O’Connor ratio research shows that the median time-adjusted sales price for a typical residence in Glynn County, Georgia is $325,000, but the median assessed value is $301,600, which is $23,400 more than the market price. As a result, much residential property in Glynn County is overvalued. The research study compares the time-adjusted sales price with the value established by the Glynn County tax assessor for 2023.

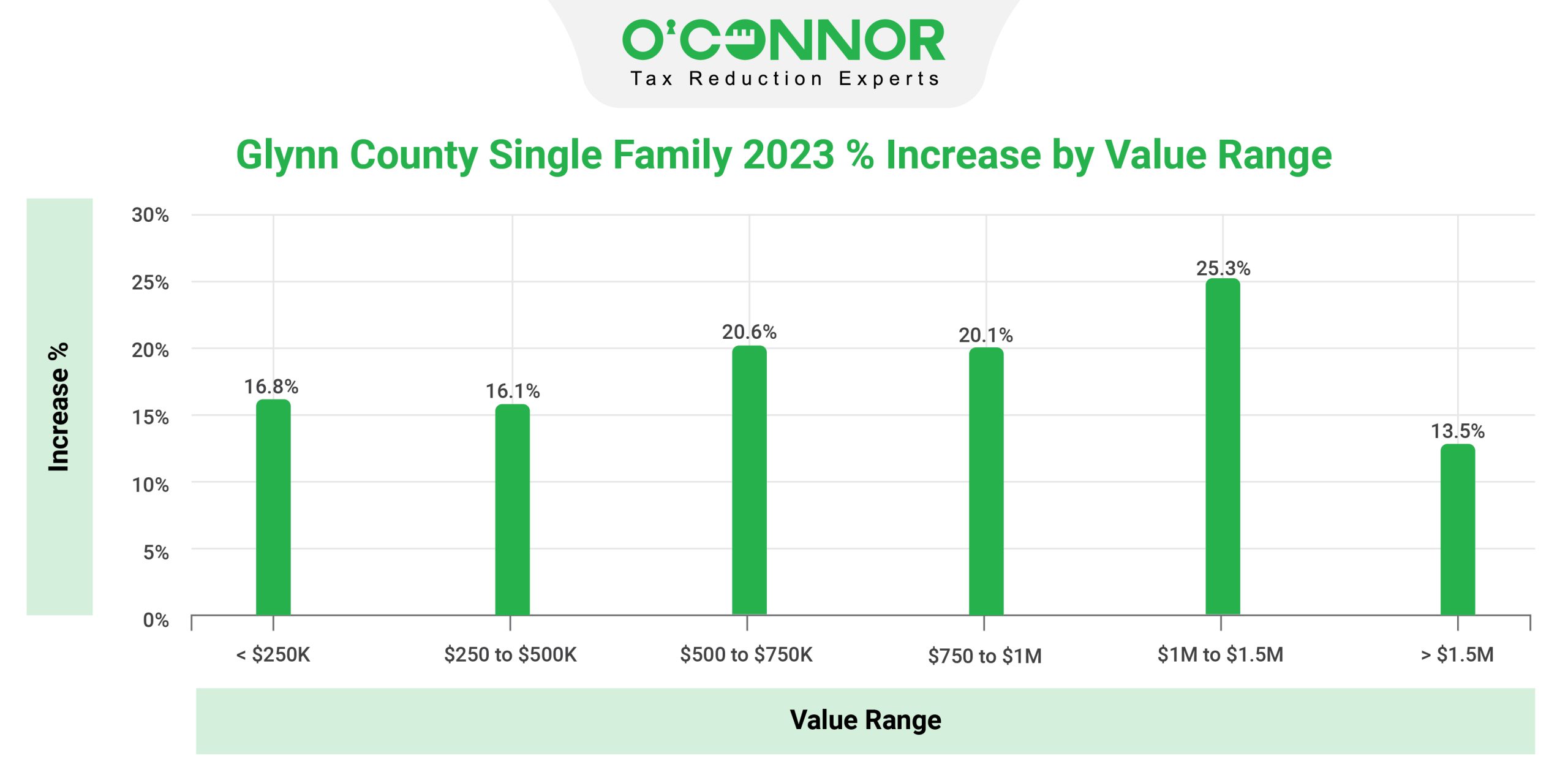

The value of a typical home in Glynn County has climbed by 17.3%, but homes in the $1M to $1.5M price range have been affected worse, seeing a value increase of 20.2%. Homes in the $500K to $750K price range are also feeling the pinch due to 20.6% higher evaluations for 2023.

