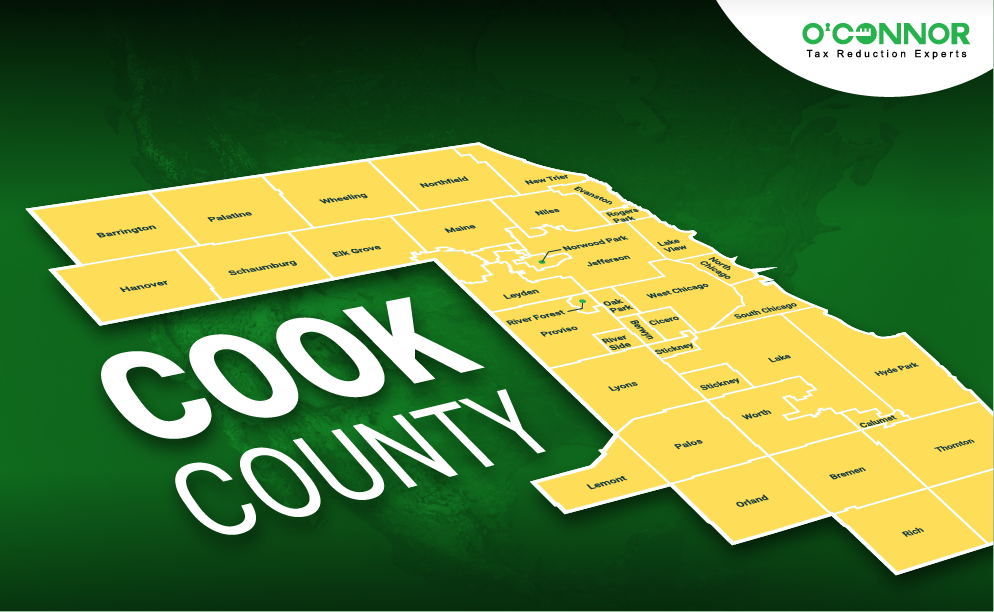

2025 has been a complex year for property taxes in Cook County. While things are never simple, thanks to a constant cycle of triennial reassessments, a dependency on the equalization factor, and Cook County working on a different system from the rest of Illinois, many complications have developed in the past 12 months. The most egregious was a computer error that impacted the release of tax bills. This led to the second installment of tax bills being released a month late, just being mailed on November 14, with a due date set for December 15.

This has proven disastrous for homeowners across Cook County, but this has been especially felt in working-class neighborhoods on the South and West sides of Chicago. These neighborhoods were already experiencing rising taxable values , but these were inflated thanks to being hit hard by the 2024 reassessment. Boosted by falling commercial values, the Cook County Assessor’s Office (CCAO) has been forced to make up revenues elsewhere. This made the perfect storm, which targeted the West and South sides the most. In this article, we will break down what is currently taking place and how it came to be.

Property Taxes Spike as High as 133% for West and South Side Neighborhoods

While the north of Cook County faced reassessment in 2025, 2024 hit the city of Chicago itself like a hurricane. Directed at the core of the city itself, the CCAO examined both urban housing and businesses. Staggering increases were handed out all across the city, most prominently in the southern and western regions. Many historic working-class and minority neighborhoods saw the worst of the increases. Home values often doubled or worse between 2023 and 2024 in these neighborhoods. This was especially true in places like Englewood, Roseland, and Lawndale. Some experienced hikes as high as 160% in just one year.

With 2025 tax bills using these 2024 numbers, the taxes due soared. This was bad enough for the first installment of bills, but things have grown far worse for the second batch. Applying the new tax rates and equalization factor, the late installment of property taxes is significantly higher. This means that many neighborhoods are seeing a sudden rise of 100% or more in their property taxes. This is especially true for Garfield Park, Englewood, and Lawndale. The median tax increase for West Garfield Park was a mind-blowing 133% for homeowners. North Lawndale taxes increased on average 99%, while Englewood added 82%. These are median numbers, meaning plenty of homes saw spikes much higher. Being home to working families, these neighborhoods can ill-afford such massive increases. With bills arriving just in time for the holidays, many people may not be able to afford to keep their homes.

Why the Increases?

There are several causes behind the sudden spikes. While the a forementioned reassessment from 2024 is the primary cause, it mostly revealed issues that already existed. While several of these are systematic to Cook County and even Illinois as a whole, others were quite unique to the core of Chicago itself. These problems include falling commercial values, gentrification, appeals favoring businesses, and increasing tax rates. Cook County in general has seen taxes increase for 30 consecutive years, and there are little signs that it will stop in the near future.

