Lake County is one of the most prestigious areas in the United States. Competing with DuPage as the wealthiest county in Illinois, Lake boasts some of the most exclusive neighborhoods in the nation. As the northernmost of Chicago’s collar counties, Lake County has strong ties to both Cook County, and Indiana and has some of the most beautiful scenery that can be found in the Midwest. As a whole, the county has many suburban, urban, and rural areas, and has the diverse economy expected from an area in the Chicago metropolitan area.

Benton Township rests in the north of the county and is a unique area all its own. Surrounding Zion Township and bordering Waukegan Township, Benton has strong urban ties, despite being a good distance from Chicago proper. While it may not border Cook County directly, the influence of Chicago can still be felt in economics and demographics. One constant connection between Chicago and Benton Township is rising property values and taxes. While this is a problem throughout Illinois, it is always magnified in the collar counties. Thankfully, another trend from the big city that has made its way north is the prevalence of property tax appeals. These join exemptions as the only way to lower taxable value and have been setting records in 2025. The final deadline for appeals in Benton Township is September 8, 2025, meaning time is growing short for taxpayers to protect their property.

Benton Township Home Values Soar 10%

All across Illinois, property values of all stripes are heading upwards. This is often combined with increasing tax rates, which translates into taxpayers seeing much higher bills. There have been efforts by assessors and taxing bodies to transfer these burdens somewhat to businesses, with the hope of giving some relief to homeowners. However, in rural and suburban areas, like Benton Township, there is typically far more residential property than businesses, and these must be used to satisfy the many funding demands across the township.

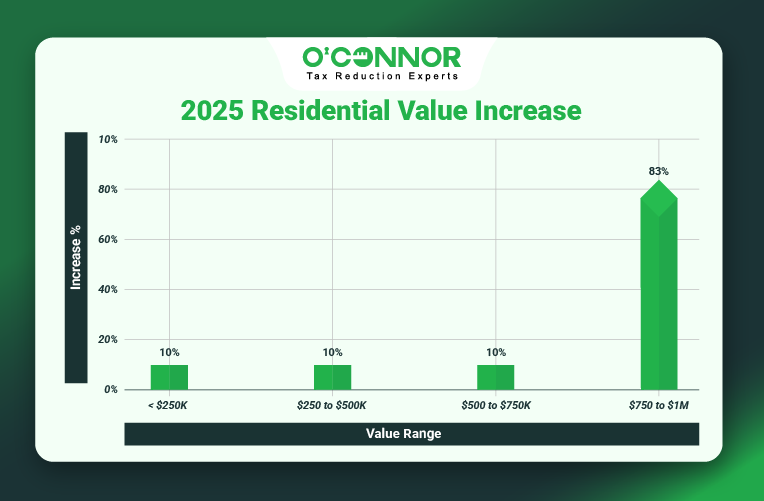

In 2024, the Benton Township Assessor estimated that all residential property in the area was valued at $1.41 billion. This was increased by 10% to $1.55 billion in 2025. This was not the result of a reassessment, but a standard increase thanks to constant monitoring of real estate sales. Keeping with its rural roots, the largest block of value in the township was of homes worth between $250,000 and $500,000. These moderate homes totaled $963.03 million, an increase of 10% from 2024. In second were homes worth below $250,000, which tallied a total of $560.57 million. These residential properties had likewise seen a jump of 10%.

Benton Township does not have the luxury homes and mansions seen in other parts of Lake County, so those two common value categories were not assessed. This does not mean that the area was short on elite homes; however, the township still had many larger homes. Totaling $24.96 million, homes worth between $500,000 and $750,000 grew by 10%. The biggest increase by percentage was for the rare few properties that were worth between $750,000 and $1 million. These nearly doubled in value, adding 83% in 2025 alone, for a modest total of $1.78 million.

Benton is Near the Top of Collar County Increases

While Benton Township is not the most populated or richest area of the collar counties, it does rank near the top in taxable value increases. Sitting at 10%, Benton saw a higher growth rate than fellow Lake County townships in Waukegan and Wauconda, which saw upticks of 8% and 7% respectively. Benton Township’s increase was tied in Kane County by Joliet, but much of that county was also below the 10% mark, including 9% for Batavia, Geneva, and Rutland. Indeed, it took until McHenry County for a few townships to surpass Benton, including 11% for Dorr and Richmond.

