The property tax situation in Illinois and especially the Chicago area has been worsening every year. Always infamous for some of the highest taxes in the nation, things finally came to a head in 2023 with the reassessment of the southern and western parts of Cook County. The third of the triennial reassessment would be remembered as a turning point and serve as a critical wakeup call for taxpayers across the state. When the reassessment rolled through the area, it left record property value increases in its wake. While spikes of 30% or more are now expected, many saw increases well above that, with many outliers being even 500% or more above what they had been in 2022. Even the average increases tended to be between 30% and 50%.

This stirred outrage and fervor in the population that had never been seen before, one that never really went away. Investigations and calls for reform washed across Cook County. When the dust settled, it was found that many blatant errors were made, including classification mistakes, empty lots being written up as luxury homes, and tax appeals transferring the tax burden from businesses to working-class people. Baldfaced gentrification also swept communities, especially those of minorities and working families. This cast doubt on everything that the Cook County Assessor’s Office (CCAO) said and put all of their numbers in question. This led to record appeals, not just in the south and west, but all across the county. Since then, the demand for appeals has only grown and slowly the effects of an educated populace have been correcting some of the outrages.

Lake View Township was at the heart of the 2024 reassessment, being one of the wealthier and more populated townships that suffered at the hands of the CCAO. Occurring one year after the unmitigated disaster of 2023, Lake View was something of a testbed for both appeals and efforts from the CCAO to change things. It was only partially successful, as while the extremes were kept to a relative minimum, huge increases were still felt across the township. Residential property soared 20%, while commercial properties added 46% to their taxable value. Thankfully, with continued efforts, it appears that 2025 was a much better year for Lake View Township, as it managed to buck the trend of large jumps in the year following reassessment. O’Connor will explain how appeals helped taxpayers in 2025 and how things are being set for the future.

Appeals Fight Growing Property Values

Once a reassessment passes through a part of Cook County, the trend is for the following year to build upon it, raising value more, albeit not to the extremes of the reassessment itself. This is because the new values established are then built upon further, adding more value on top of already inflated numbers. It usually takes until the second year for things to level off. This trend has been seen in those that were hit hard by the 2023 incident, as most of their numbers in 2025 held the same or even retreated a bit. Bremen Township is a good example of this. Of course, while they are currently holding steady, these areas are about to be hit by a reassessment again in 2026.

Lake View Township has bucked this trend and 2025 has seen minimal growth. The 2025 tax season was not an aftershock of the 2024 reassessment, as residential values increased by just 1%, while businesses climbed a bit higher by 4%. This was achieved thanks to mass property tax appeals by residents, just rulings by the Board of Review (BOR), and even some changes by the CCAO itself. We will mainly focus on the power of appeals and the BOR, as these two are linked, and are what taxpayers can actually control.

As soon as 2024 hit, taxpayers in Lake View Township began filing appeals in record numbers. The first stage is appeals directly to the CCAO, with the second being formal hearings with the BOR. BOR hearings are generally seen as more productive, as the impartial board has been siding with taxpayers, especially homeowners, to a much greater degree than in years past. With dedicated residents and a friendly BOR, the tide has been stemmed somewhat. These appeals also have the added benefit of establishing a fair market price, which can then be used in future appeals. This price also helps protect against the next reassessment, as a firm value is already present. This can be seen in the 2025 reassessment, as numbers were much more subdued for the northern areas, compared to how they were in the past.

Lake View Homes Rise 1%

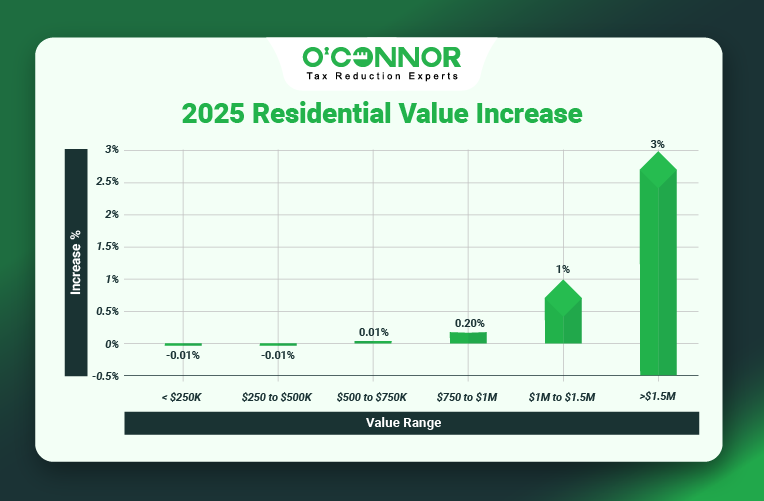

Compared to the 20% increase in 2024, residential properties got off easy with an overall rise of 1%. Lake View is quite unique as far as Cook County townships go. When broken down into categories by how much individual homes are worth, Lake View is surprisingly equal. The usual fare in Cook County is for one or two types to dominate, such as multi-million-dollar homes in New Trier. There is no standout winner for most value in Lake View, though the largest group was homes worth between $250,000 and $500,000, which combined for $9.07 billion in value. The rest of the township’s categories were all valued around $8 billion, with the exception of those worth under $250,000. These modest homes had a total of $4.38 billion, the smallest by far.

