The triennial reassessment is winding down, but the effects are being felt across Cook County and the city of Chicago. The north of the county was targeted in 2025 and taxpayers have seen some severe spikes in their property values, which inevitably led to more taxes. While there have not been the 700% increases seen in the 2023 reassessment, property owners across the county are still hurting and are looking for ways to fight back against the aggression or incompetence of the Cook County Assessor’s Office (CCAO).

New Trier is one of the townships being targeted in 2025. Part of the exclusive North Shore, New Trier is one of the wealthiest townships in Cook County, as well as one of the most exclusive areas in the United States. With so much money in the township, any hike could result in millions of dollars being lost. To help protect against rampaging values, more people in Cook County are turning to property tax appeals than ever before. The window for informal appeals passed in June, but the opportunity for Board of Review (BOR) hearings is still on the table. September 16, 2025, is the last chance to protest taxes for the year. O’Connor will discuss how much the township was hit by increases and examine how taxpayers can fight back using appeals.

New Trier Residential Values Soar by 39%

New Trier township has some of the most expensive homes in the United States. Even the name of the township has become another word for luxury in the Chicago area, with people associating it with wealth and class. Due to the sheer amount of money in New Trier, even a small adjustment in property values would translate into a huge swing. The township did not see a small increase in 2025; however, it saw a massive spike of 39%. This took the overall total of home values to $27.20 billion, an increase of $7.6 billion. This was one of the largest increases seen in the entire 2025 reassessment.

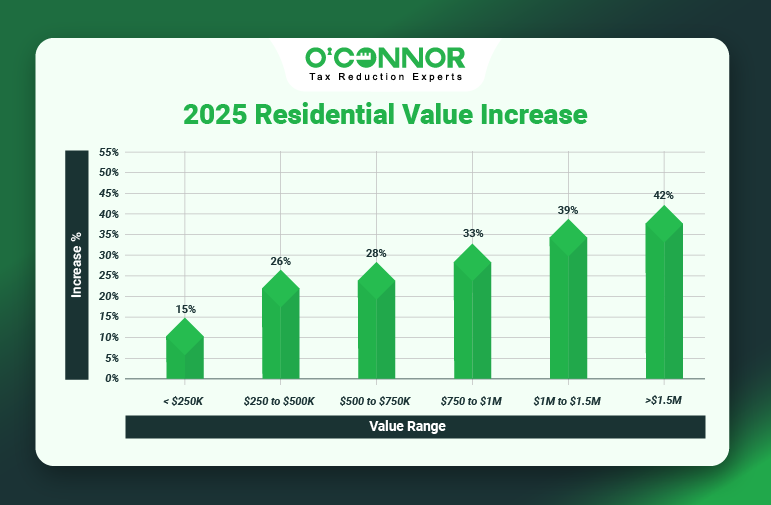

When residential property is broken down by worth, we can see that the affluent reputation of New Trier is well deserved. The largest source of value was homes worth over $1.5 million. These luxury residences saw a staggering increase of 42%, totaling $15.61 billion. In second place were homes worth between $1 million and $1.5 million, which grew by 39% to a total value of $6.01 billion. The momentum carried into those assessed from $750,000 to $1 million, as they grew 33% to $2.36 billion.

While they are in the minority, there are still plenty of common and modest residences in Ne Trier Township. Homes worth between $500,000 and $750,000 added 28% in value, ending up with a total of $2.11 billion. Jumping in value by 26%, properties assessed from $250,000 to $500,000 combined for $920.93 million. While rare in the township, homes assessed for less than $250,000 saw their values raised by 15%, for a total of $179.94 million. Though smaller homes did not see the giant swings, these rises are devastating for working people, possibly pushing them out of New Trier all together.

Reassessment Leaves No One Unscathed

Out of all of the townships in Cook County we have looked at so far, New Trier was hit the hardest. The overall increase of 39% tops the charts, which is truly saying something considering the competition. If we look at some other Cook County townships, we can see just how high the values rose in New Trier compared to others. Barrington added 33%, while Elk Grove added 28%, which were some of the highest increases. While it had a lower increase of 18%, Norwood Park did have a spike of 58% for luxury homes. Northfield added 30%, while Maine grew by 25%. Neighboring Evanston experienced a hike of 23%, while Leydon grew by 21%.

Commercial Property Jumps 34%

While New Trier is known as the residential abode of Chicago’s elite, there are plenty of businesses as well. As one would suspect, these too have a high price tag, though they represent a much smaller collection of value. These businesses were hit with a startling hike of 34% in 2025, which raised the combined total from $757.00 million to $1.02 billion. There could be two reasons for this sudden climb. The obvious is the reassessment, which has been handing out commercial property increases like candy. The other is that the CCAO has stated they are trying to offload some of the tax burden from homeowners onto the larger businesses in the area. If this is true, then local commercial real estate got hit from both ends very hard.

