While Illinois, Cook County, and Chicago all have reputations for high property taxes, nothing really prepared the people of the southern and western portions of the county for 2023. The triennial reassessment by the Cook County Assessor’s Office (CCAO) was seen as a wholesale disaster for businesses and property owners. Not only were record assessments handed out, but many blatant errors by the CCAO were exposed. This caused outrage to overflow throughout all of Cook County, as thousands of property owners were handed overinflated, inaccurate, or plain objectively incorrect assessments. Many property owners saw their taxable value increase by several factors, while some had their taxes double overnight.

Lyons Township became one of the main focal points of the controversy. It was Lyons that saw random spikes of 650% in taxable value for some homes, which became one of the major sources of fear across Chicago. It was Lyons Township that brought fears of losing homes, gentrification, and community transformation to the forefront. While such concerns were present in other areas, Lyons Township acted as the perfect example. Being a middle-class neighborhood sharing a border with the expensive Downers Grove Township also magnified things, as it took an intercity problem and moved it out to the suburbs.

With all the negatives, Lyons Township also acted as a source of change. Thanks to the attention and panic caused by the 2023 reassessment, a sea change began in the hearts of citizens across Chicagoland. Taxpayers became aware of things to come and began to take preventative measures to protect their homes and businesses when reassessment came for them. Property tax appeals were explored for the first time by many and would eventually lead to record protests across Cook County and the surrounding collar counties. It also brought the Board of Review (BOR) to the forefront. O’Connor will discuss how the embrace of appeals helped bring things back under control and how it helps property owners prepare for the 2026 reassessment that will come for Lyons Township next year.

Appeals are the Only Remedy for Inflated Taxable Value

It was not taxpayers alone that were disturbed by the 2023 reassessment. Both the CCAO and the BOR were clearly caught off-guard by the scale of the issues. Both bodies began encouraging taxpayers to protest their assessments, to help correct mistakes that the CCAO itself had made. This also led to the CCAO taking something of an accounting of itself. This eventually led to the assessor himself leading a piece of legislation to establish a “circuit breaker” for property values. The circuit breaker joined countless other solutions to the property tax problem in being jammed up in party politics. With that tabled, the CCAO and BOR implored taxpayers to challenge their assessments, as it was the only way to get accurate tax bills.

The focus on appeals has certainly seemed to work, even a year after the reassessment. In 2024, the people of Lyons Township were able to stem the bleeding somewhat, and the 2024 tax season saw small overall increases across the board. Homes saw an overall increase of just 0.6%, while commercial property spiked higher at 6.7%. This commercial spike may have been thanks to adjustments by the CCAO. One of the revelations of the 2023 reassessment was that appeals favored large businesses, which then passed the burden onto homeowners, especially those on the lower end of the economic spectrum. In an effort to fix things, or at least save face, the CCAO stated they would try and put more weight onto the largest businesses.

Thanks to appeals, 2025 was an even bigger improvement than 2024. While appeals are known for their ability to get a reduction in the same year as an assessment, they can have long-lasting effects in favor of the taxpayer. A good appeal will establish the value of a property for years to come and will act as a base for further appeals. This helps control spikes, such as assessments, and gives a foundation to build upon. This is why the best way to protect homes and businesses is a combination of exemptions and annual property tax appeals. Lyons Township is not the only former victim of the 2023 reassessment to see such improvement, as Bremen Township likewise was able to stabilize and even reverse some of the damage.

Lyons Home Values Hold Steady

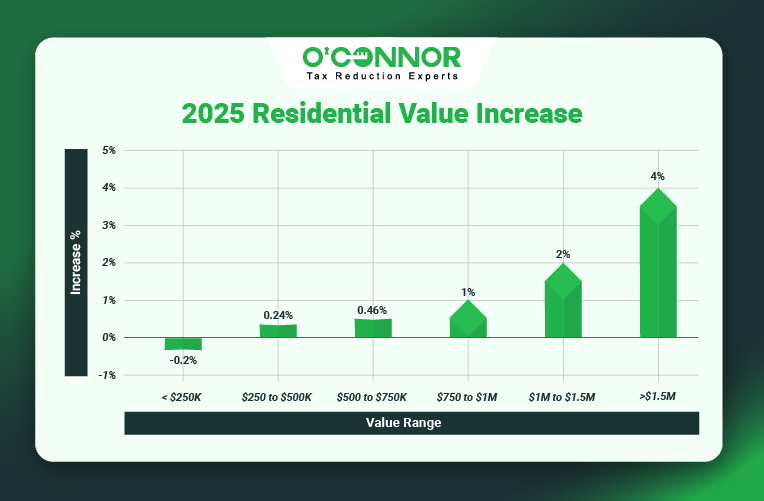

Lyons Township is a traditional home to the middle class and working families, which is why the 2023 reassessment was so devastating for the area. In 2025, the total taxable value of homes increased by just 1%, achieving a total of $14.80 billion. Most of this value came from modest homes, as one would expect in an area like Lyons. The largest group of residential property was worth between $250,000 and $500,000, which combined for $4.62 billion in value. While these homes did rise in value, it was only by .24%. Residential property assessed from $500,000 to $750,000 was in second place with $3.38 billion, which also had an increase of .46%. The No.3 spot was for homes worth under $250,000, which totaled $2.31 billion. This was the only category of homes to see a reduction, albeit a tiny one at .2%.

