Cook County property taxes have been mired in even more controversy in 2025 than usual. Thanks to a series of computer errors, property tax bills are being released at least a month late, while current valuations and bills are being questioned on validity. While the triennial reassessment churns through the north, other areas around Chicago are feeling the heat as well. This chaos and uncertainty can be confusing and worrying, but it does open the door wide open for property tax protests.

Oak Park is in a prime spot. With reassessment only a year away, now is one of the best times to appeal property taxes, setting a baseline for the inevitable hammering to come. While value increases in 2025 have been low, veteran Cook County taxpayers know that next year could bring value rises above 30%, even more in some situations. If Oak Park residents act now, they can be sitting pretty when the 2026 reassessment rolls around. Time is running out, however, as the deadline for 2025 appeals is set for August 19, 2025. O’Connor will go over how Oak Park is faring with non-reassessment increases and how taxpayers can benefit from appeals.

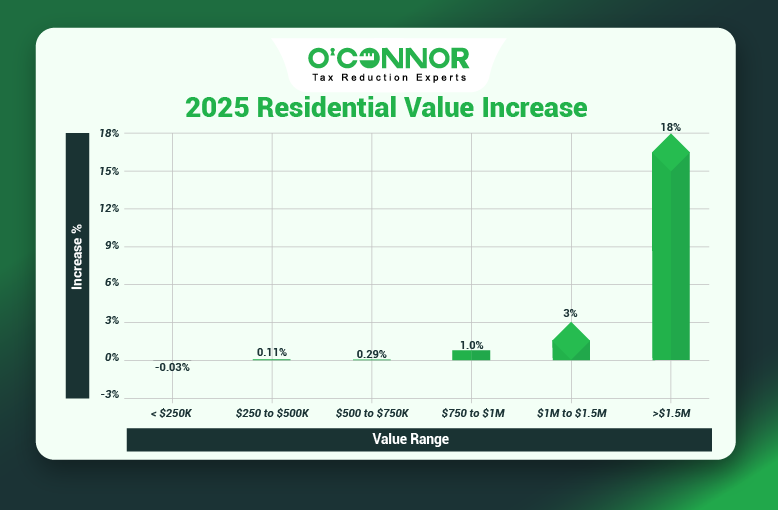

High-Dollar Homes Experience Value Spike

Oak Park last experienced the reassessment in 2023, where the township was predictably walloped by the Cook County Assessor’s Office (CCAO). 2024 was relatively forgiving for Oak Park, with the total value of all residential property only climbing 0.4%. While no tax hike is ideal, 2024 was restrained compared to many other Cook County townships that saw strong rises outside of reassessment. 2025 hit Oak Park a little harder, as the value total for homes increased 1%, going from $6.54 billion to $6.57 billion.

A trend from 2024 was carried into 2025 in the extreme. In the previous year, homes worth over $1.5 million saw their value increase by 4.18%. In 2025, this shot up to 18%, an increase of $13.40 million. While these large homes only make up a minority of the total value, this is still a strong trend upward. This was joined by a 3% increase for homes that were valued between $1 million and $1.5 million. These are both large numbers for properties outside of reassessment, putting pressure on the most elite of homeowners.

Things went much better for working families and middle-class households. While homes that were worth less than $750,000 did see increases, these were all below 1%. In fact, the value of homes worth less than $250,000 actually fell in 2025, though only by a small fraction. The largest collection of value was found in homes worth between $250,000 and $500,000, which totaled $2.76 billion. These homes saw a tiny increase of .3%, a minor miracle in Cook County. Homes worth between $500,000 and $750,000 were the No. 2 category of residential property and totaled $2.2 billion.