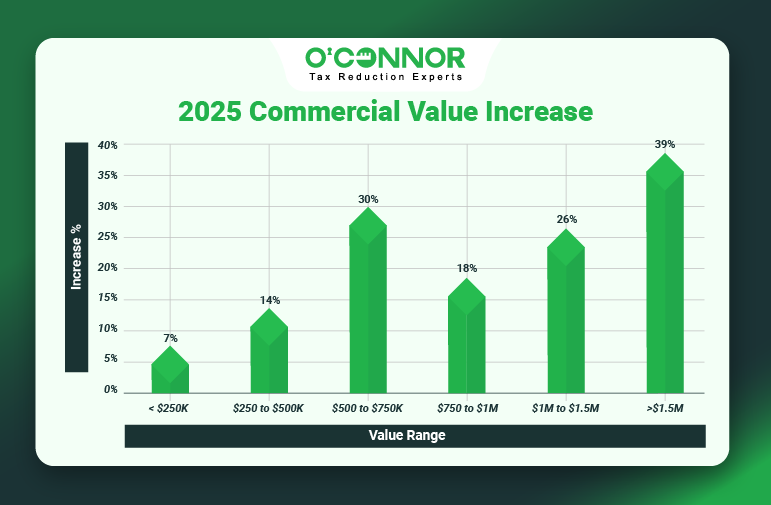

Just like the residential properties, the highest category of business real estate was those worth over $1.5 million. This is typical in Illinois and is one of the few aspects that is not unique to New Trier. These giant commercial properties combined for a total of $767.02 million, which was an increase of 39% from only a year ago. Due to their size, these properties brought up the overall average significantly on their own, making the spike look slightly worse than it actually was. The next category, properties worth between $1 million and $1.5 million, added 26% to their value, totaling $99.54 million.

The second-highest increase came from commercial real estate assessed between $500,000 and $750,000, which was struck with a jump of 30%, which resulted in a combined value of $47.71 million. Even the smallest businesses were tormented by the CCAO, with those assessed from $250,000 to $500,000 gaining 14%, while those under $250,000 added 7%. Like homes, the large hikes to smaller properties usually cause the most damage.

Cook County Assessment Becomes a Comedy of Errors

Ever since the now infamous reassessment of 2023, the CCAO has been trying and failing to recover its reputation. It was discovered that empty lots were assessed as mansions, basic measurements of real estate were incorrect, and that property tax appeals moved the tax burden from big business to low-income homeowners. To top it off, in 2025, a cataclysmic series of computer errors delayed both tax bills and refunds, freezing the whole local government, forcing organizations like school districts to get loans just to stay open. This has put the very concept of the CCAO’s numbers under serious doubt and opened up things to property tax appeals.

Appeals are Setting Records in 2025

Things have gotten so bad in Cook County that the head of the CCAO has both encouraged property tax protests of his agency’s own numbers and tried to get an emergency “circuit breaker” bill passed. Thanks to the horrors of 2023, taxpayers have been turning to property tax appeals in numbers never before seen. This has even spread to the collar counties and beyond. This frenzy has put stresses on the whole system, especially the Board of Review (BOR), which handles formal appeals in Cook County. This has even led to open strife between the CCAO and the BOR, with each blaming the other for increasing values.

The Final Appeal Date is September 16, 2025

Property tax appeals in Cook County typically come in two varieties. The first is informal appeals to the CAO, while the second is formal hearings before the BOR. The window for informal appeals in New Trier closed in June. After some months, BOR appeals finally became available as well. One of the new advantages Cook County taxpayers have over their fellow Illinoisians is that they have multiple appeal deadlines. The final cut-off date for BOR appeals is looming and the taxpayers of New Trier only have until September 16, 2025, to protest their taxes.

O’Connor can Support Your Appeal to Victory

As we have seen, the total values in New Trier Township have risen drastically and added many billions of dollars to the tax rolls. While exemptions help control some of the damage, the only way to truly cut things down is with a property tax appeal. These protests will take your case to the BOR, where your evidence must defeat that of the CCAO. Thanks to the litany of errors coming from the CCAO, now may be the perfect time to strike. While you can represent yourself to the BOR, it may be easier to have an expert do it for you.

Not anyone can represent you to the BOR, an attorney must fill that role. We at O’Connor can provide your attorney with key evidence, data, and value analysis. The only cost you will pay is a contingency fee from your winnings if your taxes are lowered. Our legal and tax experts are backed by one of the biggest property tax specialist firms in the nation. To make things even better, our team is local, working from our branch office in Aurora. This means you can meet face-to-face, along with having an ally that knows how Chicago really works. We believe a local touch cannot be beaten, especially in a high-dollar environment.

From reassessment, to the equalization factor, to the many mistakes of the CCAO, it should be clear that protesting your taxes is the way to go. The best way to go about this is to use annual appeals, something that we can help you with. Enrolling for this service is free, allowing you to have peace of mind. This will help create a solid foundation of value for your home or business, which can then be used in the future to fight any new reassessment. By constantly fighting for your value, you will not be hit with giant increases out of the blue. We have seen this proactive style of defense be extremely effective across the country, but it has been especially potent in Illinois.