People have been moving away from Chicago and Cook County in droves for years. Most are settling in the suburban counties around the greater Chicago area, known as the collar counties. These once-rural areas are quickly transforming into suburban, exurban, and even urban areas. While this was initially a slow process, many issues have sped it up. The pandemic, cost of living, and crime are all factors, but spiking property values and taxes are one of the major factors. Both homeowners and renters are hit hard by these increases, forcing them to look elsewhere.

Will County is one of the most notable of the collar counties. Home to Joliet, Naperville, and other major towns, Will County is more than a patchwork of farming communities and suburbs. One of the largest and most valuable areas in the county is Wheatland Township. Despite the rustic name, Wheatland Township has the greatest share of property value in the county, most of it residential. Due to economic factors and increased migration from Chicago, the demand for this real estate has never been higher. This has led to skyrocketing values, which in turn can lead to higher taxes. Residents are quickly turning to property tax appeals to supplement their exemptions. The time to file these appeals is almost up; however, and the final deadline is set for September 8, 2025.

Wheatland Home Values Rise 10%

Though it is a good distance from Chicago, Wheatland Township is a prime commuter hub for the many larger cities north and west of Cook County, particularly Joliet and Naperville. This has made the township a residential hotspot for years now. Much like fellow Will County township Plainfield, Wheatland’s property value is heavily weighted towards homes and other residential real estate. The value of all homes easily dwarfs that of commercial properties and notched an impressive total of $16.17 billion. This was after a large spike of 10%, making Wheatland Township the king of property value in all of Will County.

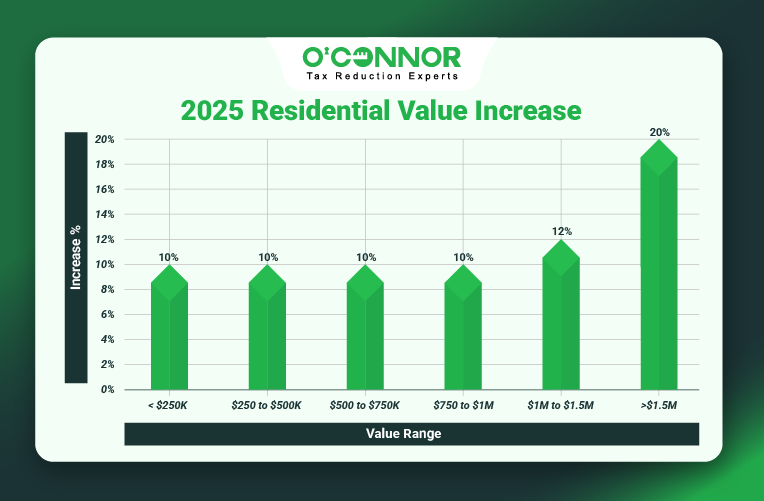

Wheatland Township accommodates families of all economic backgrounds, but middle-class professionals make up the largest demographic. This is easily reflected in homes when they are separated by value. The largest block of homes was those assessed from $500,000 to $750,000, which totaled $6.97 billion. Like other core residential property groups, these homes increased in taxable value by 10%. More modest homes came in second place, with those worth between $250,000 and $500,000 totaling $3.99 billion. This block of homes likewise increased by 10%. The trend of 10% increases held true for homes worth under $250,000 as well, which saw a combined value of $210.34 million.

High-end homes were also on the rise, with the largest blocking being those assessed from $750,000 to $1 million. After a jump of 10%, these properties amassed a combined taxable value of $3.63 billion. The top tier of residences, true mansions, saw the largest growth by percentage in the township. Residences worth between $1 million and $1.5 million added 12% to their value, for a total of $1.22 billion. Those worth over $1.5 million grew by 24%, for a combined value of $140.61 million.

Collar County Comparison

The collar counties have a diverse collection of communities and townships, each offering their own attributes and charm. When it comes to residential property increases, Wheatland Township is towards the high end. In Will County, Joliet Township saw an increase of 10%, while Plainfield rose by 8%. Kane County was much of the same, with Auroura Township growing 10%, while several more townships added 9%, including Batavia, Geneva, and Rutland. McHenry County had a few townships add as much as 11%, including Richmond and Dorr.