The Loop Passes the Buck

The 2024 reassessment showed that the major business and commercial centers in the Loop in the heart of Chicago were in decline. This saw a historic fall in value, resulting in a loss of around $379.20 million in taxable value and $129 million in taxes. The Loop has been suffering thanks to aftereffects from the pandemic, vacancies, especially in offices, and changes in the economy. While taxable commercial assets fell in the Loop, the demand for funding by various governmental bodies only increased. This led to a budget shortfall, exacerbated by late tax bills.

Since budgets are already set, the taxes must come from somewhere. This has been set squarely on the shoulders of homeowners. While the CCAO has made an effort to remove the burden from homeowners in the past year, this appears to not be true for the city of Chicago itself. The northern suburbs have seen a trend toward falling home values compared to commercial hikes, for example. Perhaps things will change in urban areas in 2026, as CCAO’s policy catches up, but it might take the 2027 reassessment to truly balance the books. In the meantime, working families are left holding the bag. The County Treasurer has even commented that “When the Loop gets a cold, the rest of the city gets pneumonia.” This seems to be true, as homeowners must weather the storm to keep the city in the black.

Appeals Favor Businesses

One of the reasons that the CCAO made policy changes is because recent studies showed that businesses were benefiting from property tax appeals much more than homeowners, which then transferred the burden to residential properties. While property tax appeals are the best way to protect a property, this disparity has been growing in favor of businesses. A noticeable trend is that corrections for appeals tend to impact working-class and minority neighborhoods the most, which is certainly being reflected for both the West and South sides. Homeowners also cannot appeal as easily as businesses, since commercial properties will have a team of employees working on the case.

Gentrification

Like other major cities, urban areas in Chicago are seeing a growing issue with gentrification. As the suburbs become unaffordable for many, people are moving back to the city core, driving up the demand for housing. This, in turn, raises property values, and consequently, taxes. This cycle repeats until traditional families are no longer able to stay in their homes. This has been something of a mixed bag for the south and west, as it is believed that many homes finally reclaimed their fair market value from the Great Recession, something that was a long time coming. However, with other factors considered, the market value and the taxable value can be widely apart.

CCAO Overassessment

Overassessment by the CCAO could always be the case. This was certainly true for the 2023 reassessment, which saw increases of over 600% in some cases. This not only included improved neighborhoods but also saw errors that included assessing vacant lots as homes and undervaluing commercial properties. The general consensus is that the market value for homes has not increased, certainly not at the pace that taxable value has. While the 2025 reassessment has been relatively sedate, this was because it learned many lessons from 2023. The 2024 assessment did not have nearly as many fixes applied to it, preserving many of the inequities seen with the previous cycle. This puts the onus on property owners to appeal, as it is the only way to permanently fix these errors.

Rising Tax Rates

While assessments, appeals, gentrification, and rising values all contribute, the tax rate is a different factor entirely. With increasing demands from school districts, pensions, and countless other organizations with their hands out, taxes must increase to fill the gap. Increases are the norm in Chicago, as the budget continues to spiral. This was not helped by the late tax bills, which forced school districts to take out loans and use other means to keep running. The tax levy is believed to have increased around 4.8% across the board, which easily outstrips inflation.

What can Taxpayers do to Protect Their Property?

While the CCAO has allegedly tried to balance things for homeowners, there have been attempts to legislate a permanent fix. However, all of these have failed due to partisan politics, and even a temporary “circuit breaker” measure failed. While exemptions are the first line of defense for any property, they are clearly not enough. Thousands of properties that had been shielded from taxes in the past found themselves owing substantial amounts of money thanks to rising values overflowing their exemptions. The only other recourse is to use property tax appeals.

The situation in Cook County has gotten so dire that the CCAO is suggesting that every taxpayer in the county protest their values, as even the assessor cannot guarantee accurate information. This has led to record appeals across the county. If you want to protect your home or business, you need to appeal. This is especially important if you are low-income, as any lowering of your taxable value can help greatly when it comes to affordability. These protests can take a rise of 100% and make it more reasonable if you have the evidence to back it up. Gathering evidence can be difficult, which is why many taxpayers turn to professionals in that regard.

O’Connor can Assemble Accurate Evidence

While only an attorney can represent you in the appeals process, tax experts can aid your appeal effort in different ways. We at O’Connor can analyze and gather evidence, review your assessment, do comparison sales, and use our exclusive database to zero-in on any other pieces of information needed. We can also help by coordinating with attorneys to make an appeal, allowing you and your legal team to know that you have everything you need to win at whatever level you desire to go to.

There is no cost for our analysis other data, or even attorney fees, and you will only be charged a contingency fee if you are able to lower your taxes. To ensure that you never get ambushed by CCAO, we will also investigate your taxes and assessments for you every year. This means you will never have to worry about missing another deadline, even if tax bills are late once again. If there are any issues with your values, we will help you by again coordinating with you and your attorneys to get you the best shot at an appeal victory.