The 2023 reassessment of Cook County has stayed in the minds of taxpayers like an ever-present shadow and has been one of the most impactful events for taxpayers in Illinois as a whole. While high property taxes are the norm in Illinois, especially Cook County, 2023 was when the wheels really fell off. Targeting the southern suburbs and the urban core of Chicago itself, the reassessment saw property values rise to a staggering degree. Even worse, individual properties saw spikes as high as 500%, some even experienced a 700% increase to their taxable value. As this was aimed at most middle-class and working people, this wrought devastation on people attempting to keep their homes or businesses.

It was this disaster that truly brought property tax appeals to the forefront. After it was revealed that the properties of working people and minorities were disproportionally targeted, people demanded a change. Unfortunately, politics being politics, little was achieved, with all proposed legislation going up in flames. This meant that property owners had to defend themselves, which is why appeals have become embraced in record numbers. Now, parts of Cook County and even the collar counties dread reassessment and are using appeals to either reduce property values or prepare for the next inevitable hike.

Lemont Township was one of the victimized areas in 2023. It has embraced property tax protests like the others and has seen some strong dividends in return. In many cases, taxpayers have been able to reverse some of the damage or at least stand their ground. The traditional out of assessment spikes of Cook County have been somewhat stymied in 2025 and much of this is thanks to diligent appeals. 2026 marks another reassessment, however, and the people of Lemont Township are preparing themselves. O’Connor will discuss how things have progressed in 2025 and what the future might hold.

Home Values Increase 3%, with Some Major Outliers

Like most other victims of the 2023 reassessment, Lemont Township homeowners took the brunt of the increases. Home values were increased by an average of 13.6%. While not the worst seen that year, it still marked a major problem for homeowners. This often pushed the assessed value of homes well over their fair market value, meaning they could not be sold for what the Cook County Assessor’s Office (CCAO) declared they were worth. This shifted significant burdens onto the people of Lemont Township, making many homes unaffordable.

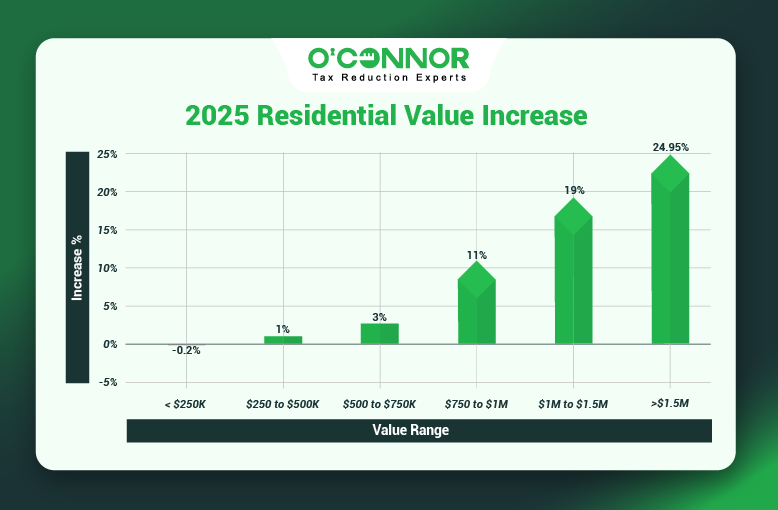

In 2025, things are certainly singing a different tune. Due to a combination of appeals and a few years of distance from the reassessment, growth is now more manageable. In total, residential property added 3% in taxable value, a very conservative number for Illinois, let alone Chicago. In total, CCAO valued homes at $4.01 billion. This value growth was not even, however, and it varied wildly depending on the worth of the properties in question. The largest block of value was homes worth between $500,000 and $750,000, which contributed $1.92 billion. These homes increased in value by 3%, adding the most to the total. Homes assessed between $250,000 and $500,000 were in second place with $1.48 billion, following an increase of just 1%.

At opposite ends of the table, properties experienced very different changes. The smallest homes, those worth less than $250,000, managed to see an overall reduction of .2%. On the other hand, the largest residential properties, those worth over $1.5 million, surged 24.95%. Homes assessed at $750,000 to $1 million added 11%, while those worth between $1 million and $1.5 million added 19%. While no hike is ideal, at least the burden was applied to the wealthiest homeowners, sparing the people that could at least afford it.

Tax Protests Shield South and Central Chicago

Lemont Township is not alone in seeing a mass reversal of fortune thanks to appeals. Cicero, which was hit even worse in 2023, saw an overall reduction of 1% in combined residential property value. In modern Cook County, a general reduction is basically unheard of. This is generally thanks to the inordinate number of appeals that have been filed since 2023. Bremen Township, another area hit hard by the reassessment, only saw a small increase of 1%. Similar reclamations can even be seen in townships that were reassessed in 2024, such as West Chicago, which increased by only 1%.

The CCAO has recorded appeal numbers never seen before all across Cook County. While their use of reducing high taxes is important, appeals and protests can also help stabilize values. They establish the correct and fair price for a home, which can then be used as a base moving forward. This is why many homeowners are now appealing every year, as it establishes a paper trail that can be used in the future, even in the face of reassessments. Lemont Township and other nearby areas will be experiencing reassessment once again in 2026, making these new values extra important to the future of the region.