Commercial Properties Tread Water

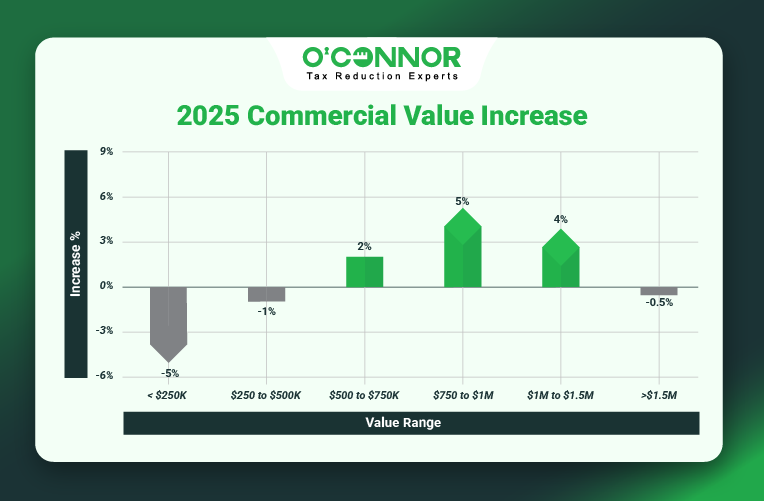

While it is typical across the nation for homes to outvalue commercial property, it is rarely to the extreme seen in Wheatland Township. While the residential value was a combined $16.17 billion, commercial property was assessed at just $870.82 million. This is actually a large number for several collar counties, but it is so eclipsed by homes that it is noteworthy. The other noticeable thing about business real estate in the township is that it neither grew nor saw a reduction. There was a tiny change from $866.60 million to $870.82 million, but it was practically an increase of 0%.

Another unusual event for Illinois took place, as the largest commercial properties in Wheatland Township saw a reduction in their values. While these large businesses accounted for the largest share of commercial value, as they always do, these properties saw a reduction of .5%. This took the combined value of the largest businesses to $513.44 million. The overall value and growth figures live and die by properties worth over $1.5 million, so this negative number certainly explains the 0% growth rate for the township. Businesses worth between $1 million and $1.5 million grew by 4% and were squarely in second place with $110.19 million.

Mid-sized businesses saw small increases. Those assessed from $750,000 to $1 million jumped by 5%, while those worth between $500,000 and $750,000 had an uptick of 2%. The smallest commercial properties both managed reductions, which is another Illinois outlier. Those worth $250,000 to $500,000 got a reduction of 1%, while those under $250,000 dropped by 5%. With reductions at the peak and at the bottom, value cuts benefited the two most important business types. Large commercial properties have a strong influence on the local economy, while small commercial properties need every little bit of help they can get to stay profitable.

The Appeal Window Closes on September 8, 2025

One of the reasons that commercial properties were able to cut value in 2025 is certainly property tax appeals. Businesses usually deploy these protests every year as a simple matter of cost reduction. This is the norm across Illinois, but they have proven especially valuable in the collar counties. With the soaring value of homes being universal, there have been calls for businesses to shoulder more of the load when it comes to taxes and this has been happening across the state. This makes appeals more important than ever to protect business interests, especially in a difficult economy with tariffs and other costs climbing.

Appeals are no longer the purview of the rich and businesses; however, and they are becoming commonplace for homeowners. As we see in Wheatland Township, residential real estate can make up billions of dollars in value, which is a prime target for assessors and taxing bodies. With legislation to solve these crippling property values foundering, each homeowner must do what they can for themselves. Appeals work seamlessly with property tax exemptions, allowing a one-two punch of cost reduction. Several assessors, including those of Cook County, now encourage all taxpayers to protest to ensure accurate taxation.

In Illinois, homes and businesses have two initial options for appeals. Informal protests to the township assessor are the first step and can often clear up simple errors that can save big. For instance, a lot may be classified incorrectly or the acreage of a property may be wrong. The other option is formal hearings with the Board of Review (BOR), which can target more issues and deliver fair verdicts. The BOR is the favored solution in Cook County and the surrounding area, but informal appeals are vital as well. Informal appeals can even be elevated to formal hearings if they fail or are insufficient. However, time is running out as the deadline for all appeals in Wheatland Township is September 8, 2025. Whether informal or formal, all protests must be lodged by this date.

O’Connor are Local and National Experts in Supporting Appeals

Property tax appeals can be a complex matter that takes a lot of effort to resolve in your favor. You need evidence to win your case before the Wheatland Township Assessor, even more so against the BOR. Photos, documentation, and a collection of property sales that are comparable to your home or business are only a few of the things you need. Putting all of this together can be overwhelming, that is where we at O’Connor come in. We can put together all of this evidence, analyze it, and use our state-of-the-art database to compare values with similar properties. This evidence can then be used by your lawyer or legal team to pursue an appeal.

As one of the largest firms in the nation that focuses solely on property tax matters, we have national resources, a network of experts, and the experience to get you everything you deserve. However, we have also focused on building local talent to help our clients, as no one knows the difficult tax system of Illinois more than people who have lived and studied there. We opened a branch office in Aurora for the purpose of building this team. We have local lawyers, tax experts, and researchers in your backyard, ready to use their knowledge for your gain.

When you enroll with O’Connor, you not only get adept allies in your tax reduction quest, but we will also coordinate protests of your property values every year. These annual investigations have proven to be the best in high-tax areas, which the collar counties certainly are. This strategy of investigation and collaborative appeals not only reduces your taxes in the short term but also helps build an established value for your home or business. Protests down the road can use this number and other victories to snowball into more savings. There is no charge to enroll with us or have your appeal coordinated every year. You will only pay if your taxes are lowered, and even then, you will only be charged a contingency fee out of your savings. If you need help in your protest journey, please feel free to reach out at any time.