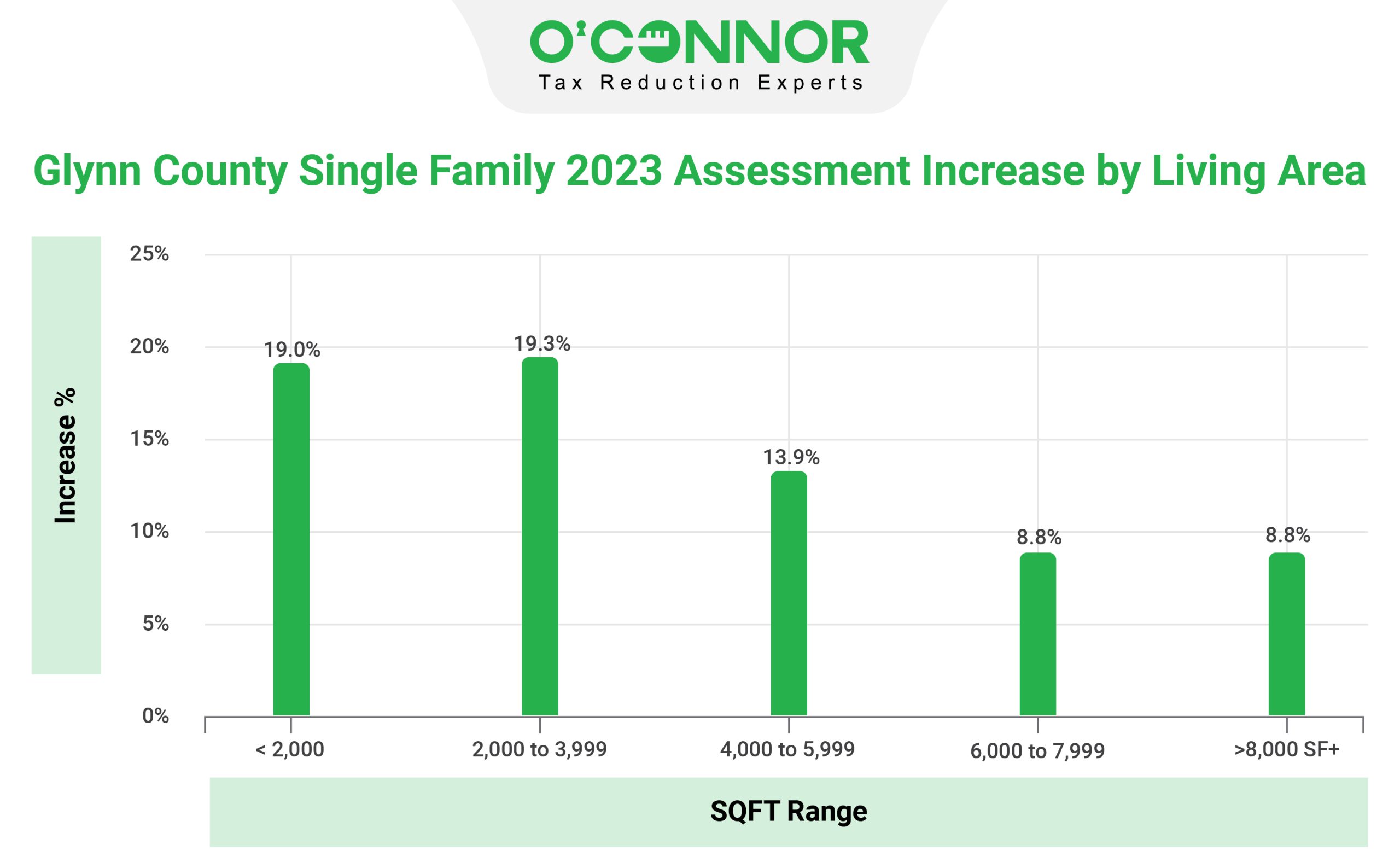

The highest increases for Glynn County single-family properties have been seen in properties with 2,000 to 3,999 square feet. Homes between 2,000 to 3,999 square feet received an increase in property tax assessments of 19.3%, while homes between 6,000 to 7,999 and above 8,000 square feet saw an increase of 8.8%.