Like most of Chicago, expensive homes are becoming a bigger slice of the pie every year, though many are formally cheaper homes that got assessed into the next tier. Those assessed from $750,000 to $1 million increased in value by 1%, for a total of $1.98 billion. Those worth between $1 million and $1.5 million added 2%, achieving a combined value of $1.76 billion. The largest increase by percentage was reserved for homes worth over $1.5 million, which was 4%. These combined for $757.84 million.

Commercial Properties Add 5% to Taxable Value

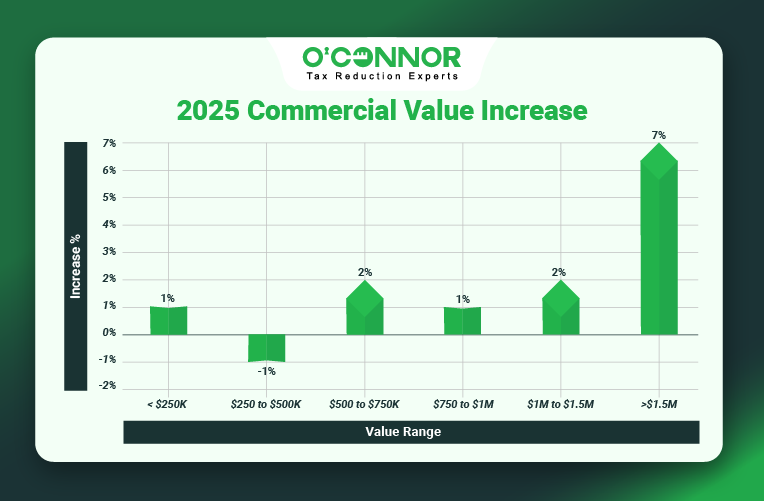

As previously discussed, the CCAO is putting more emphasis on businesses, especially larger ones, to protect homeowners. While this claim was initially seen as dubious at best, analysis of Cook County in 2025 seems to be proving that this is the case. In Lyons Township, commercial property added 5% in value, reaching a total of $3.11 billion. Most of this total came from the largest properties, those worth over $1.5 million. These businesses added 7% of taxable value in 2025, totaling $2.15 billion. It is typical in Illinois for the majority of value to come from this category, so this certainly tracks with other townships. This also fits well with the claim from the CCAO.

Outside of the big businesses, things were more varied. Those worth between $1 million and $1.5 million grew by 2%, totaling $229.52 million, while those assessed from $750,000 and $1 million added 1%. Medium commercial properties worth between $500,000 and $750,000 rose by 2%, while those worth between $250,000 and $500,000 saw a reduction of 1%. The smallest businesses added 1%, for a combined total of $175.02 million.

The Appeal Deadline is September 16, 2025

Cook County taxpayers have two chances to appeal their property taxes. First, through informal appeals with the CCAO, which can be great for resolving simple mistakes like errors in square footage or basic classifications. Those appeals closed in July but set the stage for the second option. Hearings with the BOR are generally seen as more productive, especially for homeowners. In the past few years, the BOR has sided with homeowners an increasing amount, though businesses favor this step as well.

While they are supposed to be impartial, the BOR has developed something of a rivalry with the CCAO. The BOR has blamed the CCAO for the litany of mistakes they have made in assessments, while the CCAO has blamed the BOR for dramatically shifting values. The BOR seems to be correct in this matter, and things got even more contentious when a series of computer errors delayed everything. This meant tax information was late, which delayed appeals, BOR hearings, and refunds from tax protests. This also welcomed yet another avenue for taxpayers to appeal, one the BOR actively supports.

O’Connor is Here to Help

There is not much time remaining to file your property tax appeal. Once the deadline has passed, you are totally out of options and must pay the inflated amount, waiting until next year to fix things. However, that means accepting the incorrect values, which could sabotage later appeals. At the very least, it temporarily locks you into a higher base value. If you are intimidated about doing your appeal alone, know that we at O’Connor are here to help.

As one of the biggest and oldest property tax consulting firms in the nation, we have a wealth of experience, a large staff, and resources that few can match. We can bring this entire arsenal to bear to help our clients and have done so from one end of the nation to the other. In 2024 alone, we helped 185,000 clients in their journey to lower taxes. In addition to a national reach, we also have a local presence that really tips the scales. Based in Aurora, our branch office takes care of things in Chicagoland. From Cook County to the suburbs, our local talent in Illinois can take care of everything for you. Our tax professionals will help gather evidence, while your attorneys represent you with the BOR. Best of all, we will coordinate the appeal of your property taxes every year, conferring all benefits we stated earlier in this article. And you will never pay us an upfront cost or hidden fee, as we only charge a contingency fee if your appeal is successful in lowering your taxes.