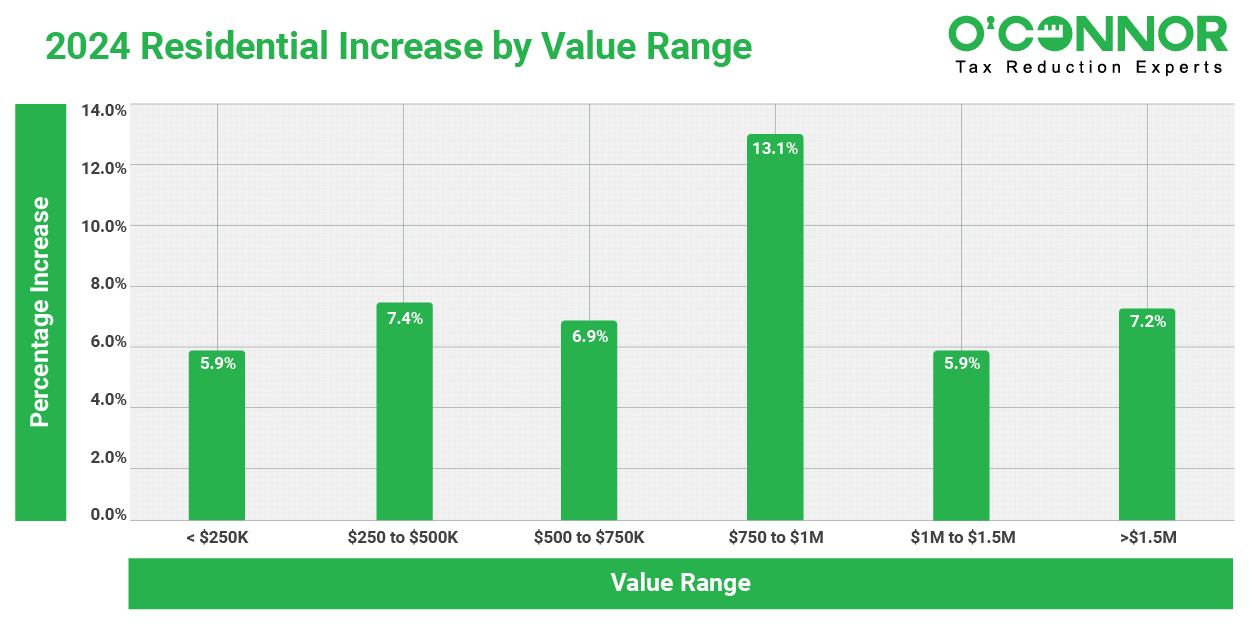

Property Values Up for Homeowners

The residential market values of property owners in Kaneville Township, Kane County, saw a substantial increase of 7.3% from $158 million in 2023 to $170 million in 2024. The most considerable value increase of 13.1% was observed in properties with a value range of $750k to $1 million. Values increased in a comparable manner across various value ranges. For example, the value of residences priced between $250k and $500k increased by 7.4%. A 7.2% increase was observed in the value of properties that were valued at more than $1.5 million.

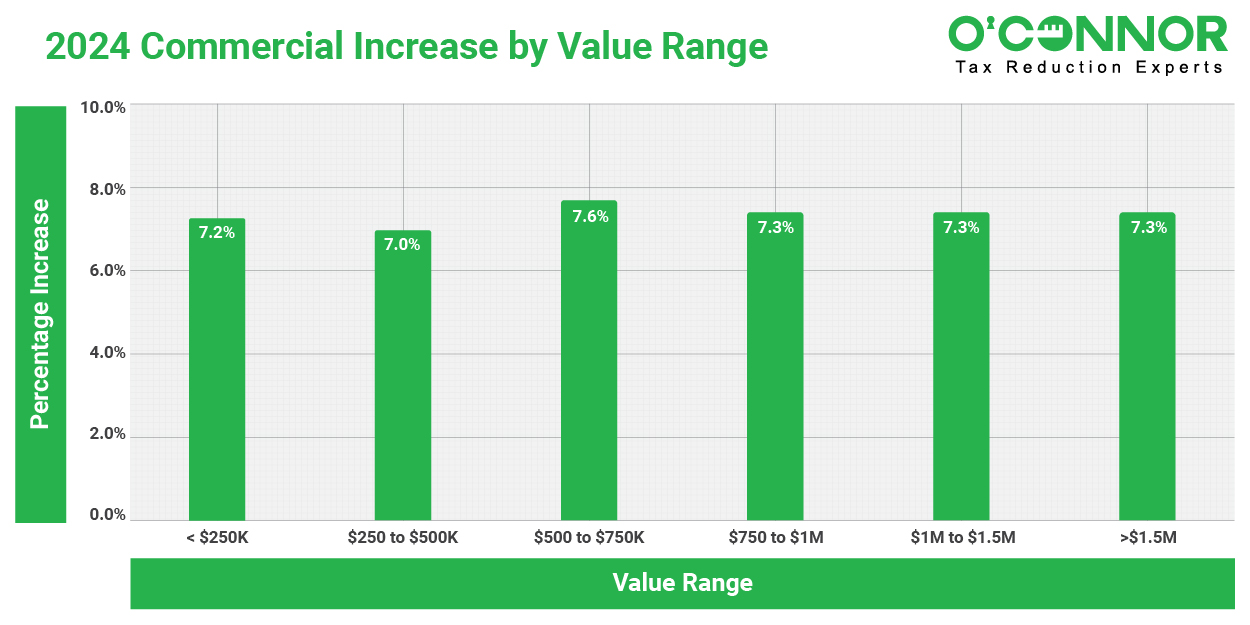

Commercial Values Gain Even More Pronounced

Similarly, commercial property in Kaneville Township had roughly identical value increases by value range in 2024. Commercial values had increased significantly by 7.2%. Every commercial value category witnessed an average rise of 7%. Properties priced between $750k and $1 million, $1 million to $1.5 million, and more over $1.5 million all saw a 7.3% gain. Commercial property owners with properties valued between $500k and $750k had the greatest rise of 7.6%.

What Can Property Owners Do?

The graphs show that Kaneville Township’s assessment in Kane County, Illinois, has climbed considerably. It is advisable for Kane County taxpayers to check for exemptions before appealing the assessment value to get a reduction. Taxpayers may find the appeals process complex, but O’Connor will help ease confusion and make the process feasible. O’Connor works with recognized property tax professionals to ensure tax reduction and unequal appraisal claims are supported by the best evidence. O’Connor and his property tax lawyers examine all options to lower their clients’ property taxes.