Commercial Properties and Businesses Add 11% in Taxable Value

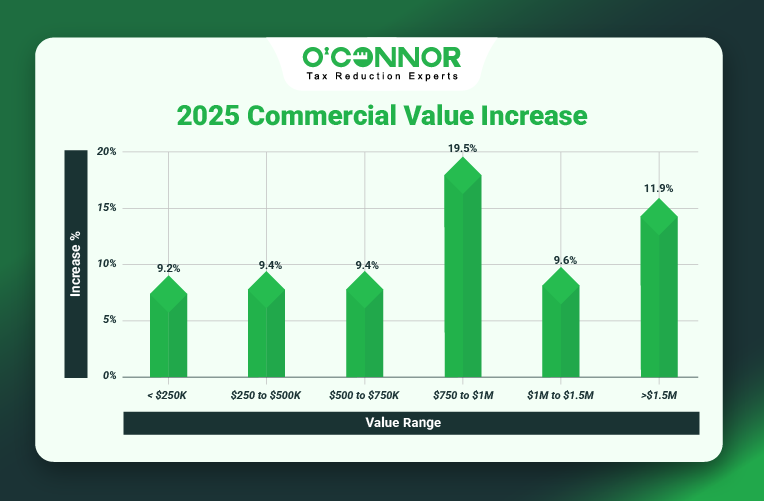

While the collar counties were once the heart of America’s industrial machine, those days are long past. This has seen each transition into its own economic niche. While most are content to be suburbs of Chicago, Joliet, or Aurora, plenty of other townships have strong commercial property portfolios. Like Will County, Lake County tends to favor residential property over that of businesses, and it is common to see homes dwarf commercial interests. This is true in Bremen Township, as all commercial property combined for a total of $160.79 million in 2025. This was an increase of 11% from 2024 and either indicates strong economic growth or overzealous valuation. As discussed above, many counties are aiming to move tax burdens from homeowners to businesses, so it could have more to do with the Benton Township Assessor than economic realities.

The primary block of value was created by business real estate worth over $1.5 million. This is in keeping with the rest of Illinois and the nation as a whole, as the largest businesses are usually responsible for the majority of all value. This was certainly true in Benton Township, where these commercial titans contributed $75.17 million to the total. This was a 12% increase from 2024 and the main reason why there was an overall increase. The next tier of commercial properties experienced an increase of 19% as well, but this ended up with a total of only $11.15 million. Commercial properties worth between $75,000 and $1 million saw a giant increase of 19%, reaching a total of $10.23 million.

Smaller businesses made up most of the value outside the top category. The most extensive of these properties were those assessed from $250,000 to $500,000, which combined for $25.08 million after an increase of 9%. These were followed in value by properties assessed from $500,000 to $750,000, which reached $21.07 million after a similar jump of 9%. The 9% trend continued with business real estate that was worth less than $250,000, which combined for $18.10 million.

The Cute-off Date for Appeals is September 8

All across Illinois, both property values and taxes continue to increase. It could be a mansion in a swanky Lake County neighborhood, a convenience store in south Chicago, or a tiny home in a rural town, all are seeing increases like never before. There are manyfold reasons for this, including skyrocketing demand, population migration, and lifestyle and technology changes that allow remote work from anywhere. While some things have changed since the pandemic, it is hard to put the toothpaste back in the tube and more people than ever are escaping into the countryside.

While tax rates are set by individual bodies and cannot be lowered by a taxpayer, property values certainly can. Exemptions are usually the first line of defense, and every property owner should apply to as many as they are eligible for. Property tax appeals are the next step and are a reliable way to get the taxable value down. The appeals work by contesting the assessed value of a property, hopefully reducing the overall value and getting it more in line with what it would see on the open market. This could mean correcting errors in assessment, unequal appraisal, and a few other factors. As all legislative solutions continue to fail due to partisan gridlock, many assessors are encouraging taxpayers to protest values.

While taxpayers in Cook County have several deadlines to protest their taxes, the rest of Illinois is not so lucky. Informal assessor appeals and formal hearings with the Board of Review (BOR) share the same cut-off date, which means a taxpayer only has one shot to get it right. This can bring a lot of pressure to a business or homeowner, especially those that can barely pay their property taxes every year. These are already the No. 1 expensive for homeowners in Illinois, and value increases only make them worse. The deadline for all appeals in Benton Township is September 8, 2025. This is the same for all of Lake County.

O’Connor can Change the Balance in Your Favor

With only a few days left, launching an appeal can feel overwhelming. Evidence needs to be collected, including documents, photos, invoices, and more. If you are trying to protest about an unequal assessment, then you need to find and document the home sales of similar properties in your area. If this is too much, or you just want the help of an expert, then we at O’Connor are ready to serve you.

For over 50 years, we have been helping our clients build evidence to lower their taxes. We managed to assist over 185,000 clients in 2024 alone and are set to do even more in 2025 and beyond. We are one of the largest firms in the United States that specializes in property taxes and have the people, resources, and experience to get you the best deal possible. We also have a branch office in Aurora that we founded for the sole purpose of supporting Chicago and the collar counties. These local experts know how to approach the tax situation in the region in order to maximize your savings. They will help coordinate your appeals with your team, along with providing evidence, data, and analytics.

We will not only assist with your taxes this year but will do so annually as long as you are enrolled with us. Annual appeals are generally the best practice when it comes to lower taxable value, as they lay down a foundation price for your property. This can then be used in later appeals as a baseline. Also, each victory tends to build on the previous one, setting up a chain of reductions as these years roll on. This is useful even in the face of reassessment. To top things off, there is no charge to enroll with O’Connor, and you will only be charged if your property taxes are reduced.