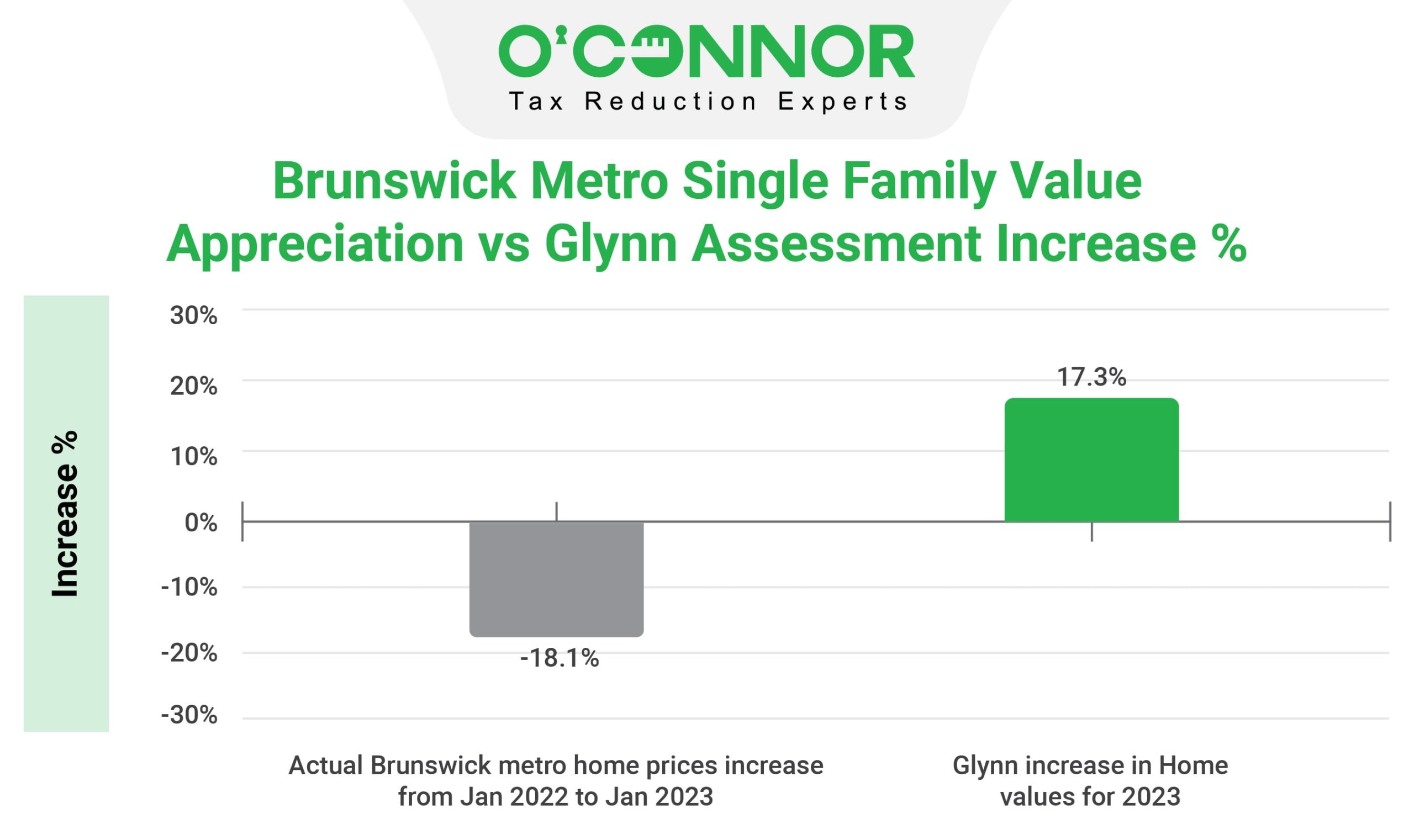

The Glynn County property tax appraisals increased by 17.30% but housing prices declined by -18.10%, according to the Brunswick Metro sales price statistics. The gap in these is over 35 percentage points. In short, assessments rose but sales fell in the metro area.