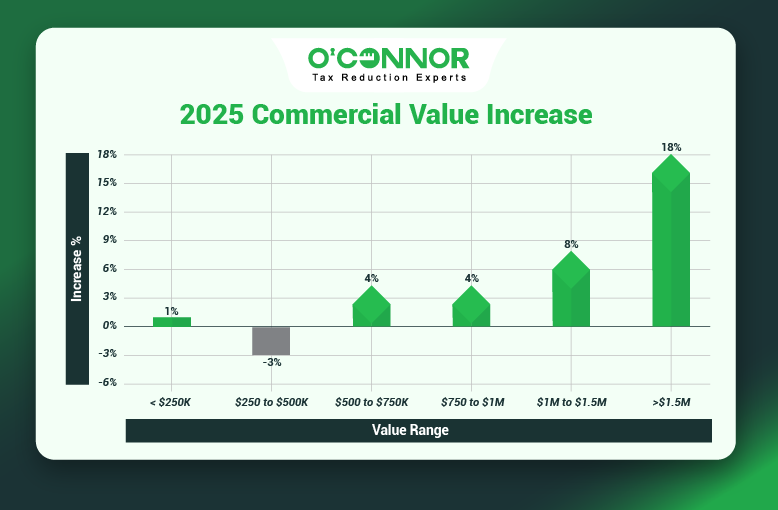

Oak Park Commercial Property Surges 14%

While residential property made it through 2025 relatively fine, the same cannot be said for commercial property. With a combined jump of 14%, the value of commercial properties climbed from $1.22 billion to $1.39 billion. This is on top of a 2024 rise of 17.3%, which itself was on the heels of reassessment. That is a hard three-year stretch for even the hardiest of businesses to deal with and continues the general Cook County trend of placing higher values on commercial property to, in theory, give a break to homeowners. The efficacy of this has been debated strongly.

Like homes, the majority of the raised values were for properties worth over $1.5 million. Unlike residences, the top commercial properties also represented the lion’s share of the total value. Increasing by 18% in 2025 alone, the total value of businesses worth over $1.5 million was $1.39 billion. This was a colossal jump, which joined with the 2024 increase of 22.7% and the huge increase from the reassessment in 2023. This is a lot of stress to pile on businesses in a stretch of only three years.

Commercial properties worth between $1 million and $1.5 million experienced an increase of 8%, rising to a total of $112 million. Things began to slacken up as the worth of properties decreased, with those worth between $500,000 and $1 million going up 4%. In a strange outlier, businesses worth between $250,000 and $500,000 saw a value drop of 3%, bringing relief to the smaller commercial properties. Property worth under $250,000 saw a small bump of 1% added to their taxable value.

Preparing for Reassessment in 2026

While Oak Park certainly suffered some bumps in 2024 and 2025, the next reassessment is only a year away. If we look at some townships currently undergoing reassessment, we can see what the future might hold. Norwood Park’s residential property value spiked 19%, while Evanston was hit worse at 23%. Elk Grove and Northfield popped by 26% and 30% respectively. And these are just for residential properties, as commercial got it even worse. Elk Grove, for instance, saw a commercial value surge of 52%.

Now is the time for taxpayers to begin protesting their taxable value in preparation for 2026. If a homeowner or business owner can establish the worth of their property now, then they have a much stronger case going forward. This, of course, has the added benefit of helping lower current values, possibly even cutting into the extra value generated over the previous few years. The CCAO is now actively encouraging taxpayers to protest, as it is the only way to guarantee they are being treated fairly now or going forward. Tax appeals are no longer a luxury, but are a key part of a person protecting their home or business.

Final Appeal Deadline set for August 19

There is no time to delay, as the last date to file an appeal in Oak Park is August 19, 2025. Informal appeals to the CCAO have been closed since May, but there is still time to protest before the Board of Review (BOR). The BOR is currently seeing record numbers of appeals and there seems to be no sign of stopping. With failed legislation and computer issues galore, the BOR is looking like the best hope for taxpayers trying to get a fair shake. Once the deadline passes, residents of Oak Park will be stuck with their values for another year and will be in a perilous situation with reassessment ready to hit.

Let O’Connor Lead the Way

While time is evaporating, you still have a chance to protect your property. Tax appeals can be carried out by laypeople, but there are many complex issues to navigate. Appeals must be filed, evidence gathered, and property comparisons made. There is even more pressure when formal appeals before the BOR are involved. This is where a tax consultant like O’Connor can make the difference and relieve your burden in this difficult time.

For 50 years, O’Connor has been championing taxpayers in their battle to be treated fairly and with respect. We helped over 185,000 clients in 2024 alone, across the entirety of the United States. We opened a branch office in Aurora just to deal with Cook County and the surrounding collar counties. We have local experts that know how best to take on CCAO and how to please the BOR with the right evidence. Joining is easy, free, and secure. We will protest your taxes every year, meaning you never have to worry about a deadline again. We will build a portfolio of evidence and a string of victories to help you each year, with compounding results usually being even more effective. You will pay us nothing if we fail to lower your taxes, so there is no risk to you.