For those living in Texas, taxes are one of the certainties in life but it doesn’t mean you will have to agree with the amount of taxes you pay. Property tax valuation amounts are not carved on stones, it can be reduced if taxpayers make use of the property tax appeals to their fullest advantage. This blog is all about how, when, and why should taxpayers submit a property tax appeal letter. Let’s start off with answering the question, Why?

Why submit a property tax appeal letter?

Once you receive a valuation notice from your assessor, you must be shocked looking at your valuation amount. You always have a dual choice in your pocket, one is either pay the high tax bill because of the lack of time to appeal or file an appeal and lower your tax bill.

But then, there must be a question bothering you. What is the reason for the high valuation? And to get this question answered there is one easy way, request for the assessor’s work papers. This will help you find ways to fight and win your protest. Here are a few scenarios you might disagree with your assessor on:

1. The assessor might have included business personal property items that no longer belong to you.

2. Assets or real property not owned by you

3. There are chances of double assessment

4. Assets under depreciated by the assessor

5. Inaccurate property details

6. Valuation not as same as the other properties in the jurisdiction

7. Unreasonable increase in the value of the property when compared to the past year.

How to submit a property tax appeal letter?

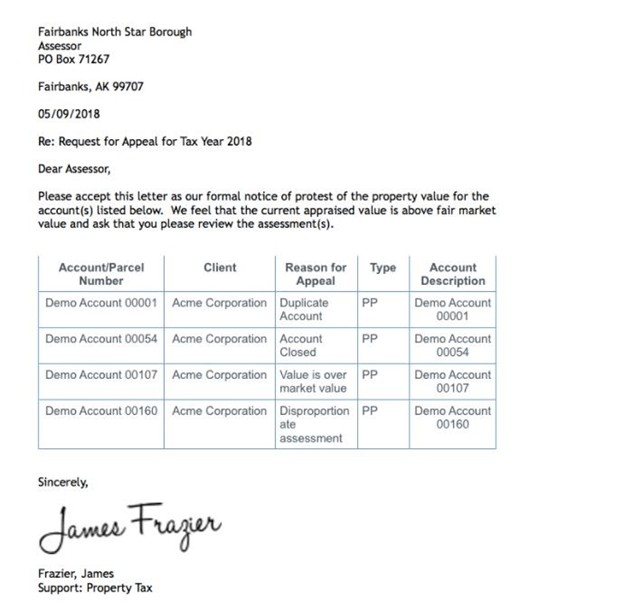

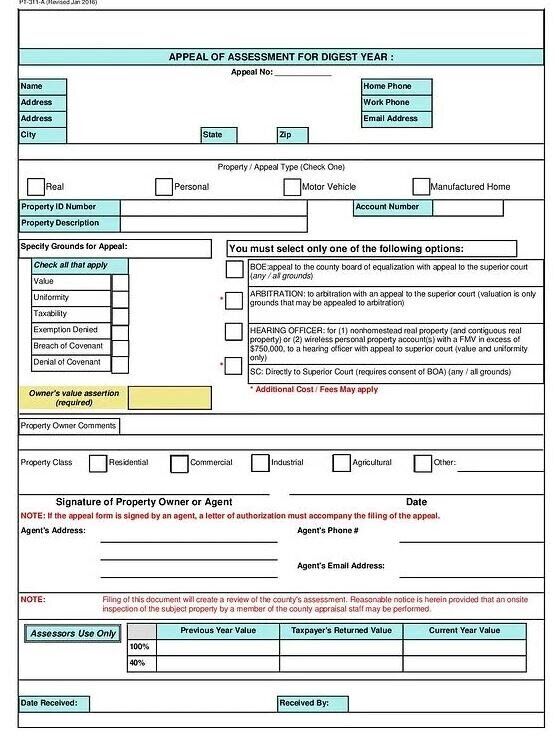

Write a letter to the assessor. This should include all your intentions. There are a few aspects to keep in mind. The letter should say it is a formal notice of protest, should have the account number, the reason for protest, and your signature. Other than that, you can simply fill in the notification form.

When to submit a property tax appeal letter?

From the time you receive the valuation notice, you have 30 to 45 days’ time to send the letter. This duration varies across states. By this time, if you feel the appraisal district has valued your property correctly, you can withdraw your appeal at any time. Once you send the letter, you will receive a confirmation letter. Sometimes you might also receive your appeal number along with the date and time for your hearing.

Submitting a property tax appeal letter is just the beginning. It is important to be aware of the deadlines and to complete research in order to win the case. This might eat your time and sometimes the process might also seem laborious. This is where O’Connor helps you from analyzing existing assessments, researching, and presenting the appeals to coordinate a mutually agreed lawsuit if required.

ENROLL TODAY In the Property Tax Protection Program

Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. If your business personal property taxes are not reduced, you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Many FREE benefits come with enrollment.

How helpful that you say how to submit a property tax appeal letter. I want to buy a new home this fall. I will find a great service to help reduce property taxes in my area as well.