With the exception of the two top tiers of homes, there was no real growth or reduction. There was some slight movement either way, but it resulted in a net gain of 0%. Homes assessed at $1 million to $1.5 million experienced only an increase of 1%, reaching a total of $8.25 billion. Thanks to an increase of 3%, homes worth over $1.5 million managed to rise into second place in overall value, with $8.35 billion. Lake View generally represented a strong middle-class, a growing elite, and a shrinking working-class.

Commercial Properties Experience an Uptick of 4%

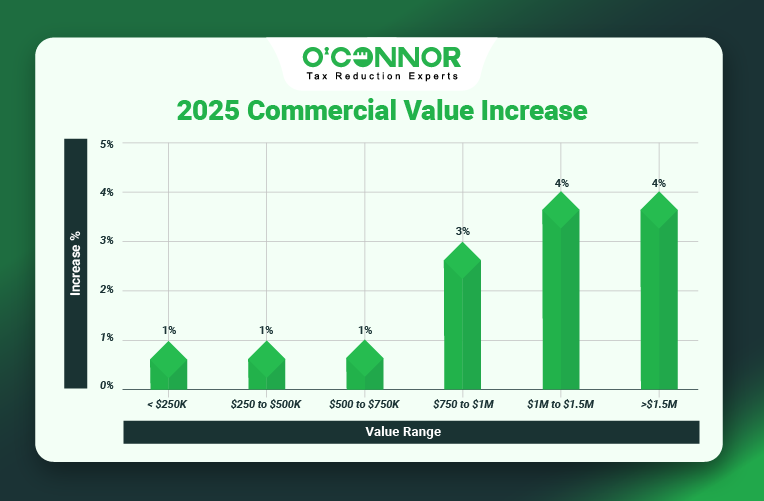

Business owners got blasted in 2024, with an overall increase of 46%, which set the combined value for all commercial real estate to $11.83 billion. In 2025, there was a much smaller overall rise handed out, this time it was 4%, which brought the total to $12.24 billion. The increase was eerily similar to the one experienced in 2024, at least proportionally to that of residential properties. The CCAO has been trying to move more of the burden from homeowners to businesses and this seems to be working across the county. This trend is generally considered one of the few positive things the CCAO has done, though it does make things more difficult for businesses.

The main category for commercial property was those worth over $1.5 million. $10.44 billion in value was attributed to these large businesses, following an increase of 4%. These shaped the overall value and the general economic livelihood of the township. In 2024, they skyrocketed by 51%, so this has a minor adjustment in comparison. In distant second place was business real estate worth between $1 million and $1.5 million, which grew 4% to total $773.52 million. With 3% growth, commercial property assessed from $750,000 to $1 million reached a total of $289.96 million. The remaining three categories all saw increases of 1%.

The Final Appeal Deadline is September 16, 2025

There has already been one appeal deadline that has come and gone in Lake View Township. In June, the cut-off date for informal appeals with the CCAO passed. While this means that this path is now closed, taxpayers can still file their protests with the BOR. This deadline extends to September 16, 2025. This is a boon for taxpayers, as these twin deadlines are only open to Cook County residents. This is also considered the better appeal opportunity for both businesses and homeowners.

There are many reasons to file an appeal in Cook County, not just the ones previously stated. While the CCAO is attempting to be fair, there have been a lot of problems in the past year. One of the biggest is a series of computer errors that delayed bills, collecting taxes, and issuing refunds. This ended with significant blame-shifting but ultimately showed that the figures released by the CCAO remained unreliable. In addition, any attempts to fix the property tax problems legislatively have failed, meaning appeals are the only way to go. Protests are now being encouraged even by the CCAO themselves, casting more doubt on the inflated numbers that residents are seeing on their tax bills.

O’Connor Can Help

This is a complex issue and there is a lot at stake. No matter if you own your own home or run a business, property tax appeals join exemptions as a necessity to protect your property, and like exemptions, appeals should be a yearly occurrence. This may seem like a big ask, as the appeal process can be strenuous, with evidence needing to be gathered, paperwork filed, and hearings attended. We at O’Connor can help you with many issues and are standing by ready to get you all that you deserve.

The bedrock of any appeal is evidence, and that is where we at O’Connor come in. Our tax experts, researchers, and more can build the perfect portfolio of evidence for you and your attorney to use in the appeal process. This analysis can be useful at every stage of the process, including the BOR and the statewide Property Tax Appeal Board (PTAB). We are one of the top property tax consulting firms in the nation, but while we have a national reach, our local presence is the most vital. With an office in Auroura, we are equipped to deploy local experts to your case. Our Chicagoland staff have been supporting appeals for a long time and have varied skillsets. They know how Cook County operates and are the best allies you could ask for. Best of all, you will never be asked to pay an upfront cost or hidden fee. You will only pay a contingency fee if your taxes are lowered.