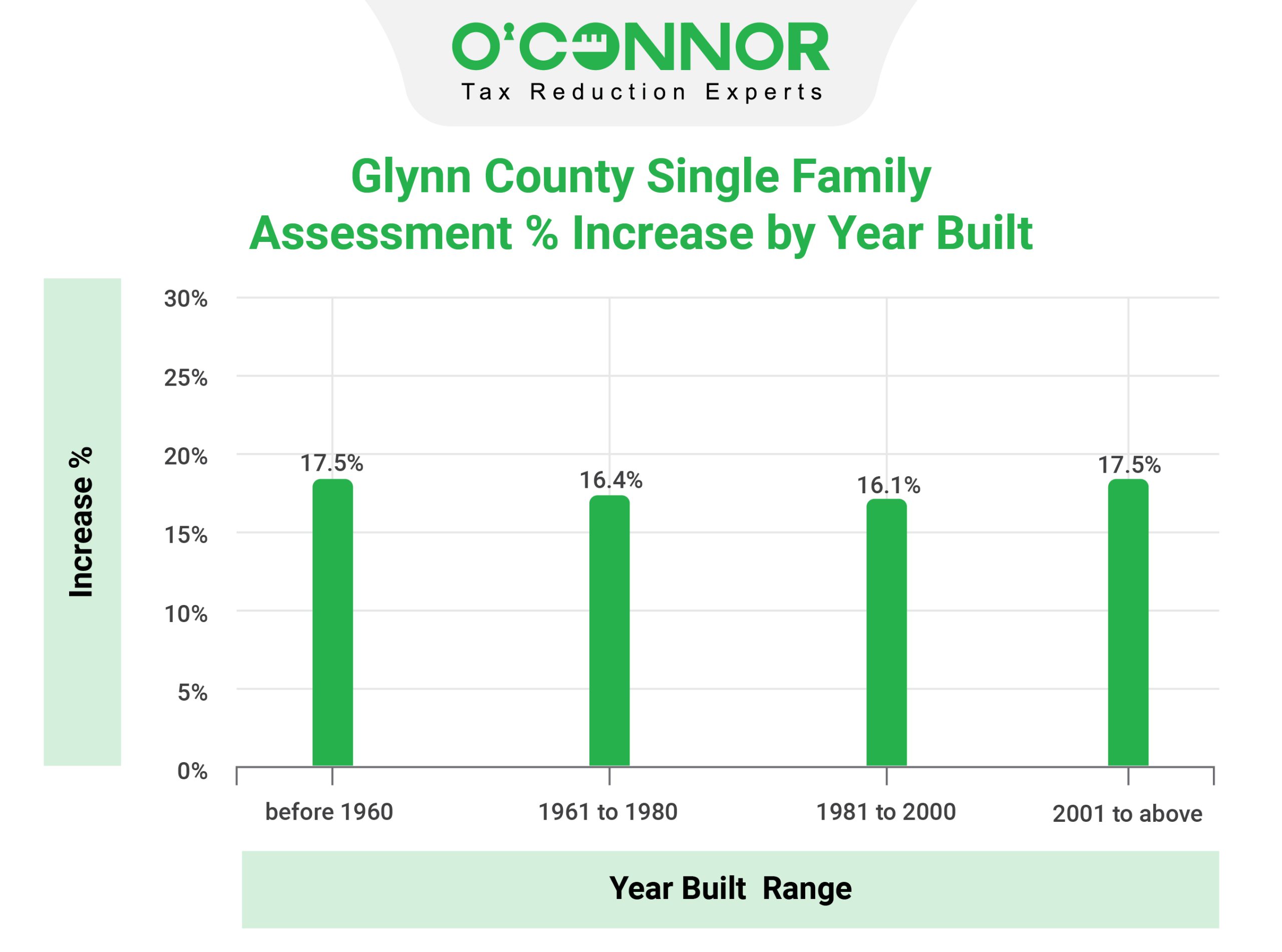

In Glynn County, assessments for houses constructed between 1960 and 2001 saw an increase in value of 17.5% in 2023. The least affected were single-family homes built between 1981 and 2000, yet assessment values nevertheless increased on average by 16.1% in these residences.