Lemont Commercial Property Jumps 7%

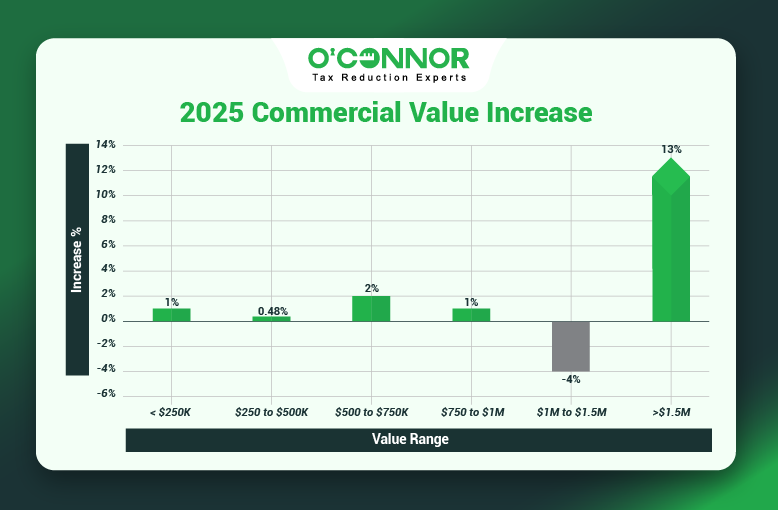

While the collective outrage over 2023 has been beneficial to homeowners, business owners have seen a mixed bag. Recent studies reveal that appeals had vastly favored businesses, and that much of the tax burden was transferred from them to homeowners. In response to this revelation, the CCAO vowed to reverse this and put more strain on commercial properties. While few took this at face value, studies of 2025 have revealed that businesses are generally seeing the largest increases, in or out of assessment. This was true for Lemont Township, as commercial property as a whole grew by 7%, totaling $331.51 million.

In typical Illinois fashion, it was the larger businesses, those assessed at over $1.5 million, that generated the most value. Growing by 13%, these big commercial properties contributed $179.63 million. This pattern is universally observed across the state, even in the smallest of rural townships. The outsized growth rate is a bit unusual, but this is also becoming more common. However, the 4% reduction experienced by commercial properties worth between $1 million and $1.5 million was a break from tradition. Most businesses, especially larger ones, appeal every year to save costs, so this could be another win for protests.

Commercial property saw little change outside of the above categories. Those assessed at $750,000 to $1 million only increased by 1%, while those at $500,000 to $750,000 increased by 2%. Businesses worth between $250,000 and $500,000 only added .48% in value, while the smallest only grew by 1%. As we can see, the overall increase was deceiving, as nearly all growth came from the larger businesses. This is why it is so important to drill down on statistics to find the truth.

Appeals Prove Their Own Case in Cook County

The impact of appeals is clearly being felt across the Chicago area and even Illinois as a whole. Once only used by the wealthy and businesses, property tax protests have become the tool for the common person to defend their business or home. With reassessment set for 2026, it is more important than ever to not only secure a reduction this year, but to establish a property’s fair market value to weather the storm ahead. Strangely, appealing taxable value is encouraged by the CCAO, the same organization that hands those values out.

Failing to appeal in Cook County is not only leaving money on the table but is also putting your home or business at risk. From computer errors that have delayed refunds and bills, to investigations that uncovered massive overassessments and fraud, it is clear that the CCAO’s numbers cannot be trusted. Until budgets are overhauled and things are brought under control, it is up to the citizens of Lemont Township and other areas around Chicago to protect their wallets and land.

Informal Appeal Deadline is September 2, 2025

Tax protests in Illinois come in two basic flavors. The first is informal appeals directly to the local assessor, which would be the CCAO in this case. These quick appeals are perfect for proving basic errors, such as assessing a vacant lot as a home, or accidentally doubling the size of a business. This usually requires little evidence or effort on the taxpayer’s part and can still yield good results. The other option is formal appeals to the Board of Review (BOR), which sees a taxpayer take on the CCAO in front of a neutral board. These hearings require more time, effort, and preparation to achieve success, but victory can be quite lucrative. The BOR is quickly becoming a favorite of Cook County residents.

The deadline for informal appeals in Lemont Township is September 2, 2025. This is a hard line in the sand, and no extensions are given. Even if you are thinking about the BOR, an informal appeal is a good first start. If you are not granted the settlement you desire, you can escalate things to the BOR anyway. The BOR dates have not been scheduled either and could take months, especially with the demand for hearings. It may be in your best interest to try an informal appeal first, to see if you get a satisfactory result.

O’Connor has National and Local Reach

If you are thinking about a tax protest in Lemont Township or anywhere in the Chicago area, you might want to bring us at O’Connor onto your team. As one of the largest and oldest property tax consulting firms in the United States, we have the experienced people, resources, and connections needed to sway things to your side. We handle analytics, data collection, evidence, and will even coordinate appeals by engaging with attorneys. We helped over 185,000 clients in 2024 nationwide alone and are looking to do even better in 2025. We are not just a national brand but also have a local office in Aurora just to deal with Cook County and the collar counties.

Our local talent knows the ins-and-outs of Illinois’ esoteric laws and can zero-in on the best evidence to impress the CCAO or the BOR. We will also investigate your taxes every year, which, as stated above, is the best way to lower your values and keep them there. Best of all, we will do all of this with no upfront fees or hidden costs. You only pay us if your taxes are lowered, and even then, it is a contingency fee from your savings. You have nothing to lose and everything to gain by signing up with us, and we hope we can get you the deal you deserve.