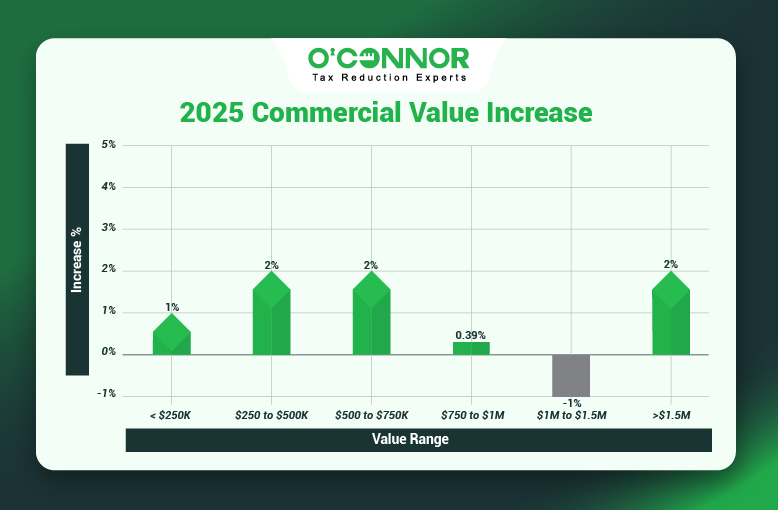

Joliet Commercial Property Offers Mixed Results

When it comes to the collar counties, commercial property sees a lot of variation. While Cook County has seen higher values passed onto businesses, there has been no consistent pattern outside Chicago. In some townships, the value stays flat, while some places see growth rates of over 20%. In Joliet Township, commercial property saw an uptick of only 1%. This translated into a total of $1.47 billion, up from the 2024 total of $1.45 billion.

Most of the value was concentrated on commercial properties worth over $1.5 million. Totaling $813.45 million, these businesses added 2% in value. It is common for the most expensive properties to generate the most value, so Joliet Township was typical in that regard. Things break from tradition when other categories are explored, however, with some strange outliers popping up. The most obvious is for commercial properties worth between $1 million and $1.5 million. These businesses actually cut value by 1%, bringing their total value to $122.45 million. Commercial real estate assessed at $750,000 to $1 million added .39% in value.

Smaller business properties had an interesting twist, in that they were all very close in total value. The biggest share of the value for this tier was for those businesses worth less than $250,000, which accounted for $149.68 million after growing 1%. Those assessed from $250,000 to $500,000 were valued at $142.85 million, which saw a growth of 2%. Those worth between $500,000 and $750,000 were valued at $141.45 million, and these also added 2%.

Joliet’s Final Deadline for Appeals is September 8, 2025

It is a common practice for businesses to protest their taxes annually, as it acts as a natural cost-cutting measure. This could be one of the reasons that Joliet Township’s commercial property stayed somewhat level, which is far from the norm in Illinois. With scandals rocking Cook County and all attempts to fix skyrocketing taxes failing in the legislature, it is little wonder that appeals are becoming common place. The collar counties may not have all of Chicago’s baggage, but it is clear that appeals are becoming necessary there as well.

Property tax appeals and protests can even the playing field or at least ensure that taxpayers are assessed at the correct values. Property values in Illinois have a nasty habit of growing even outside assessment, usually because township assessors are always comparing properties to recent sales and adjusting ever-upward. Local governmental bodies then use this number to levy taxes. Along with the equalization factor, this means most taxpayers will simply see their bill increase each year. Along with exemptions, protests are the only way to counter this.

While Cook County has several appeal deadlines, the same is not true for the rest of the state. There is only one in Joliet Township, which is set for September 8, 2025. This is for both informal appeals to the Joliet Township Assessor and for formal hearings with the Will County Board of Review (BOR). If an appeal to the assessor is rejected, taxpayers can still escalate it to the BOR. This means that taxpayers must get everything they need crammed into a tight window. Once this date passes, taxpayers will have no choice but to suffer increased values and taxes for another year.

O’Connor Can Support Your Appeal

With time running out, doing an appeal, or multiple appeals, can be a daunting task to do by yourself. If you want experts by your side, we at O’Connor are here to help. We have a branch office in Aurora that was specifically set up to help the people of Chicago and the collar counties. This is staffed by local experts that know what is needed to lower taxes in the area and understand the quirks in the system that no outsider could grasp. This gives us, and you, a strong advantage when it comes to appeals to the assessor or hearings with the BOR.

This local team is backed by one of the largest property tax firms in the nation. With local experience and a slew of resources to back them up, we believe we offer the best of both worlds when it comes to Illinois. For over 50 years, we have been lowering property values for clients, representing over 185,000 of them in 2024 alone. We will put all of this backing into our Illinois branch, as we are passionate about protecting our clients above anything else.

There is no cost to enroll with us at O’Connor, and you will only pay a contingency fee from your savings if we can lower your taxes. We will protest for you every year, meaning you will never have to worry about a deadline coming out of nowhere. Many assessors can keep these cut-off dates close to their chest, along with hidden value rises. We will make sure you are always prepared. Yearly appeals also help establish a firm value for your property, which can then be used in the following years as a building block to secure more savings. Cumulative victories have proven to be the best in our experience, and annual appeals are the only way to achieve this.