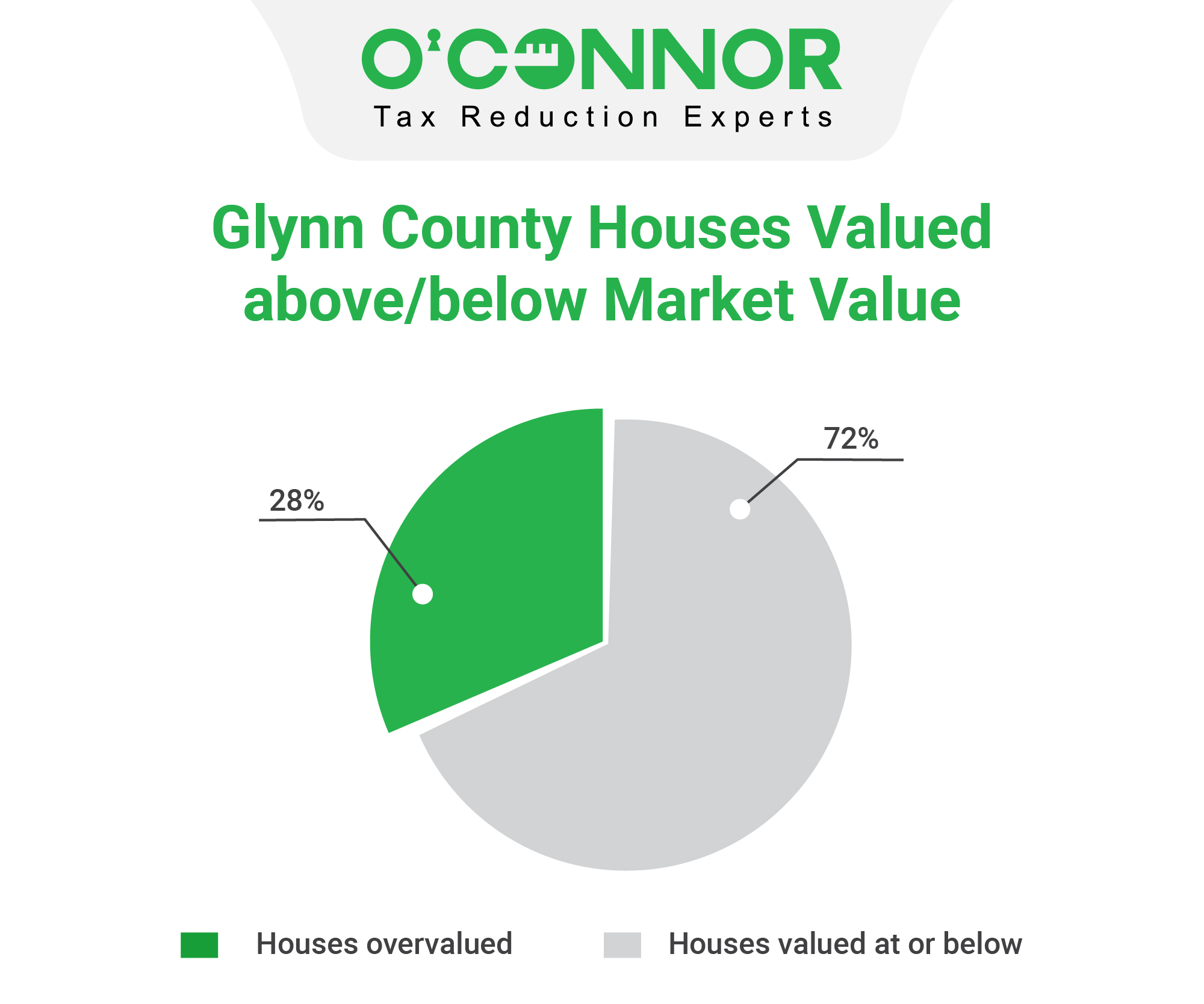

The illustration that follows contrasts homes in Glynn County with taxable values that are greater than their market values with those that are valued at less. In Glynn County, 28% of the homes were overpriced while 72% were priced below market.

Home valuation in the entire county is a difficult undertaking for the Glynn County Tax Assessor. The right to appeal and the duty to inspect rest with the property owner. It’s worth taking a second look in 2023 when property values have increased by more than 17% and 28% of them are above market value.